Prices

August 29, 2019

Hot Rolled Futures: Giving Up on a Rosy Outlook?

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

I realize that many of us have spent this week in meetings and conference presentations. I will keep this update on futures brief and touch on a few key points.

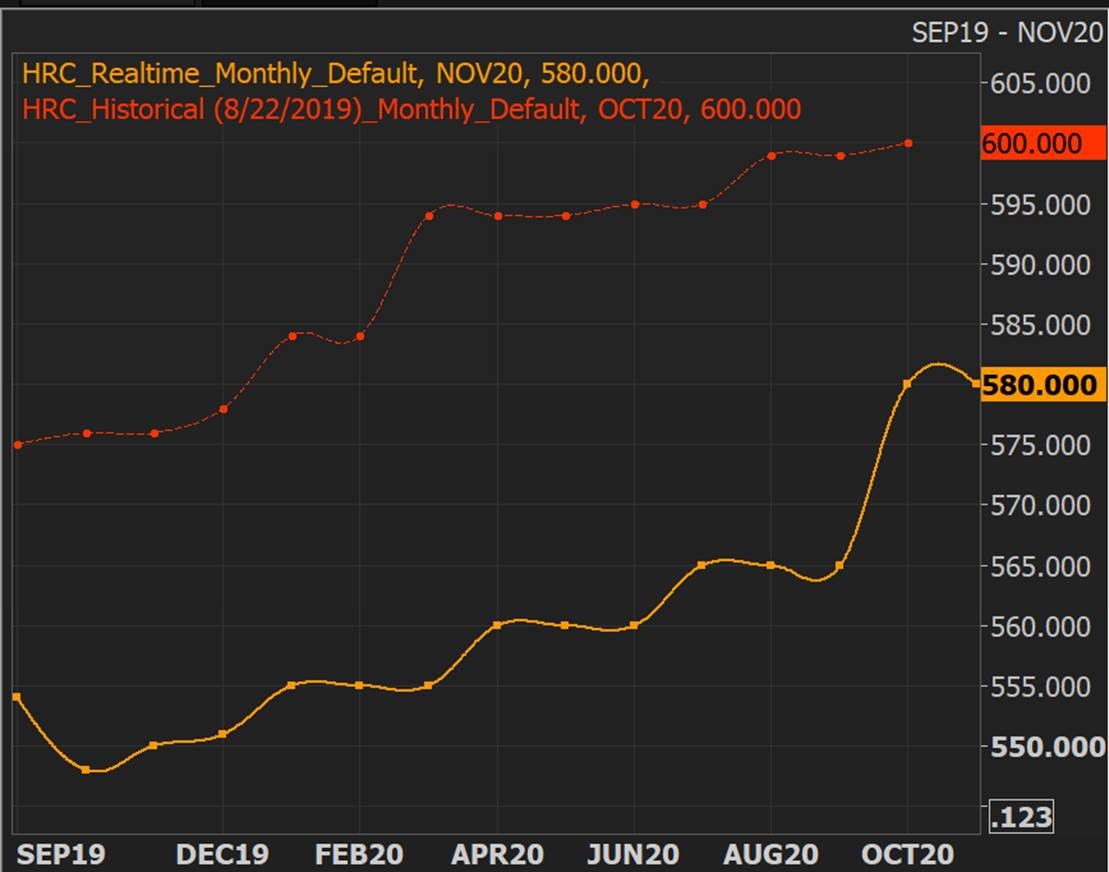

As the lines in the chart below highlight (red, Forward Curve one week ago; orange, today’s curve at close), the market has moved lower. The move lower follows a few days of a standoff between buyers and sellers. Q4 2019 levels have come off from $575-580 to a $545-550 level. This has pushed the nearby months to a level below the current index. This implies that the futures market expects the prices to come down further. The push lower in the nearby has moved us again into a steeper contango (nearby months are lower than the further out).

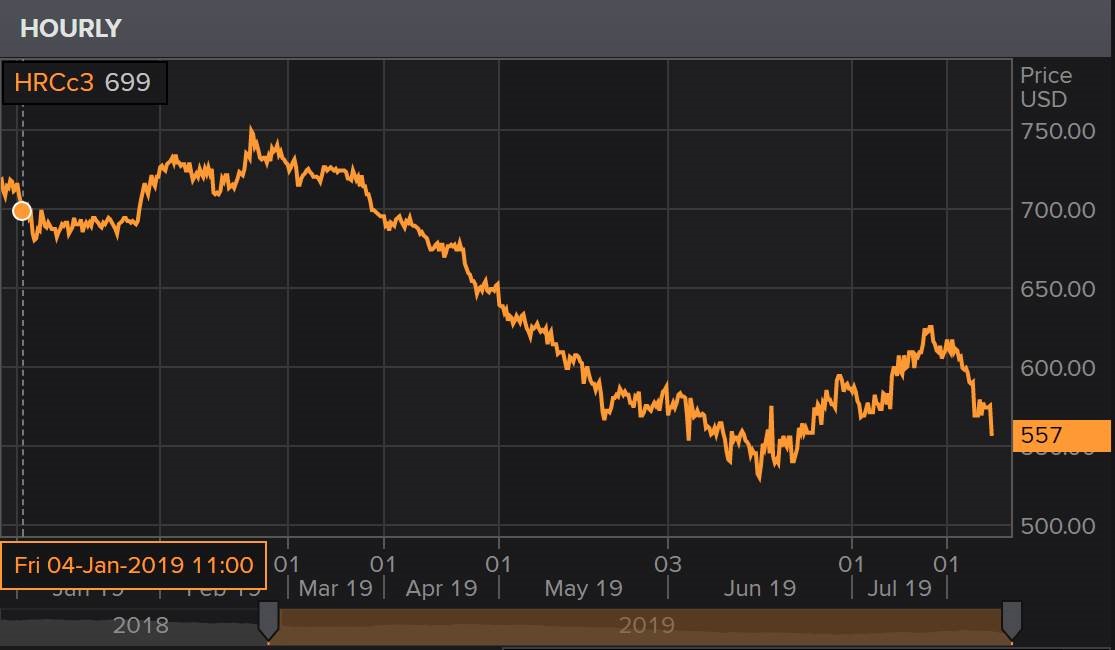

As with the questions we fielded during the conference and presentations, this expectation of the futures market is nothing other than the view of market participants. As the chart below highlights (HRCc3- Rolling 3rd month HRC contract), these expectations have moved around quite a bit. Clearly, the futures markets were more bullish and hopeful of the move higher than the actual spot market reality is shaping up to be. September ’19 was trading at levels higher than $600 at one point. This positive sentiment in the futures market was an opportunity for those long inventory to lay off some of the risk.

I see a few factors that have shaped the loss of hope in the HRC market. I list these out but in no condition is this an exhaustive list:

- Lead times at mills are slipping as buyers return to the sidelines.

- Weaker raw material market; scrap is expected to be lower in September.

- International markets continue to signal tough demand conditions.

- Macro concerns are leading buyers to be more cautious (persistent de-stock).

Among these factors, the international weakness is one that I’d like to highlight. Readers should continue to track what is happening in Chinese steel markets despite the fact that we have Section 232/AD/CVD protection from direct Chinese steel exports. Chinese rebar has slipped to the lowest levels since 2017 and the steel mill margins are in negative territory. Mills are likely to push ore further down to get back in the black as demand is weak.

While we are all fresh from the conference, we still have many thoughts swimming in our heads. One small item I’d like to add to this list of ideas is for you to tabulate how much net exposure [Long (inventory, firm buys etc.) minus Short (firm sales)] your firm is running. Then look at how the move in the forward curve benefits(or hurts) your margins. This is an important operational exercise that can help you better identify opportunities and quantify them.

Have a happy Labor Day weekend.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information