Market Data

August 29, 2019

Economist Beaulieu: Recession? Not Until 2022

Written by Sandy Williams

Don’t get too worried about a recession just yet, advised ITR economist Alan Beaulieu at the SMU 2019 Steel Summit in Atlanta this week. The economy is slowing down and consumption will be tepid for the rest of this year and into the first half of 2020. But conditions will improve in the second half of 2020, providing a good year for business in 2021. It’s not until 2022 that the economy will see a serious downturn.

“Looking at the media view, you see a lot of people predicting a full-on recession in the United States next year. I want you to know that is not true. The first half of 2020 will be off, but in the second half of 2020 your businesses will do better. As we head into a presidential election year, there is no macroeconomic recession in 2020—unless we go completely off the rails in terms of international relationships,” Beaulieu said.

ITR Economics predicts a mild recession in 2022—though not nearly bad as the Great Recession. He advises companies to prepare ahead of time. “As you make your three-year plans, make sure your cash flow is adjusted for a down year in 2022. Make sure you don’t run out of cash,” he warned.

Prepare for the coming recession by strengthening your company, he advised. “Look for the bassett hounds. A basset hound is a product, place, procedure or person that you don’t need anymore. They may be beloved and difficult to part with, but you have to take them on a one-way walk to the farm. To be prepared for the recession you must stay ahead of the competition and manage your firm better,” he said.

Late ‘22 and ‘23 will be a great time to buy a sound, but cash-poor, company at a discount, Beaulieu added. If you are looking to sell your company, wait until 2025.

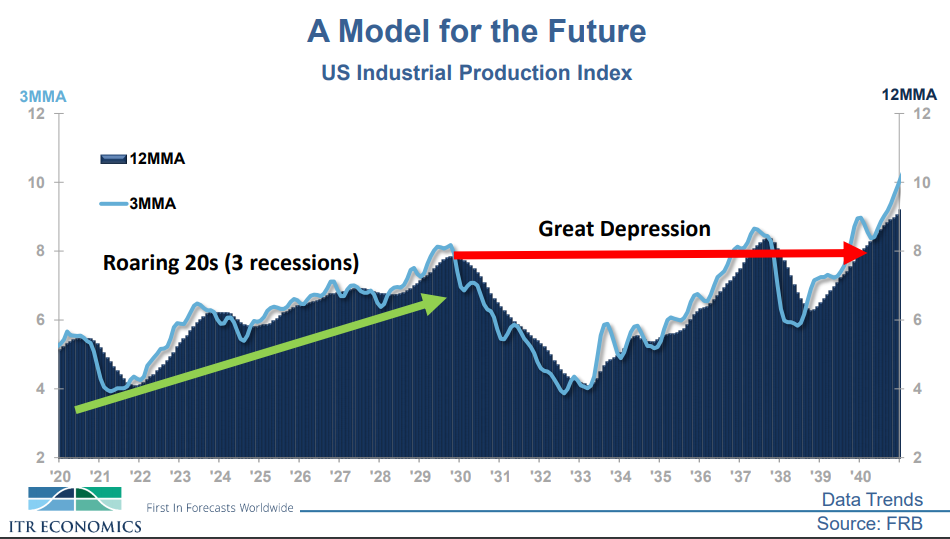

Beaulieu predicts a Great Depression starting in 2030 and hitting bottom in 2033 before engaging in a steep rise to 2037. The Depression is already in the cards, he said, driven by demographics, health care costs, entitlements, inflation and a huge U.S. National Debt.

If you would like to learn more about ITR forecasts, Alan Beaulieu’s presentation can be accessed here or on the SMU App.