Analysis

August 27, 2019

North American Automotive Production Down in July

Written by Peter Wright

Steel Market Update is pleased to share this Premium content with Executive-level members. For more information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

North American auto production exhibited the normal slowdown in July.

This report is based on data from LMC Automotive for automotive assemblies in the U.S., Canada and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating. Heavy trucks and buses are not included).

![]()

In this report, we will briefly describe light vehicle sales in the U.S. before reporting in detail on assemblies in the three regions of North America.

U.S. Vehicle Sales

Economy.com summarized July’s vehicle sales as follows: “U.S. unit vehicle sales slowed slightly in July to 17 million annualized units. Light truck and SUV sales fell 1.1 percent to 12.2 million annualized units. Car sales fell 2.7 percent to 4.8 million annualized units. July vehicle sales were slightly above their second-quarter average of 16.9 million annualized units. The lack of volatility in the new vehicle market is indicative of the unwavering confidence of the U.S. consumer. The ongoing trade war and slowing world economy have yet to significantly hold back individuals looking to purchase new vehicles. The consistency over the last few months is not expected to continue throughout the near-to-medium term as the economic expansion reaches its later stages.”

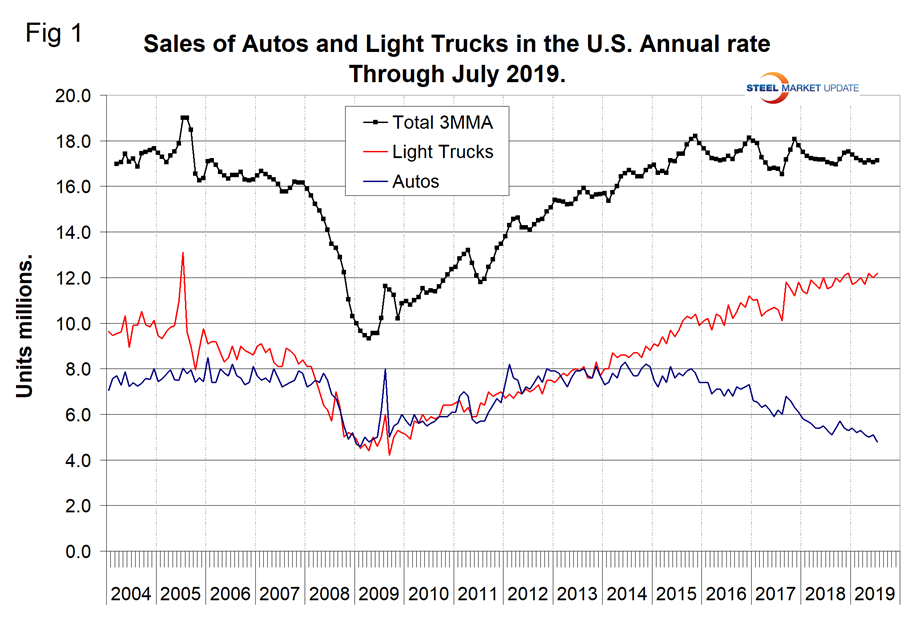

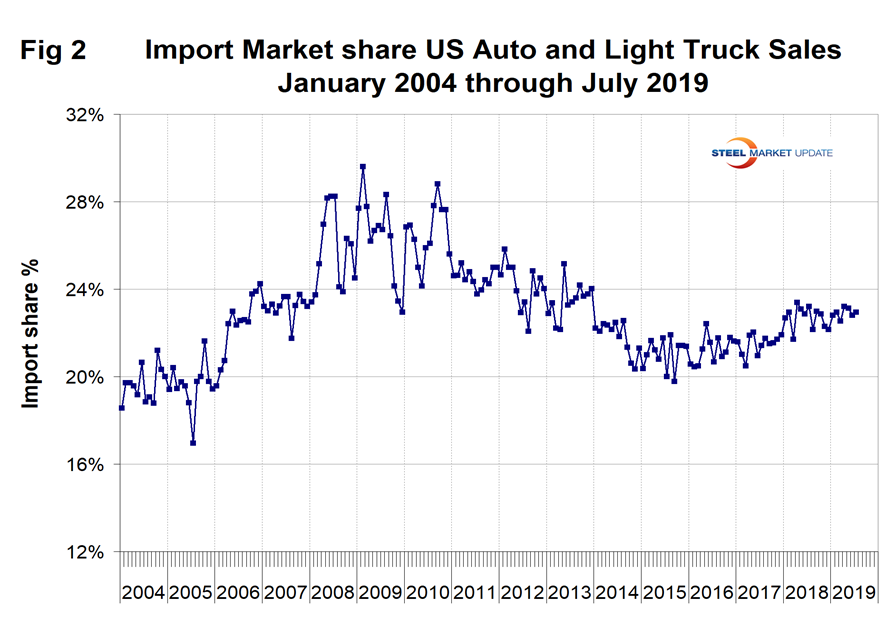

Figure 1 shows auto and light truck sales since January 2004. In July, total sales were up by 0.4 percent on a three-month moving average (3MMA) basis year over year. Light trucks that include pickups, SUVs and crossovers have been surging at the expense of cars for four years. In July, the mix was 71.8 percent light trucks and 28.2 percent autos. May was the first month ever for light trucks to exceed a 70 percent share. In 2019, import market share had a high of 23.2 percent in April, declining to 22.9 percent in July as shown in Figure 2.

North American Assemblies

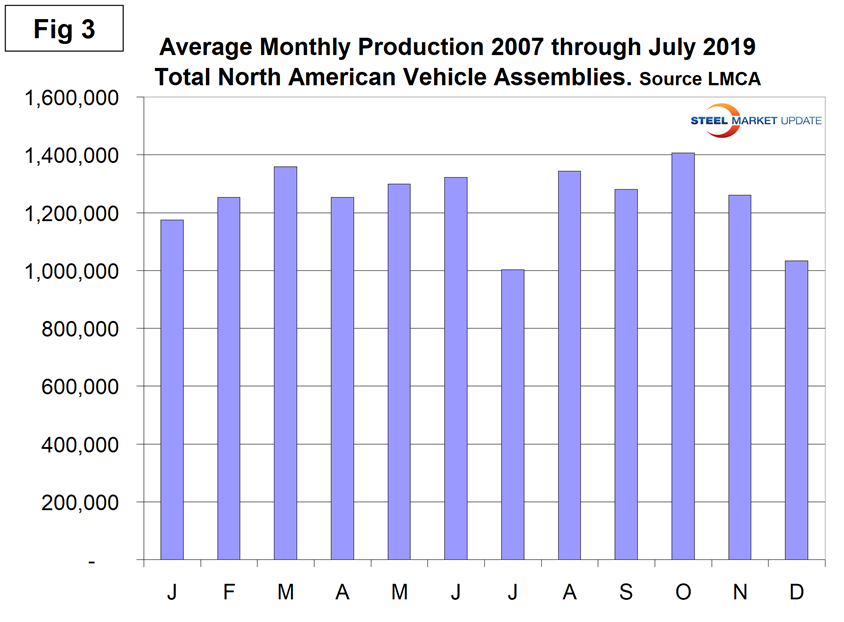

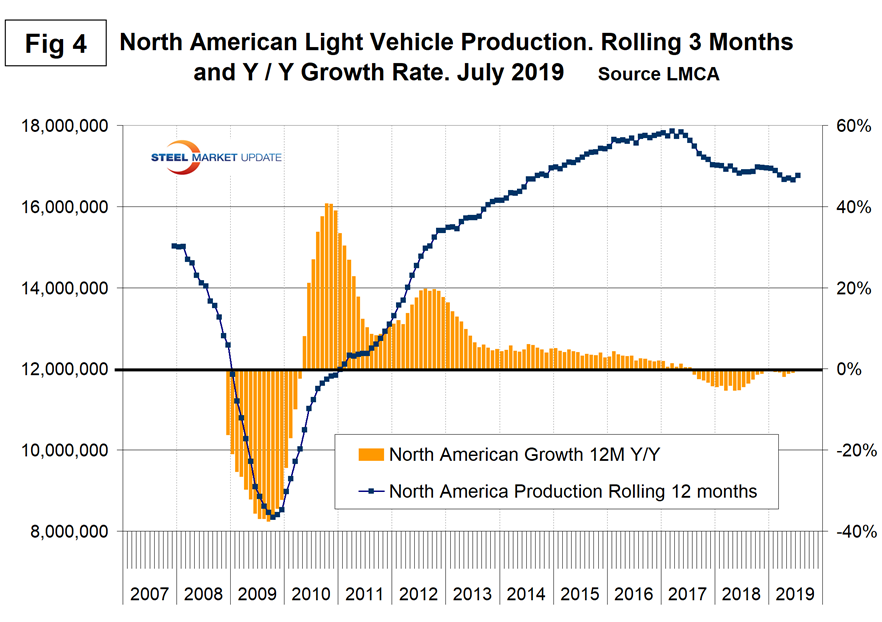

Total light vehicle (LV) production in North America in July was at an annual rate of 14.4 million units, down from 16.9 million in June. On average since 2007, July’s production has been down by 24.1 percent from June as auto assemblers take their summer re-tooling shutdown. This year production was down by 14.8 percent. Figure 3 illustrates the seasonality of production on average since January 2007. On a rolling 12-months basis, total North American assemblies were down by 0.5 percent year over year through July. Note that production numbers are not seasonally adjusted; the sales data reported above are seasonally adjusted.

There has been a gradual slowdown in production since August 2017, which has now almost stabilized as indicated by the brown bars in Figure 4.

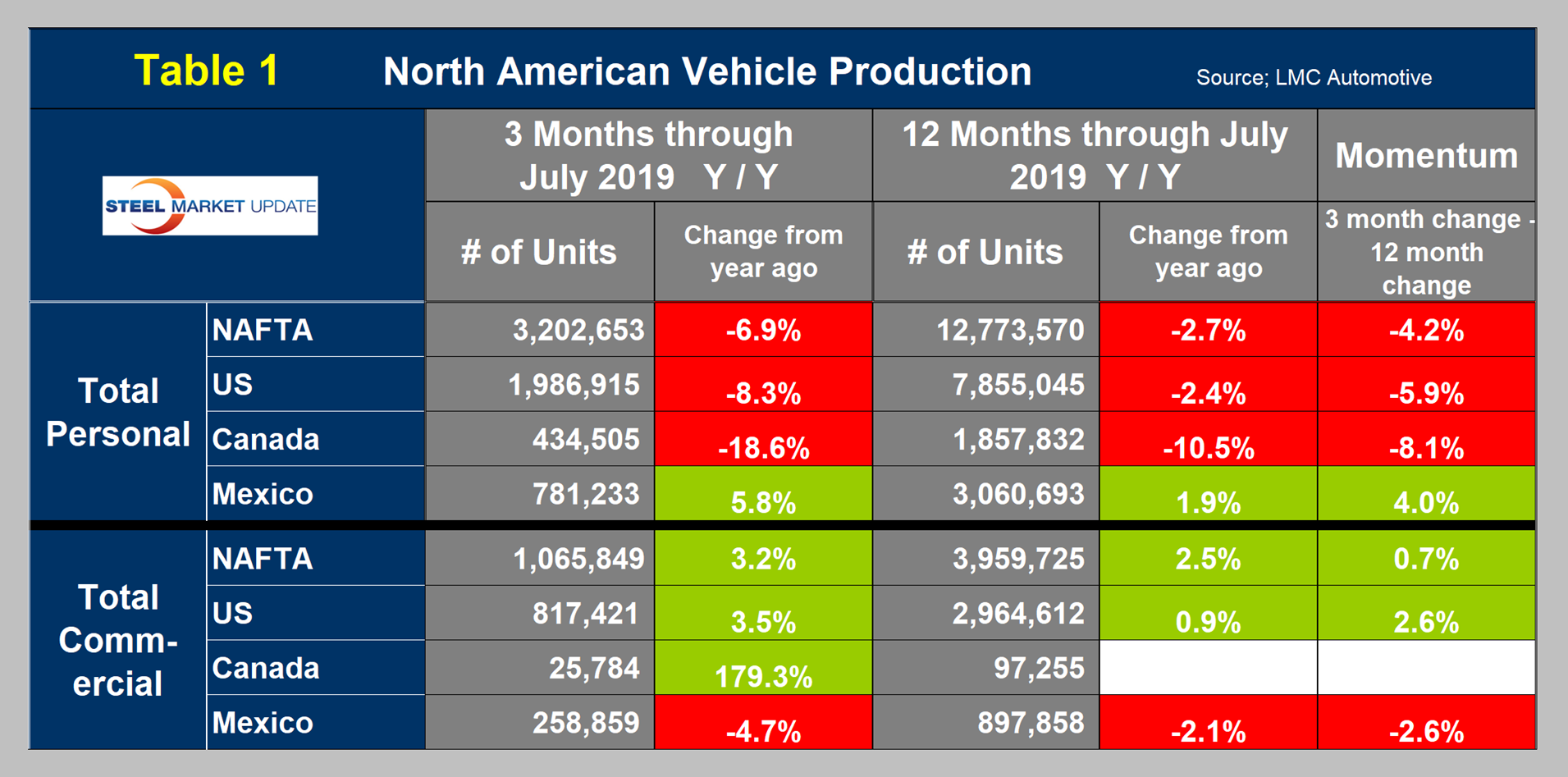

Table 1 is intended to be a short-term snapshot of assembly by nation and vehicle type. It breaks down total North American personal and commercial vehicle production into the U.S, Canada and Mexican components and the three- and 12-month growth rate for each. At the far right it shows the momentum for the total and for each of the three nations. Overall, momentum for personal vehicles is negative as the U.S. and Canada decline and Mexico accelerates. For commercial vehicles the reverse is the case as the U.S. accelerated and Mexico declined in the latest data. (Note, there are blank cells for Canadian commercial production. See explanation below.)

The longer term picture is shown in the following charts by vehicle type and nation.

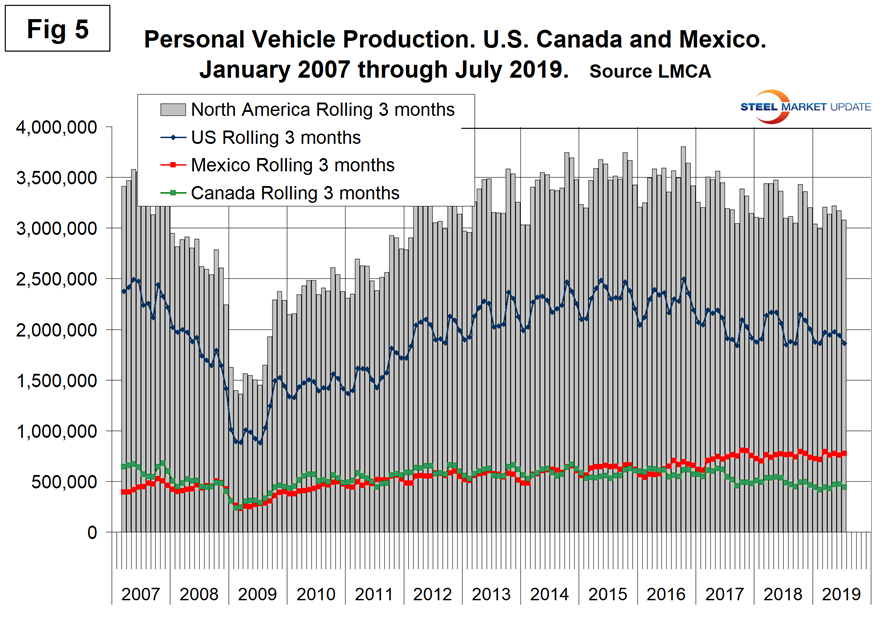

Figure 5 shows the total personal vehicle production for North America and the total for each nation.

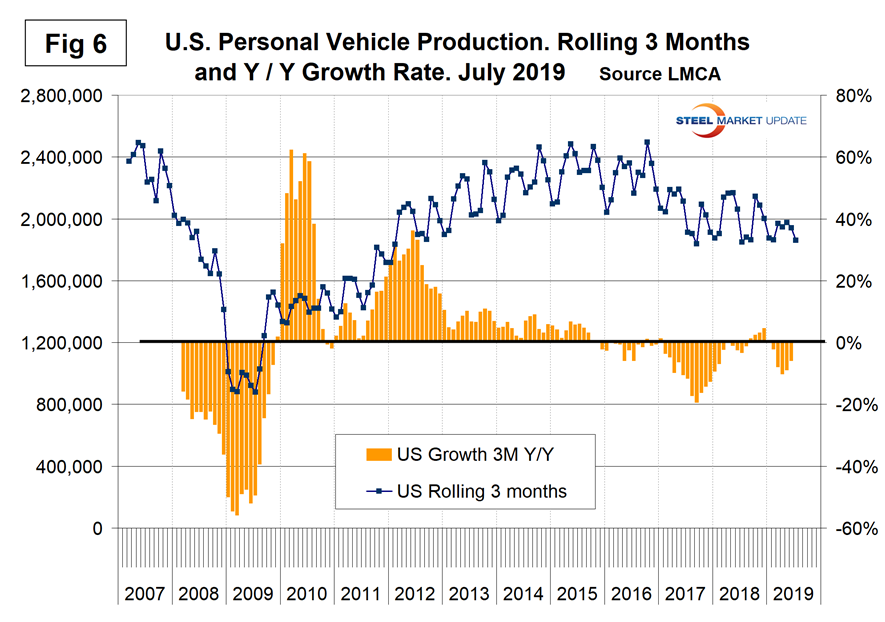

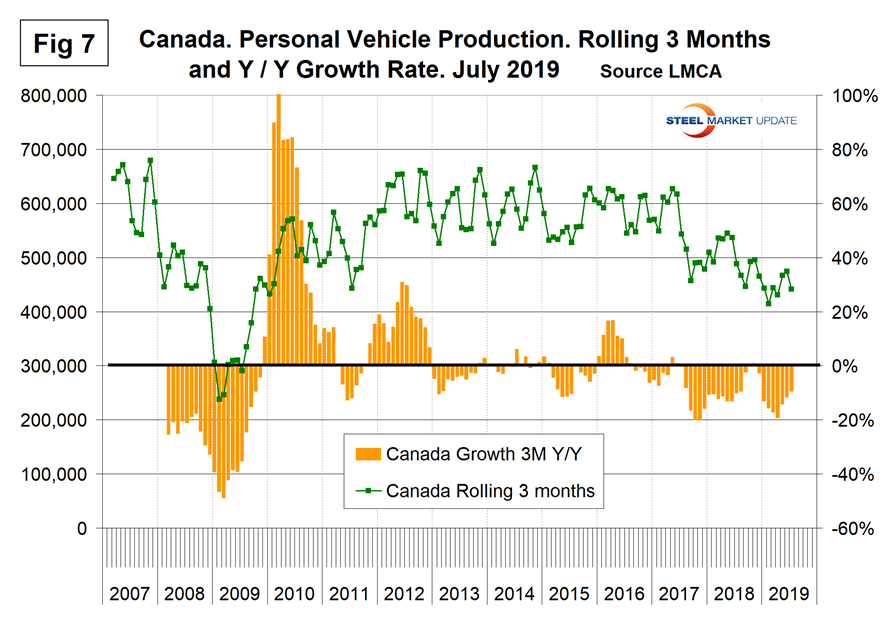

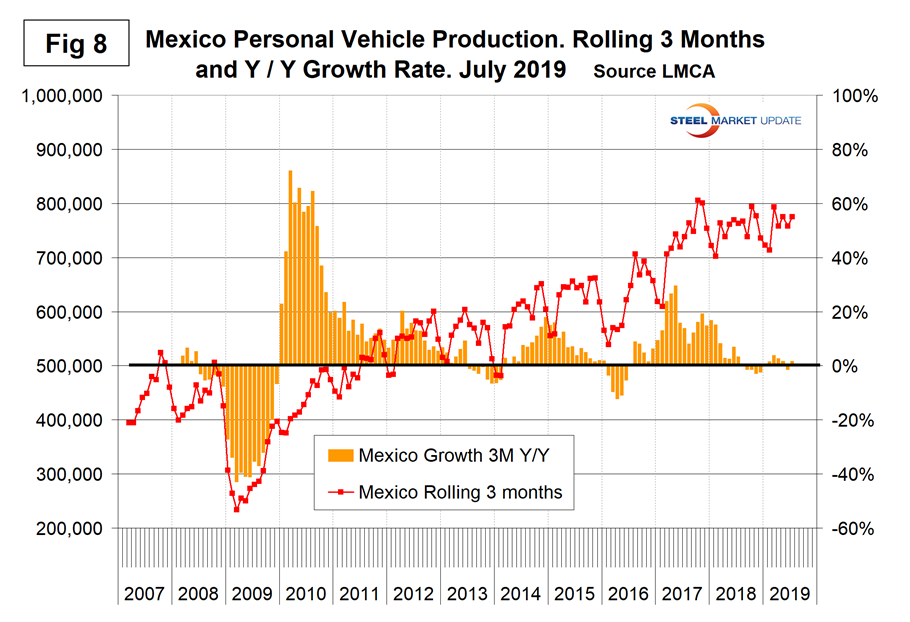

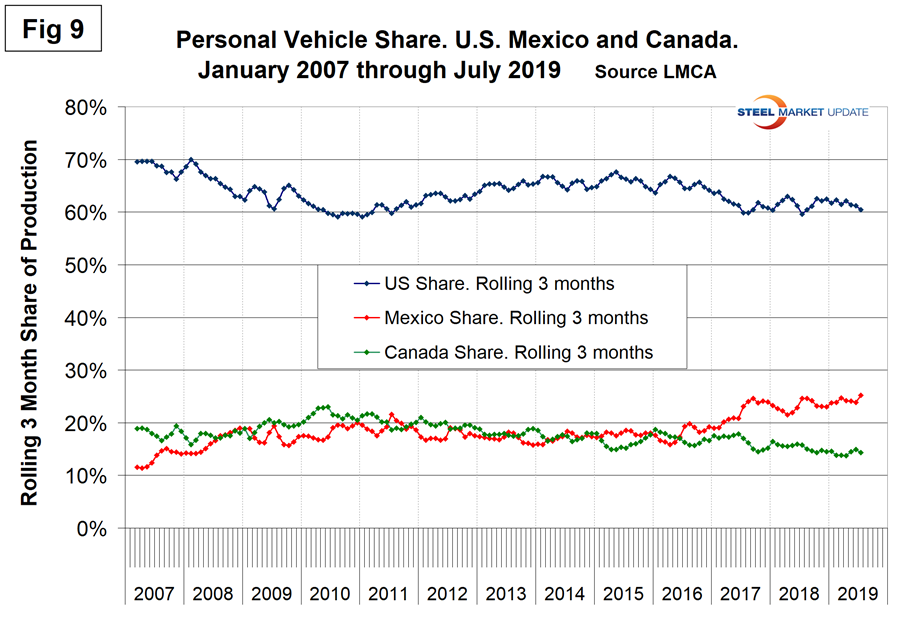

Figures 6, 7 and 8 show the production of personal vehicles by nation and the year-over-year growth rate for each. Figure 9 shows the production share for each nation. Production in the U.S. and Canada has declined since 2015 as Mexico has increased. The Mexican share rose from 17.2 percent in late 2014 to 25.2 percent in July 2019.

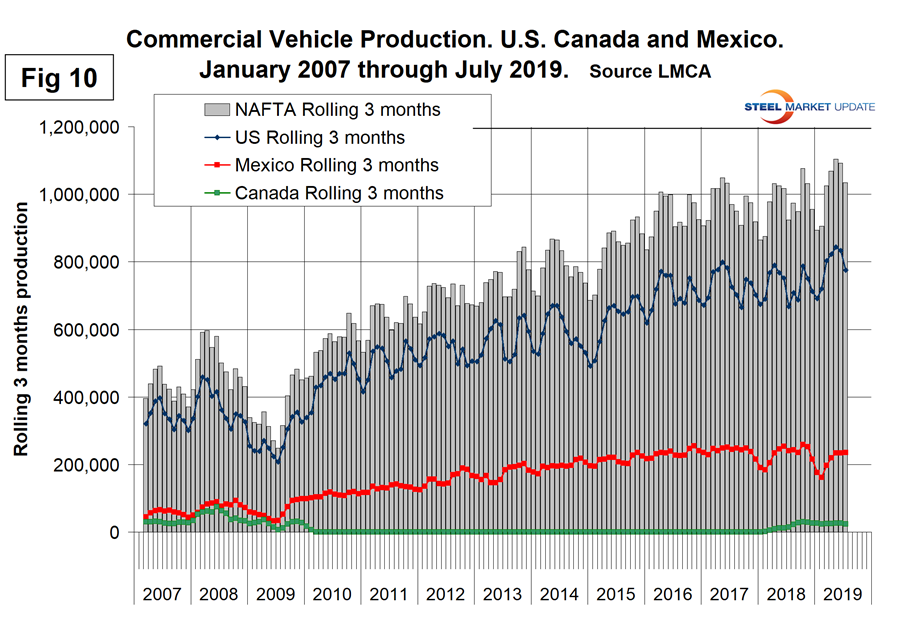

Figure 10 shows the total commercial vehicle production for North America and the total for each nation. The U.S. has held its ground much better in commercial vehicles than in the personal segment.

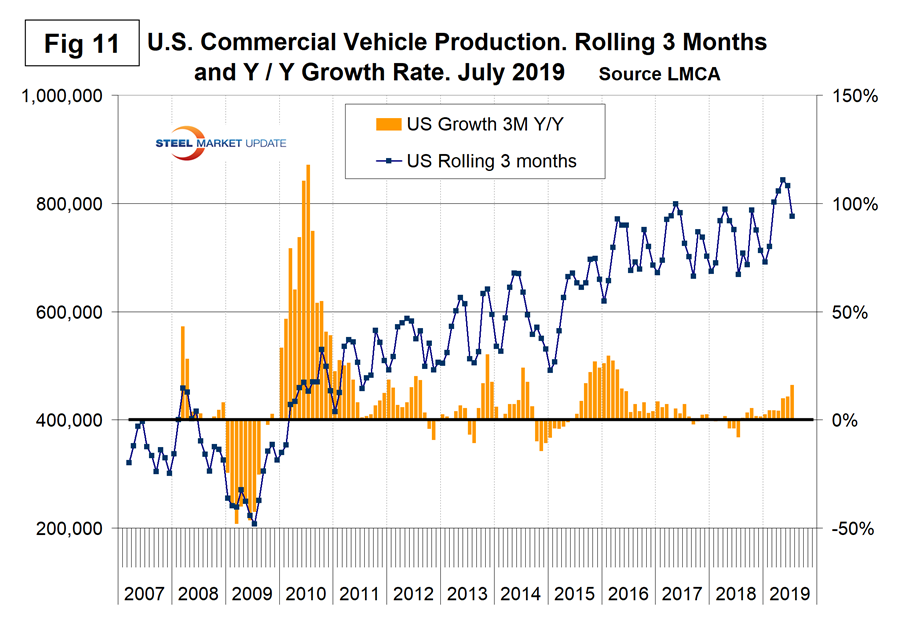

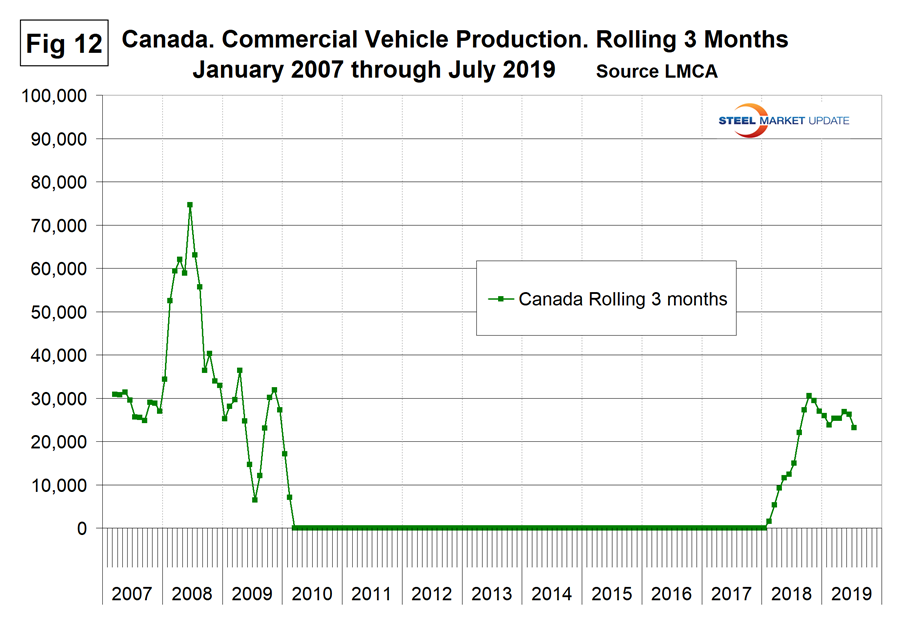

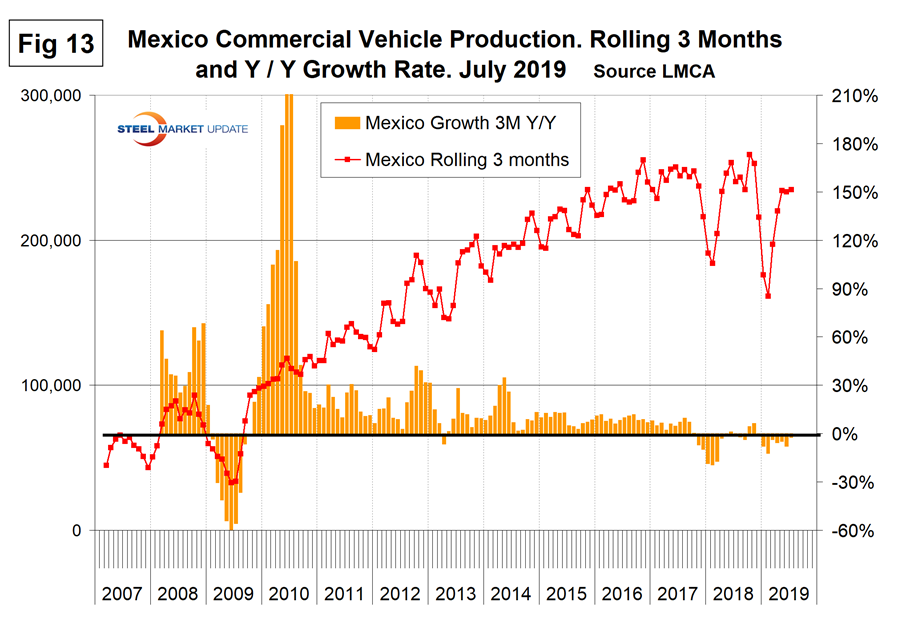

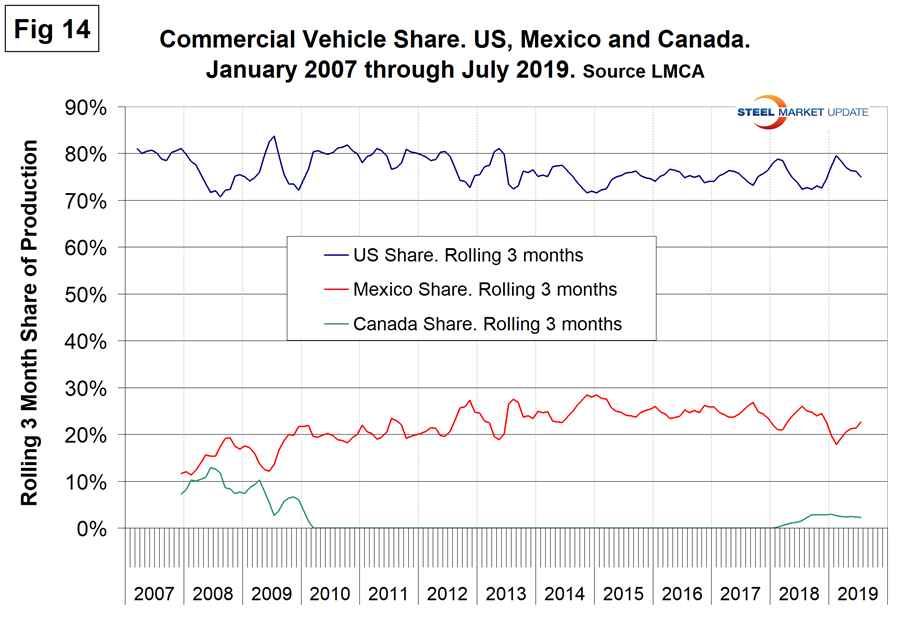

Figures 11, 12 and 13 show the production of commercial vehicles by nation and the year-over-year growth rate for each, and Figure 14 shows the production share for each nation. Commercial vehicle production in Canada was zero from January 2010 through January 2018. The only Canadian plant making commercial vehicles in the past couple of decades was in Oshawa. At the end of 2009, they shifted their production from Silverados to build the Chevy Camaro. That changed again in February 2018 when the Oshawa plant shifted away from the Equinox (personal vehicle) and again began to produce the Silverado and Sierra (both commercial vehicles). GM has declared its intention to permanently close the Oshawa plant.

Both the U.S. and Mexico have achieved strong growth in commercial vehicle assemblies since the recession and their production shares have been stable and almost a mirror image of each other in the short term. Mexico currently exports about 80 percent of its light vehicle production with the U.S and Canada as the highest volume destinations.

SMU Comment: North America experienced the normal July slowdown in vehicle assemblies. Mexico has been taking share of personal vehicle production but not of commercial vehicles. It remains to be seen whether the renegotiated North American trade agreement will result in a move in production share to the U.S.