Overseas

August 27, 2019

CRU: Coking Coal Price Consolidation Continues

Written by Tim Triplett

By CRU Senior Analyst Manjot Singh

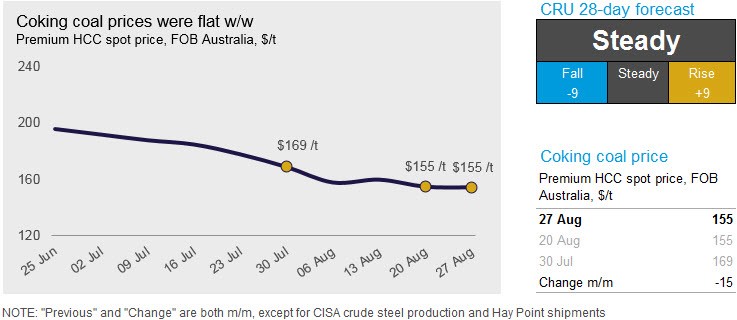

Coking coal prices have remained steady for another week on the back of mixed signals on the demand side and abundant supply from Australia. On Aug. 27, CRU assessed the Premium HCC, $0.5 /t lower w/w at $154.5 /t, FOB Australia.

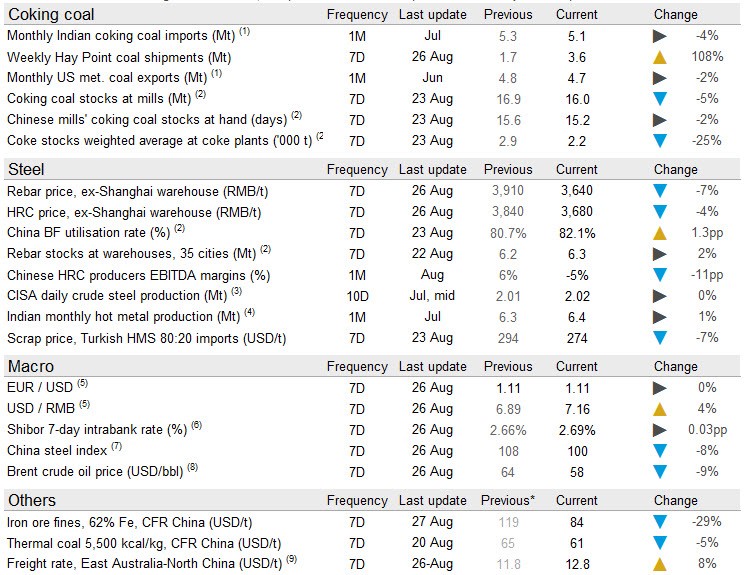

There were more deals concluded by Chinese buyers as demand for steelmaking raw materials remained healthy. It looks like Chinese steelmakers are making a conscious effort to maintain high stocks as some coal ports will be in danger of overshooting their allotted annual coal import quotas in the next couple of months. If this happens, just like last year, the customs authorities will start blocking almost all coal cargoes at those ports. Due to this reason, we have heard many Chinese utilities have been issuing thermal coal spot tenders lately to build up their inventory before port restrictions escalate in Q4.

Moreover, the Tangshan government has released details of another round of capacity restrictions for the months of September and October. This regulation will be focused primarily on restricting pelletising, sintering and coking capacity, but restrictions on BF capacity will ease slightly from current levels. Despite these restrictions, we think Chinese buying interest will remain firm in the coming weeks.

We haven’t seen a lot of buying interest from Indian buyers as steel demand remains muted. However, the central bank has announced a fresh stimulus package today to improve the market sentiment and boost the domestic economy.

On the supply side, there were record shipments from Hay Point last week, totalling 3.6 Mt, up 1.9 Mt w/w. It’s possible that some supply got pushed to last week due to maintenance at Hay Point port in the prior week.

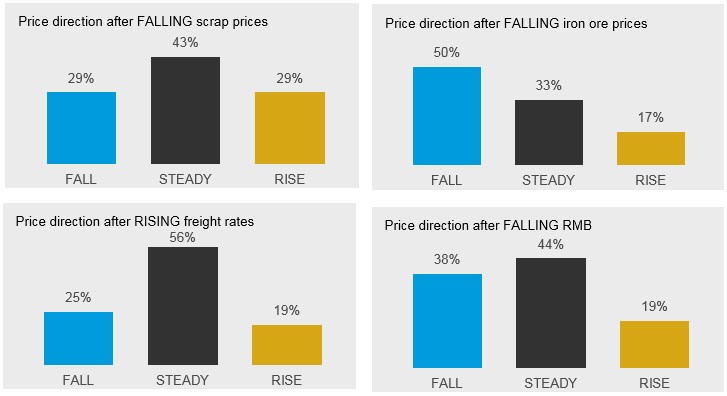

Going forward, we expect prices to consolidate around current levels as supply is ample, but at the same time there is restocking interest from Chinese buyers and the likelihood of Indian buyers making some spot purchases as the monsoon season draws to a close.