Prices

August 18, 2019

Steel Prices Moving Up…But for How Long?

Written by Tim Triplett

Since late June, the nation’s steelmakers have raised prices three times on flat rolled and twice on plate products, managing to reverse the 40 percent decline in steel prices that began last summer. Steel prices have increased more than 12 percent since bottoming in early July. The mills have seized the momentum heading into the second half of the year. But for how long?

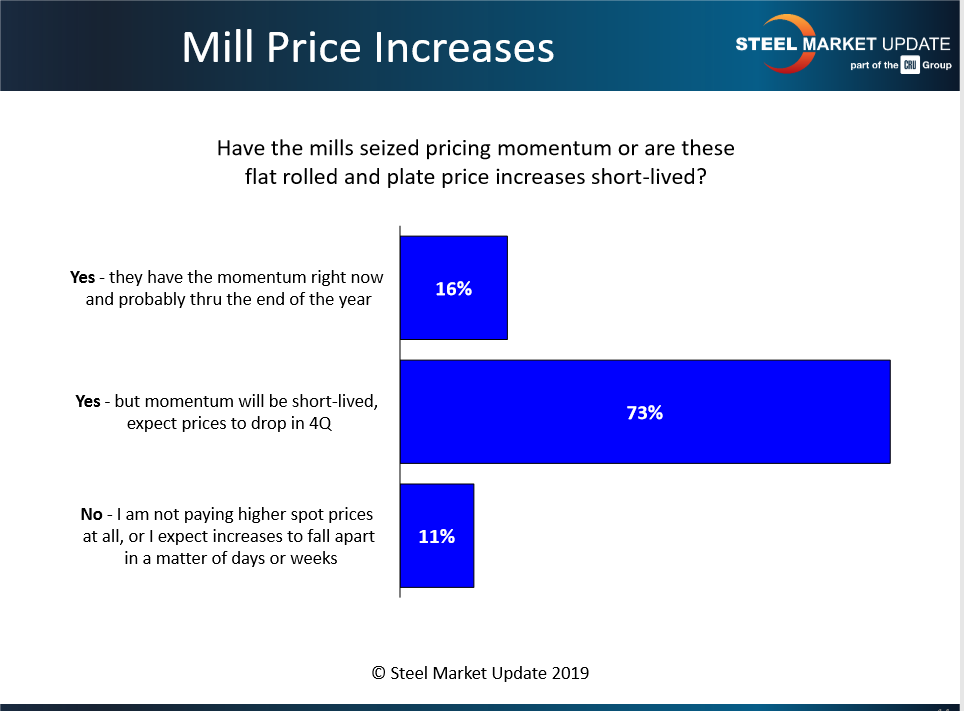

Three out of four buyers—manufacturer and service center executives—who responded to Steel Market Update’s market trends questionnaire in the week of Aug. 12 said they expect the mills’ ability to collect higher prices to be short-lived.

About 11 percent said they were not paying higher spot prices at all, even after the string of mill price hikes. Another 73 percent said they expect steel prices to drop in the fourth quarter. It’s only the remaining 16 percent that expect the mills to maintain their pricing momentum at least through the end of the year.

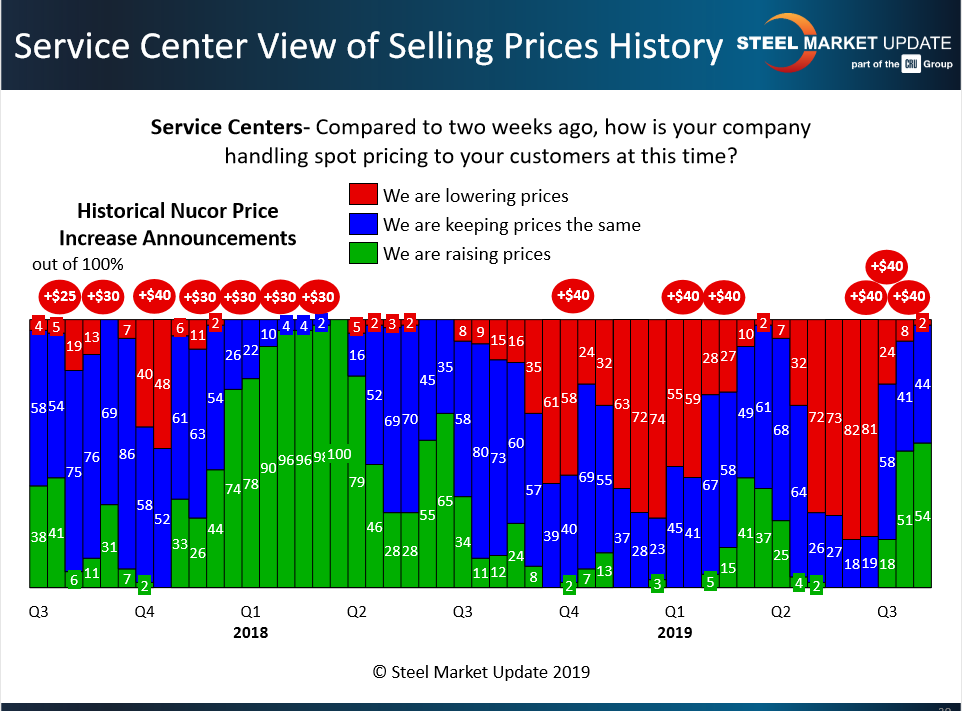

The longevity of the uptrend in pricing depends in large part on the support the mills get from distributors. Nine out of 10 service centers told SMU they were having trouble passing along the higher prices to their customers.

Nevertheless, as seen in the chart below, the majority (54 percent) reported they were raising prices to their customers in mid-August. Very few (2 percent) admitted to continuing to offer discounts to win sales. Still, a substantial percentage (44 percent) were holding the line but not attempting to raise their prices in support of the mill increases.

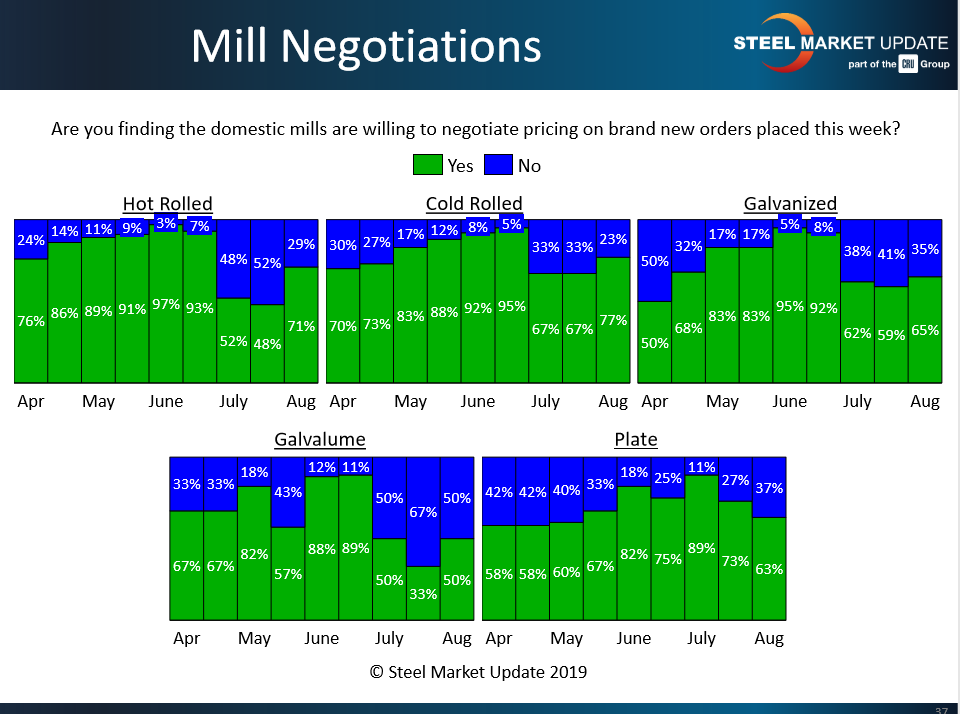

For a steel industry that is hoping to collect higher prices on flat rolled and plate products, the mills seemed surprisingly willing to negotiate, according to SMU’s mid-August data. As the green bars in the chart below show, the vast majority (from 50 to 77 percent of buyers, depending on the product) reported the mills were still open to price negotiations. Of course, with a total of $120 per ton in flat rolled increases and $80 per ton in plate increases in play, the mills had room to negotiate and still collect a portion of the upcharge.

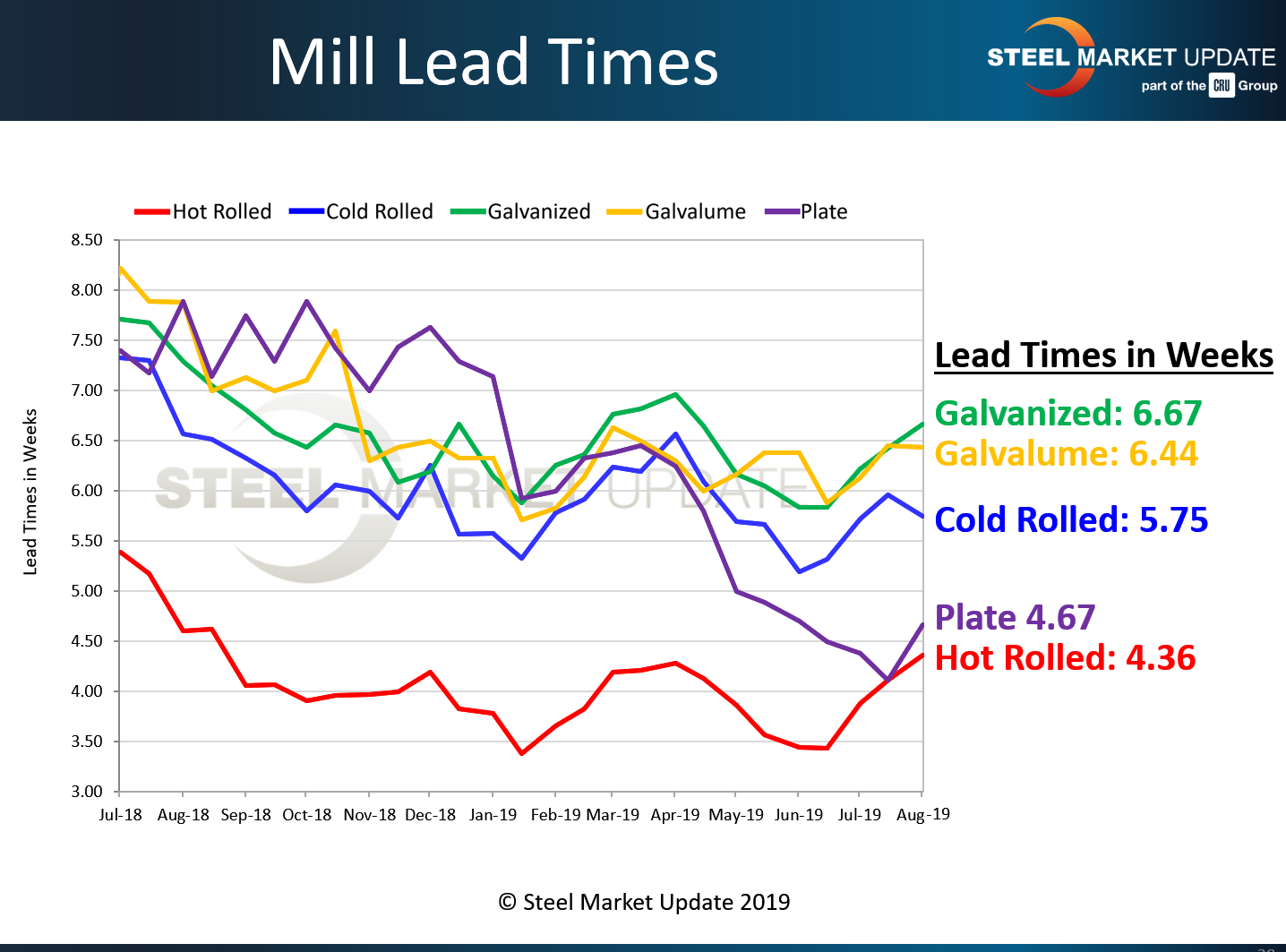

Mill lead time is one key indicator of price momentum tracked by SMU. The longer the lead times for spot orders of steel, the busier the mills, and the less likely they are to negotiate price. As the chart below shows, lead times have extended a bit so far in the third quarter.

Steel Market Update Prices

SMU gathers real-time pricing data from steel buyers every week. SMU’s Price Momentum Indicator has been pointing Higher for flat rolled products since mid-July.

According to SMU data, the benchmark price for hot rolled steel (FOB the mill, east of the Rockies) averaged $585 per ton ($29.25/cwt) as of Aug. 12 with lead times that had stretched a bit to 3-6 weeks. That compares to $550 per ton and 3-5 week lead times in mid-July. Cold rolled averaged $760 per ton ($38.00/cwt) with lead times of 4-7 weeks, up from $710 per ton a month prior. The benchmark price for galvanized 0.060-inch G90 coil averaged $848 per ton with lead times of 4-11 weeks, up from $798 with 5-7 week lead times in mid-July.

Steel plate prices have been on the decline all year and the jury is still out on whether the market has found a bottom as a result of the latest price hikes. The delivered price for plate in mid-August averaged $790 per ton ($39.50/cwt) with lead times of 4-6 weeks, just a small increase from the $780 price and 3-6 week lead times the prior month.

What’s the Market Sentiment on the Price Increases?

“I think they have pulled orders ahead and we will see some price reduction in late October or November. But I don’t think it will get back to the bottom numbers we saw in July.”

“We feel orders were pulled ahead, and beyond September mills may be challenged to keep order books full.”

“It’s all posturing before contract season. Without supply-side discipline, demand fundamentals will kick in. Also, foreign pricing has already peaked, so any domestic tailwind will quickly become muted.”

“One theory going around is that the domestic mills are smarter today and will manage capacity to ensure that the prices don’t drop. That would be a first.”

“Until the morons in the White House begin to realize their trade wars are not being borne by the Chinese and in fact are inflicting pain on domestic industries and ultimately the U.S. consumer, I see a recession on the horizon.”

Adding to the uncertainty over steel pricing, U.S. Steel made a splash on Aug. 13 when it announced it will no longer use index-based pricing, effective with its 2020 contracts. Widely used by most mills, contracts that adjust up and down with a published index price are designed to protect both buyers and sellers from unexpected fluctuations in the market. U.S. Steel contends that such adjustable price contracts are excessively influenced by spot market transactions, which represent only a small fraction of the total market. Thus, they claim, the volatility of spot market prices distorts the economics of volume-based agreements. Should other mills decide to follow U.S. Steel’s lead, the change has wide-ranging implications for steel prices and the way mills negotiate contracts with buyers in the future.