Market Data

August 18, 2019

Market-Linked Contracts Can Benefit Steel Buyers and Sellers--What If They Cease?

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

U.S. Steel recently announced its intent to withdraw from spot market-linked adjustable price contracts in 2020 (i.e. contracts where the price moves with the spot market in some way). The following offers insight on the use of such contracts and what may come about if the intended change is implemented more widely.

According to U.S. Steel’s 2019 Q2 earnings report, 23 percent of its sales were on the spot market with the remainder on contract. Contracts were then nearly equally split between spot market-linked, firm (fixed price) and cost-based.

The market-linked contracts used by all mills are predominantly based on the prior month or quarter’s spot price. For example, a manufacturer may have a contract that allows them a specific amount of volume to be ordered in September, based on the spot market price in August, or if quarterly, based on the average market price from April through June. Some contracts allow for an annually negotiated price that moves month to month or quarter to quarter based on the movement seen in a spot price index, such as CRU’s U.S. Midwest HRC price, The CRU. Others are established as a market price and a negotiated spread from that index.

Over the past few years, this form of contract has grown. Indeed, Nucor, the largest steel producer in the USA, noted in their 2018 annual report that their use of contracts has risen from 60 percent of sales in 2016 to 75 percent of sales in 2018.

Benefits

Market-linked contracts have provided benefits to buyers and sellers. These include but are not limited to volume certainty, more limited exposure to spot market volatility, and commercial transaction efficiencies from not having to negotiate the price as frequently. The latter case does not remove proper negotiation and discussions between buyer and seller, as the way the index is used (how the actual buy/sell price is linked to the index) is determined by the relevant counterparties alone.

For Mills

For a mill, there is a gain in having committed volume and a guaranteed sale rather than constantly competing for volume. This has allowed mills to lock in sales to multiple smaller buyers, as well as much larger service center buyers. In other words, these contracts can secure baseload volume, which helps their operations planning and volume share of the crucial domestic market.

The past few years have given a particular context to this, with new producers emerging with new and restarted steelmaking facilities as well as from a divestment. Market-linked contracts in the past have thus been one commercial tool for mills to consolidate new volume and therefore market share. In fact, when Big River Steel was nearing initial production, some mills offered their customers a two-year contract in order to limit their exposure to this new competitor. Without these contracts, producers are more challenged to fill their order books. More expansion is coming and as domestic production increases, the battle for market share will intensify.

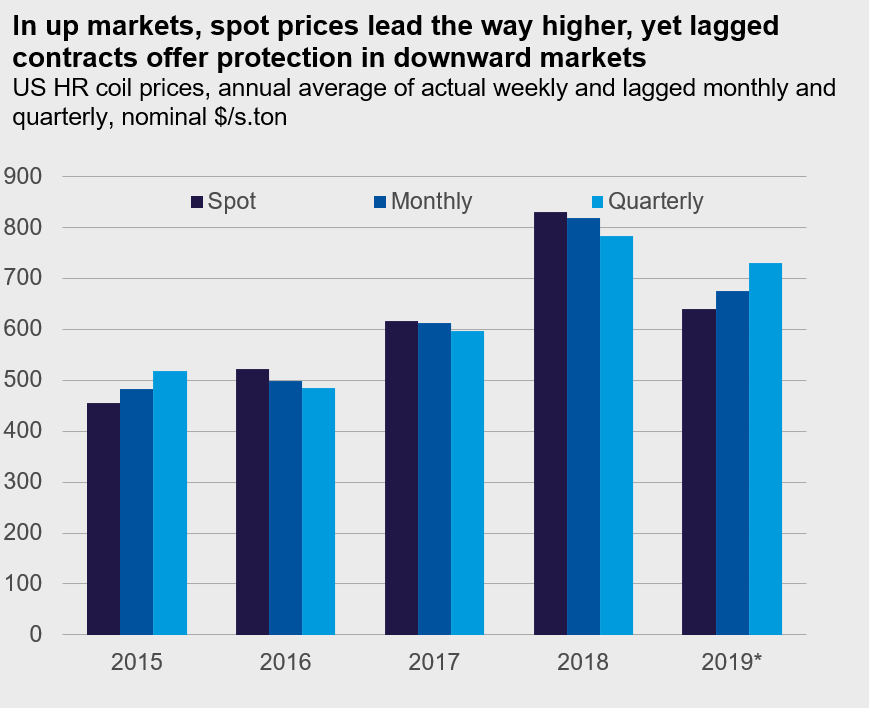

Market-linked contracts referencing prior quarter prices have also allowed producers to limit their exposure to the more volatile spot market. The following chart shows annual spot prices alongside the lagged monthly and quarterly contracts for that same calendar year (excluding any discount or premium). In an up market such as 2018, less exposure to spot prices leads to mill selling prices that naturally lag the market, but in falling markets such as 2019, more exposure to lagged contracts offers downside protection for mills. Over the course of a market cycle of two to three years, spot prices are nearly identical to lagged monthly and quarterly prices. Therefore, the market-linked contracts track the spot market through the cycle but can reduce volatility.

For Buyers

Equivalently, buyers may also benefit from reduced price volatility in this way, but those both buying and selling on market-linked contracts can also manage risk, by locking in margins.

A more competitive purchase price than would have been possible in the spot market may also be achieved, especially where they are medium to large buyers who can negotiate prices well below the spot market due to the size of their orders, the ease of production for their supplier, and even the reputation of the buyer. Most buyers need to visibly show their executives that steel procurement costs are competitive with the market, if not better. Market-based contracts allow them to accomplish this goal as they may be negotiated at a discount to the market.

What If the industry Joins U.S. Steel and Contracts are Not Renewed?

If the release of U.S. Steel’s internal memo spurs all producers to no longer agree to market-based contracts, we expect that more volume will return to the spot market at lower prices as buyers need to procure steel at the most competitive prices. In other words, as buyers return to the spot market, some aggressively priced activity will no longer be “hidden” in contracts and will inevitably get back into the spot market and market indices.

The net effect is that mills will, over time, likely not see any benefit in terms of their average revenue per ton as the more low-price activity that shifts from market-based contracts to the spot market will simply drive spot prices down to where they would have been otherwise. This would then also provide a lower spot market reference point for the negotiation of fixed-price longer-term contracts. In this scenario, we believe a change in contracting mix would ultimately be a zero-sum game in terms of average realized price levels, while the volume security and other advantages outlined above would diminish.

The CRU View

With new steel mills being built in the U.S. over the next few years, it is our view that mills will want to keep some portion of their sales locked into a contract. Yet buyers will continue to require that their steel prices are competitive with the market. Therefore, our view is that market-based contracts will remain in use for the foreseeable future, though perhaps mills will strive to be more disciplined in terms of minimum and maximum monthly volumes or the term of these contracts may be in force for multiple years.

The Best Price for All Applications

As we have previously stated, CRU’s focus remains fixed on providing the best HRC price to all of the market through all market conditions – for index-based contracts, the settlement of CME’s HRC futures contracts, negotiation support when entering fixed-price or other contracts, and for market intelligence purposes. The CRU is formed and delivered in step with leading CRU analysis and market insight, and we have a long-established and proud history of serving the market with it, irrespective of the application, which of course the market will decide.