Analysis

August 16, 2019

Single-Family Housing Starts Improve in July

Written by Sandy Williams

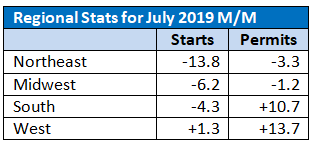

Housing starts in July dipped 4.0 percent from June to a seasonally adjusted annual rate of 1,184,000, but were 0.6 percent higher than a year ago, reports the U.S. Department of Commerce. Single-family housing starts gained 1.3 percent from the previous month, while starts for buildings with five units or more fell 17.2 percent.

Building permits rose 8.4 percent from June to July to a SAAR of 1,232,000 and were 1.5 percent higher than a year ago. Single-family permits gained 1.8 percent while multi-family housing permits of five units or more jumped 24.8 percent.

“Permits bottomed out in April and single-family starts hit their low point in May, and now we are starting to see the gradual improvement in the market that we’ve been forecasting,” said NAHB Chief Economist Robert Dietz.

“Given reduced mortgage interest rates and improved inventory levels, we expect continued modest gains for single-family construction bringing 2019 totals to relatively flat conditions,” said Dietz. “This matches the signal provided by the NAHB/Wells Fargo HMI, which improved to a positive level of 66 in August. Indeed, single-family permits, a leading indicator, also improved in July, expanding by 1.8 percent, although remaining lower on a year-to-date basis by 4.7 percent.”