Prices

August 15, 2019

Zinc’s Price Still in Thrall to Trade Rhetoric

Written by Tim Triplett

By CRU Senior Analyst Helen O’Cleary

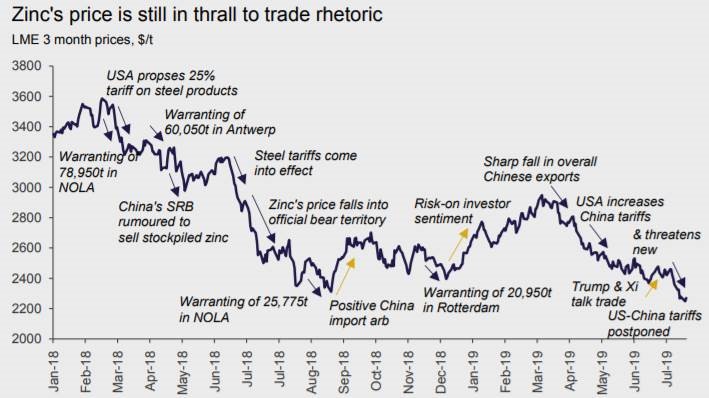

Zinc’s price has been testing long-term support in the low $2,220s in recent days and has come under pressure on both the LME and ShFE. Zinc’s price on the LME hit a year-to-date low of $2,248.5/t on Aug. 12 and has lost 24 percent of its value since the start of the year. Despite a small uptick on news that the USA has decided to postpone the introduction of some of the next round of trade tariffs to early December, it is hovering close to a three-year low at the time of this writing.

Investor interest across the base metals (with the exception of nickel) has been muted in recent months and zinc’s price has been underperforming copper’s since early May. Trade tensions continue to play their part in zinc’s price movements and to date most of these have been to the downside. This, coupled with recent U.S. dollar strength and some modest deliveries of metal into LME warehouses at the start of August, contributed to recent losses.

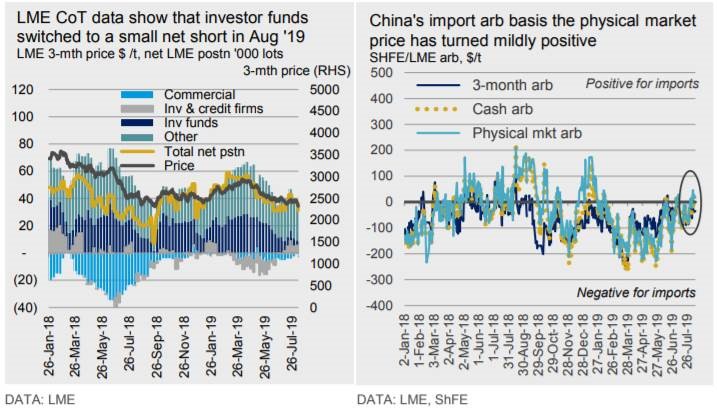

The LME’s commitments of traders data show that investors’ net non-risk-reducing zinc long position (which we take to mean speculative) was 42,000 lots (1 Mt) in mid-July when the price was still in the high $2,400s, but has since fallen to 31,500 lots (787,500t). Although exchange stocks continue to fall, there has been no repeat of the cash squeeze and wide backwardation in zinc’s forward spreads which has defined the market almost continuously for the past two years. The recent decline in zinc’s price and a return to contango markets has led to some restocking, although weak demand and the seasonal summer slowdown means that this has been relatively modest. Zinc’s price is still vulnerable to a renewed technical squeeze while LME stocks remain low, as illustrated by the re-emergence of a dominant cash warrant holder at the end of July, which tipped the cash to three-month spread into backwardation for five days.

Meanwhile, the LME has announced its intention to extend final open outcry sessions in the LME ring from 5 to 10 minutes from the end of September. A successful three-month trial for zinc resulted in a more than 50 percent increase in volumes traded, suggesting that the extra time is beneficial to market participants who prefer to use the ring.

Although refined output has underperformed our expectations at some smelters so far this year, demand has also been weaker than expected. We are confident that Chinese smelters will continue to increase output month-on-month in 2019 H2 as revenues remain high despite the recent fall in zinc’s price on the ShFE. Improved Chinese smelter output has been a key factor in zinc’s recent price decline. We also expect Chinese demand to pick up in H2, although we still expect a full-year contraction.

Zinc’s price on the ShFE has tracked the LME lower in recent weeks and reached a fresh year-to-date low of rmb18,490/t on Aug. 12. Meanwhile, the premium of China’s physical market price over the ShFE cash price increased to an average of rmb178/t in the first two weeks of August, compared to an average premium of just rmb34/t in July. This has tilted the arb based on China’s physical price into mildly positive territory and led to metal being imported into China’s domestic market from bonded warehouses.

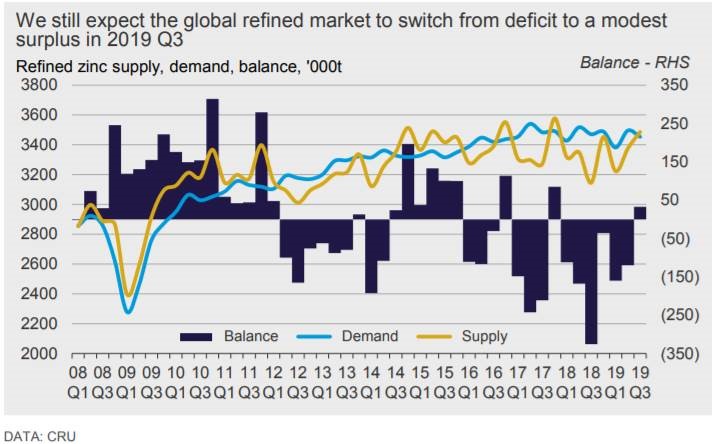

Disappointing 2019 Q2 Smelter Output Leads to Larger Than Expected H1 Deficit

Lower than expected second-quarter refined output from HZL in India and Valleyfield in Canada has led us to revise down our expectations of full-year smelter production. As our estimates of refined demand are little changed since last month this has led to a widening of the 2019 H1 deficit, which we now estimate reached 280,000t. We are still forecasting a return to market surplus in 2019 Q3, albeit a modest one (33,000 tonnes) and expect a 2019 Q4 surplus of around 140,000t to result in a full-year deficit of around 100,000t.