Market Data

August 12, 2019

Employment by Industry Through July 2019

Written by Peter Wright

Job creation slowed in July but is still healthy and in its 10th year of uninterrupted expansion, according to Steel Market Update’s analysis of the latest Bureau of Labor Statistics data.

In July, 16,000 jobs were created in manufacturing industries and 4,000 in construction activities. About 148,000 jobs were created in the private sector, while government gained 16,000 positions.

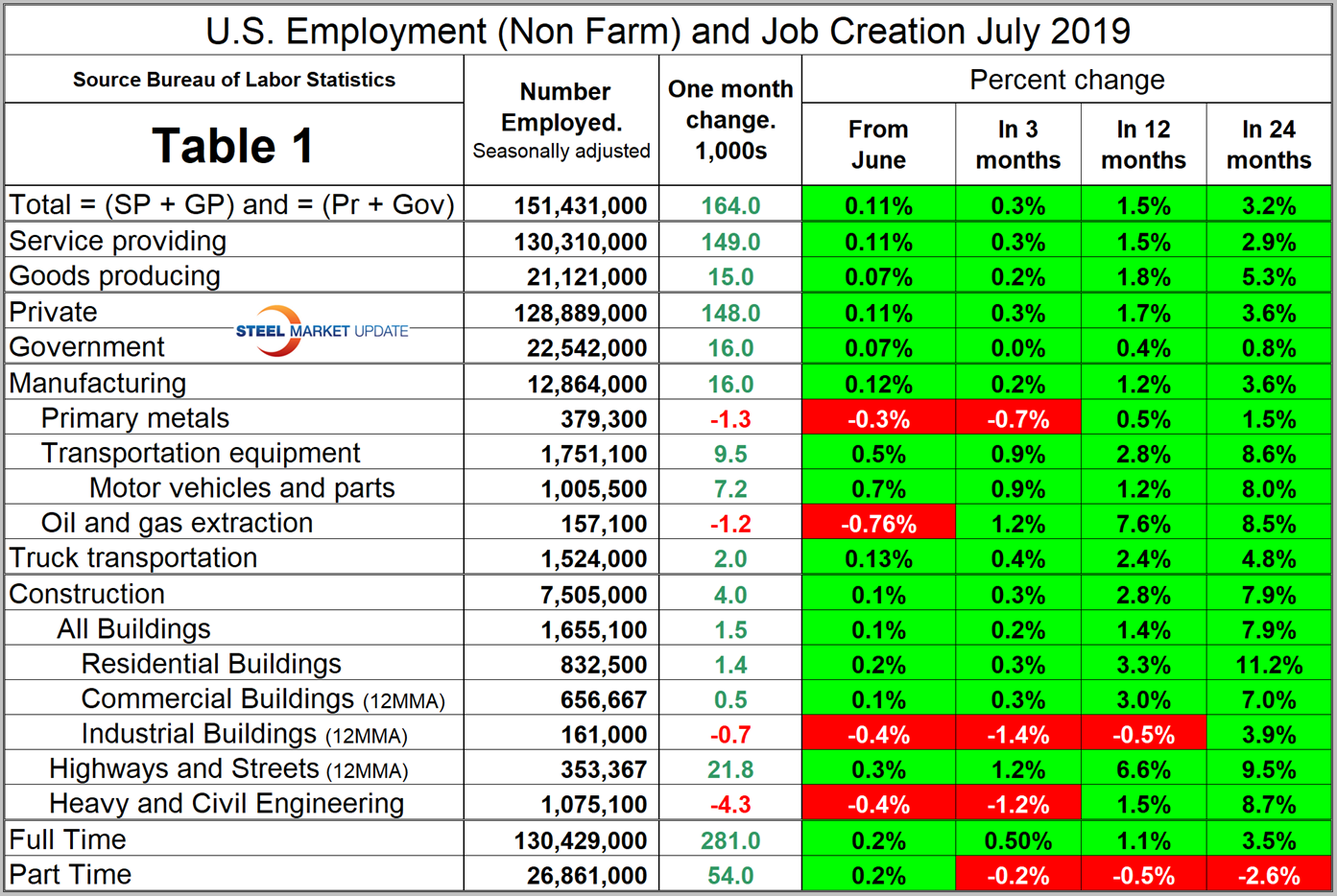

Table 1 breaks total employment down into service and goods-producing industries and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction, and the components of these two sectors of most relevance to steel people are broken out in Table 1.

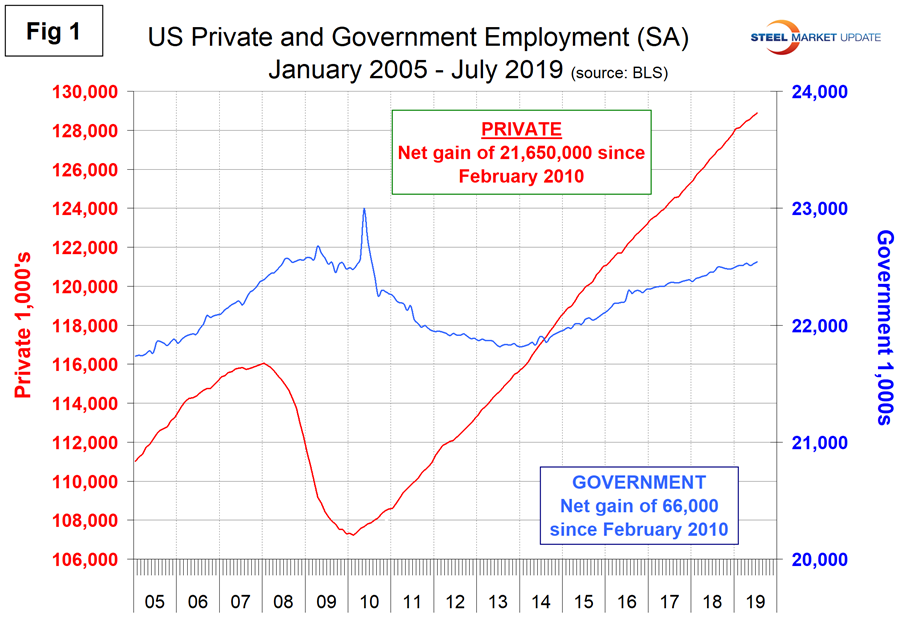

In July, the number employed by the federal government increased by 2,000. State government employment was unchanged and the local level gained 14,000. Since February 2010, the low point of total nonfarm payrolls, private employers have added 21,650,000 jobs as government has gained 66,000 (Figure 1).

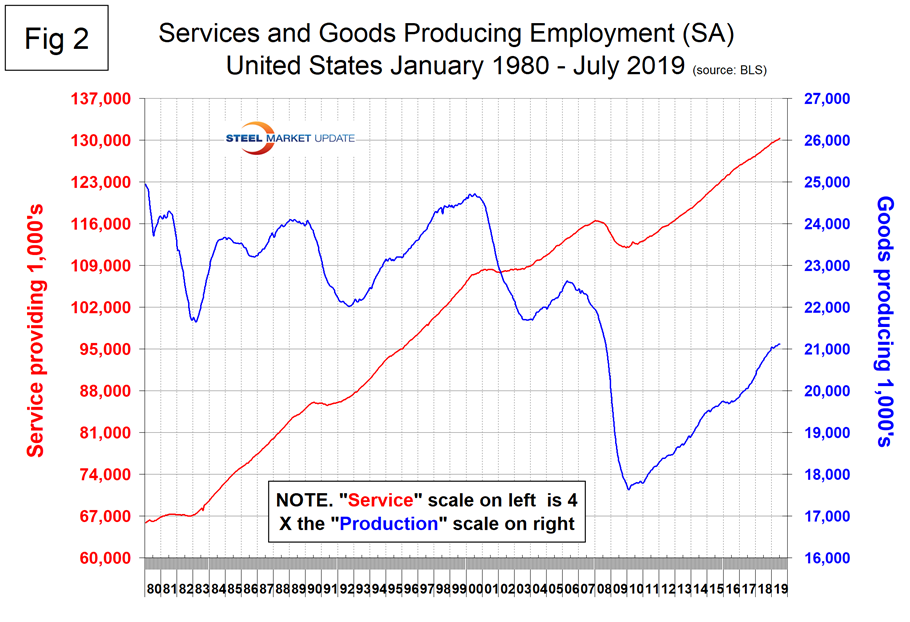

In July, service industries expanded by 149,000 as goods-producing industries, driven mainly by construction and manufacturing, gained 15,000 (Figure 2). Since February 2010, service industries have added 18,222,000 and goods-producing 3,497,000 positions. This has been a drag on wage growth since the recession as service industries on average pay less than goods-producing industries such as manufacturing. The good news is that in the last 24 months the rate of job creation in goods producing industries on a percentage basis has been higher than in service industries.

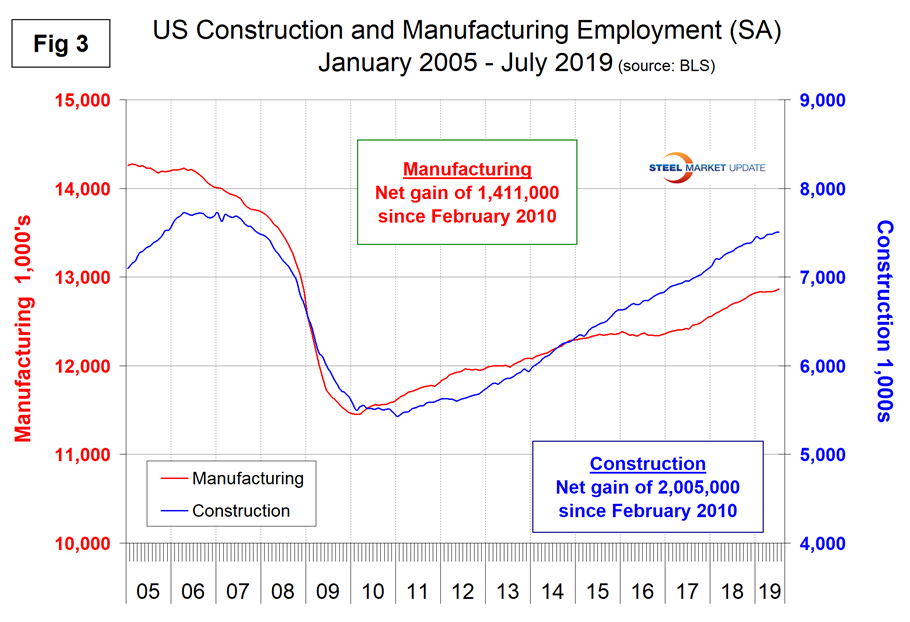

Construction was reported to have gained 4,000 jobs in July as manufacturing gained 16,000. Since and including January 2018, construction has added 412,000 and manufacturing 319,000. Manufacturing productivity improved by 1.2 percent in Q1 2019. Figure 3 shows the history of construction and manufacturing employment since July 2005. Construction has added 2,005,000 jobs and manufacturing 1,411,000 since the recessionary employment low point in February 2010.

The Associated General Contractors of America reported in August: “Job gains in construction have slowed markedly in recent months, but the industry is still increasing employment nearly twice as much as other employers,” said Ken Simonson, the association’s chief economist. “The recent slowdown in hiring and construction spending may reflect contractors’ difficulty in finding enough qualified workers, rather than a downturn in demand for projects. Despite these recent signs of a slowdown or pause in construction hiring, contractors still say it is very difficult to find qualified workers, and the latest government data on construction job openings showed they set yet another record high in May.”

Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

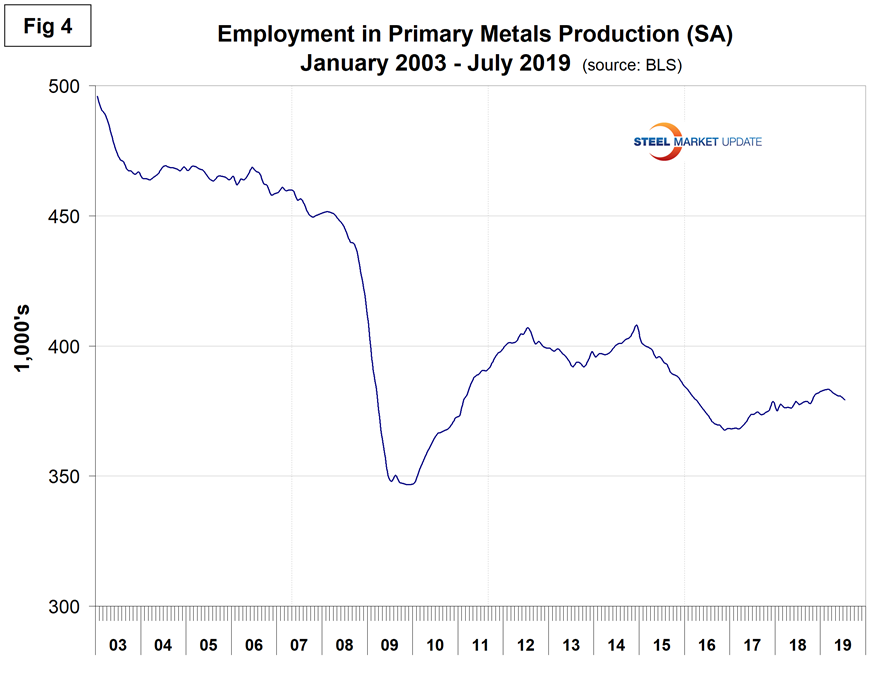

Table 1 shows that primary metals lost 1,300 jobs in July and in the last 12 and 24 months has gained on a percentage basis less than manufacturing as a whole. Figure 4 shows the history of primary metals employment since January 2003. There has been a decline of 4,000 in the last four months.

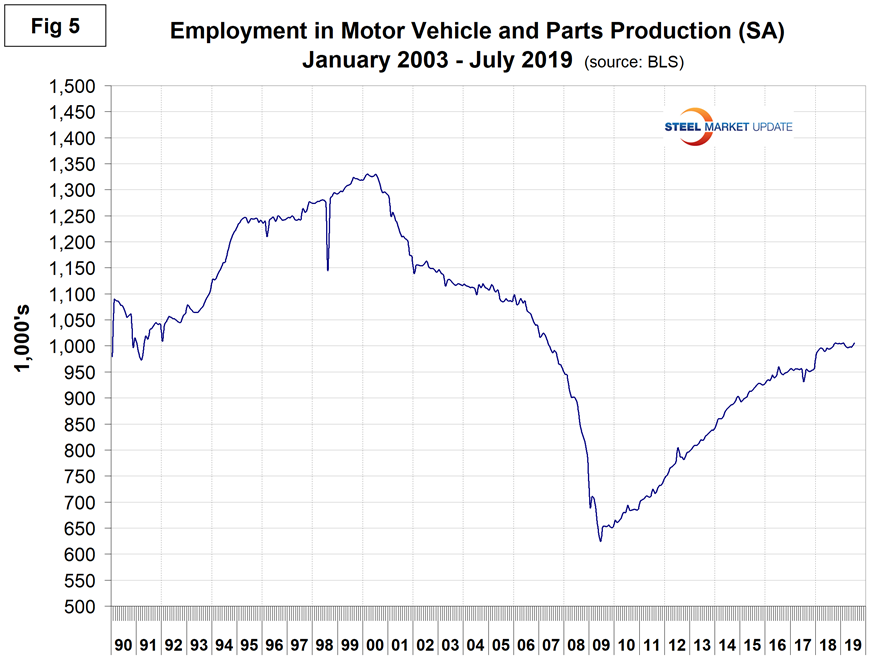

Motor vehicles and parts industries were reported to have gained 7,200 jobs in July. This was the best month since February last year. Figure 5 shows the history of motor vehicles and parts job creation.

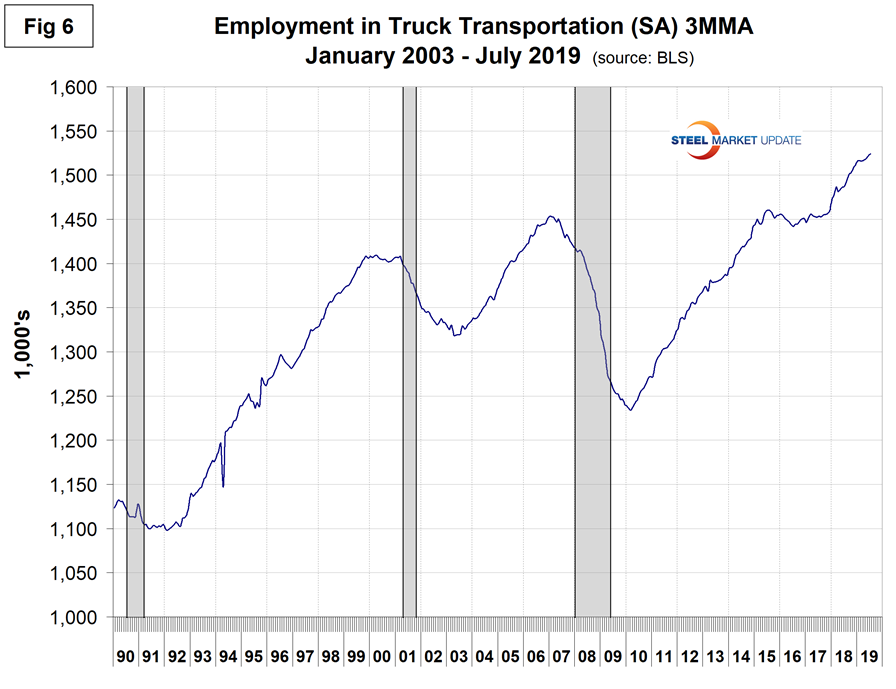

Trucking gained 2,000 jobs in July, resulting in a 12-month gain of 36,300. Employment in truck driving is one of SMU’s recession monitors and Figure 6 suggests that through July the economy is still strong.

SMU Comment: Undoubtedly the rate of job creation is slowing, which is probably a result of a lack of qualified employees. Employment is now in its 10th year of uninterrupted growth. In the last 12 and 24 months, goods-producing industries have been generating jobs at a faster rate than service industries, but that is changing and the reverse was the case in the last three months. In the last 12 months, private employers generated jobs at a rate over four times faster than the combined three levels of government. Overall, this is still a good report as an indicator of future steel demand.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.