Analysis

August 7, 2019

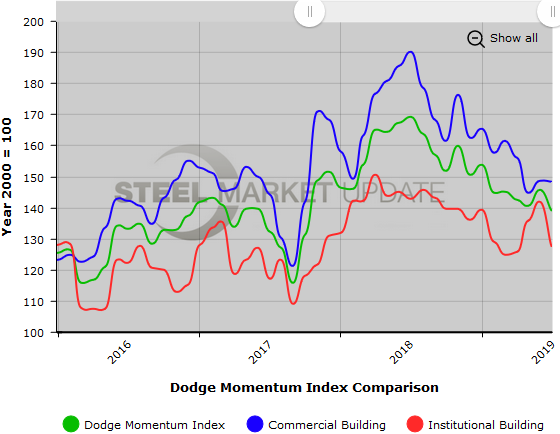

Dodge Momentum Index Declines in July

Written by Sandy Williams

A leading index for nonresidential construction is continuing a downward trend that started in mid-2018. The Dodge Momentum Index fell 4.6 percent last month to a reading of 138.9. The index by Dodge Data & Analytics is a measure of the first report for nonresidential building projects in planning, which have been shown to lead construction spending by a full year.

Institutional projects in planning pulled back 10.2 percent after increasing 6.0 percent in June. The commercial segment was mostly flat with a slight decline of 0.3 percent.

“After peaking in July 2018, the Momentum Index has generally receded, with the latest month’s drop consistent with that trend,” said Dodge Data & Analytics Compared to a year ago, the Momentum Index in July 2019 was down 11.6 percent, with its commercial segment down a steep 17.4 percent while its institutional segment was down a relatively modest 1.8 percent. Much of the decline for the Momentum Index over the past year took place during the latter half of 2018, as December was reported 10.6 percent below the July 2018 peak. Since then, the descent for the Momentum Index has been more gradual, with the July 2019 reading down just 1.2 percent from last December.”

There were 13 projects valued at $100 million or more that entered the planning phase in July—nine commercial and four institutional projects.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.