Market Segment

August 3, 2019

U.S. Steel Shipments Rise in Q2 Despite Challenges

Written by Sandy Williams

U.S. Steel reported sales of $3.5 billion in the second quarter, down from $3.6 billion a year ago due to lower steel prices. Net earnings totaled $68 million, down from the $214 million in the second quarter of 2018.

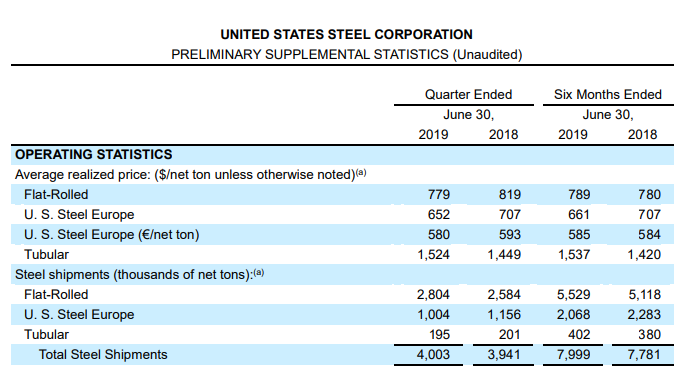

The company’s flat rolled segment posted earnings of $134 million despite significant weather-related logistics problems during the quarter. Average selling price was $779 per ton for the segment, down from $798 per ton in Q1 2019 and $819 per ton the previous year. Flat rolled shipments defied guidance expectations and improved to 2.8 million tons, up from 2.6 million tons in the second quarter of 2018.

“Our execution in the second quarter was strong despite challenging market conditions,” commented President and CEO David Burritt.

“In the Flat-Rolled segment, we delivered for our customers and overcame significant weather-related logistics challenges at the end of the quarter,” said Burritt. “We also announced adjustments to our blast furnace footprint. Our supply is more balanced, and we are better positioned to serve customers and optimize value. There will be a lagging effect on pricing in the third quarter, but we are beginning to see signs of a rebound.”

U.S. Steel temporarily idled two U.S. blast furnaces in June (Gary Works in Indiana and Great Lakes Works in Michigan) and one in Europe to better align production with order book demand. When asked how long the furnaces will be idled, U.S. Steel executives said it would depend on market conditions.

“We always start with the customer, right?” said Burritt. “We have to understand what the customers’ needs are, what’s the order book. And we want to make sure that we’re able to sell the value and create the value for our stockholders. So, this is at the appropriate pace, at the appropriate time, and we’ll make sure that we manage that well.”

“What we’re looking for and what really influences our decision making is sustainable improvements and market conditions that have a positive impact on our order book,” added Kevin Lewis, general manager of Investor Relations.

U.S. Steel has numerous revitalization projects under way including significant upgrades at Gary Works, Mon Valley Works and a new electric arc furnace at the Fairfield tubular mill. The company expects its $1.6 billion investment in its mills to improve reliability, capability and efficiencies, and provide nearly $400 million in run-rate EBITDA benefits.

U.S. Steel currently has no plans to sell slabs from the melt capacity of the new EAF. Commented Lewis, “We’re currently focused solely on rounds production, construction of the EAF as well as enhancements to the rounds caster. So, the in-sourcing of rounds continues to be the anchor tenet in the business case.”

Market conditions are encouraging, said Lewis. “If you look at index prices that show we reached a bottom in late June, four weeks of consecutive price increases for CRU is certainly a positive indication.”

“Lead times have extended to over five weeks. That is certainly an encouraging sign,” he added. “Market chatter on the scrap price is certainly positive and suggests that the momentum is enduring. And market demand is generally strong. So, we have positive indications of continued momentum.”