Analysis

August 2, 2019

U.S. Auto Sales Strong in July, But Down 2% in First Half

Written by Sandy Williams

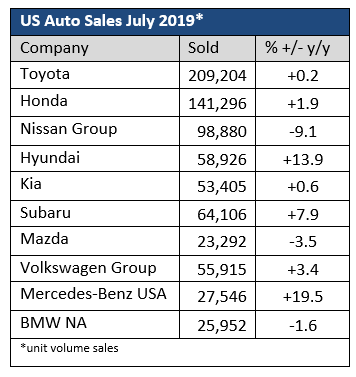

U.S. auto sales appeared to do well in July despite some cooling of the market. Toyota, Honda, Subaru and Hyundai all posted gains for the month. Although Ford, General Motors and FCA no longer report monthly data, analysts suggest that the Big Three also saw sales increase in July.

Cox Automotive said the auto market remained strong last month. “July sales are coming in near where we expected – a slightly slower pace than the YTD average,” said Charlie Chesbrough, Cox senior economist. “Clearly, the market remains on solid ground and buyers are still in the new-car market even with higher prices. Strong sales of some small cars may suggest that affordability shoppers have not entirely abandoned the new-vehicle market. Given the strength of used-vehicle prices, and supply constraints limiting selection, more interest in lower priced new vehicles is not surprising.

“Our full-year forecast for the new-vehicle market in the U.S. remains at 16.8 million,” said Chesbrough. “July’s results will not alter the outlook. And while the Fed’s interest rate cut yesterday will help contain borrowing costs, we do not think the impact on car sales will be much, and not for a while.”

Kelly Blue Book estimates the average transaction price for a new vehicle in July was $37,169, down 0.8 percent from June but up 3.5 percent from a year ago.

“While July is expected to come in below a 17-million SAAR pace, the industry average transaction price continued its steady rise, up 3 percent year-over-year,” said Tim Fleming, analyst for Kelley Blue Book. “Trucks were the big story in July as new mid-size and full-size offerings helped to drive truck prices up about 3 percent while contributing to sales growth in this down market. With the new 1500 trucks from RAM and GM that came out last year, full-size truck prices have now eclipsed the $50,000 mark, and new heavy-duty trucks from these manufacturers this year will push those numbers up even more.”

IHS Markit estimates new vehicle sales fell by 1.9 percent to 2.2 percent in the first six months of the year.