Overseas

August 1, 2019

CRU: Steel Prices in U.S. Ignore Global Downtrend

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

Sheet prices in the U.S. have continued to rise as both buyers and sellers have reported higher transactions. Overall volume reported has been steady over the past few weeks and near 2019 average levels. The overall price range remains wide, around $50 /s.ton. We anticipate that prices will continue to rise from current levels, though discounted monthly contracts will eventually weaken the resale market.

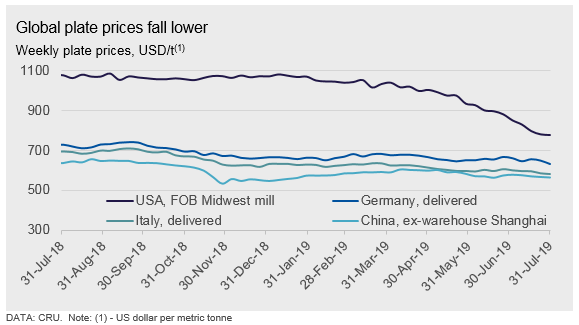

As for plate, the price increase we anticipated has been announced. Plate prices, based on transactions from last week, have continued to fall, though the w/w decline was only $3 /s.ton. Prices next week may be in transition, though we expect plate prices to follow the higher trend set by sheet prices throughout August.

European sheet prices have moved lower again this week, other than Italian HR coil, which is unchanged at €452/t. German HR coil prices are the lowest they have been since November 2016, so essentially all the strong market period of 2017-18 has now been unwound. The ECB is making noises about additional stimulus measures for the European economy after the summer, but for now the steel market at least is waiting and seeing on that. ArcelorMittal has postponed its planned outage at Krakow, meaning that one element of efforts to tighten the supply side has been removed. Plate prices are unchanged this week in Italy at €520/t but took a large step lower in Germany, by €12/t w/w to €566/t. We have highlighted for a little while now that German prices looked high relative to both HR coil and to Italian plate prices, and this may be the start of that expected downward correction.

In China, sheet prices edged up this week while longs prices fell. Though some divergence existed between longs and sheets prices, market fundamentals for both products remained weak. The Tangshan government extended the environmental production restriction to August. However, some market participants said that the impact would be less than July. Moreover, although the EBITDA margin of BF-BOF based mills dropped to 2.4 percent, they maintained strong production. The lossmaking EAFs only lowered their output marginally. Steel prices were also hard to find some support from the demand side. The continuous hot temperature forced some workers to start working after sunset. We expect price weakness to continue.