Government/Policy

July 30, 2019

Leibowitz on Trade: Which Segment of the Steel Industry Wins from Tariffs?

Written by Sandy Williams

Trade attorney and Steel Market Update contributor Lewis Leibowitz offers the following update on events in Washington:

Recent reports indicate that parts of the U.S. steel industry are being helped by the steel tariffs, while others are being hurt. Sixteen months into the trade war, the division of steel producers into three distinct industries (and perhaps more) has become clear.

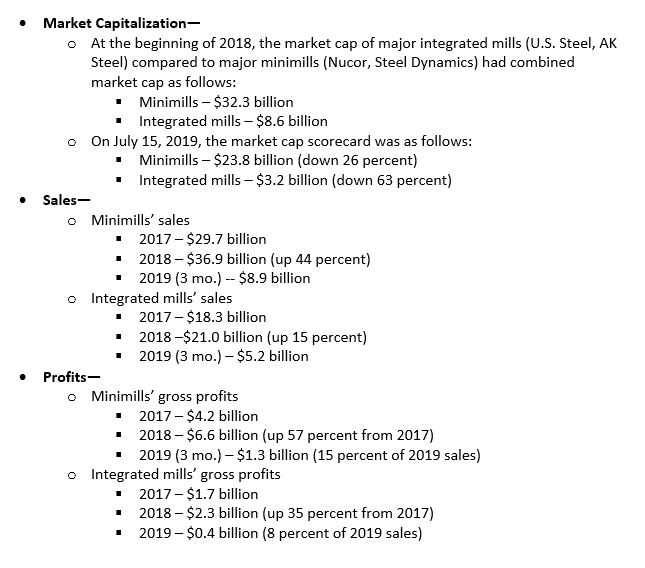

Those who produce raw steel use two separate production methods, as most in the steel game have known for years: electric arc furnace (minimills) and blast furnace producers (integrated mills). In many ways, these are two separate industries. They have had quite different experiences under the tariff regime dating from 2018. Based on three major benchmarks (market value, sales and profits), the minimills are doing much better under the tariff regime than the integrated mills.

Obviously, there are many ways to measure relative success; these are only three. The picture is clear, however, that the minimills have improved their financial picture much more than the integrated mills. The data for the largest integrated mill in the U.S. (Arcelor Mittal) is global, so the U.S. operations cannot be broken out based on public data. To give an idea of the scale of Arcelor Mittal, its market capitalization in July 2019 ($17 billion) was about eight times that of U.S. Steel and only slightly larger than Nucor. Because Arcelor Mittal’s U.S. operations cannot readily be broken out, I looked only at U.S. Steel and AK Steel on the integrated side.

Looking at the announced capacity changes, the integrated mills suffer by comparison with the minimills. U.S. Steel announced restarts of shuttered blast furnaces at Granite City, Ill., and Pittsburgh (Homestead Works). But Nucor and Steel Dynamics are announcing “greenfield” projects with up-to-date technology. The likelihood of any new steel blast furnaces being built in the United States is near zero. The most recent new blast furnace in the U.S. was the Burns Harbor complex in Indiana, built by Bethlehem Steel Corp. in the early 1960s.

The ability to make use of the extra market share opportunities that the Trump tariffs have given the integrated mills is, therefore, not as effective for them as it is for the minimills.

The third segment of the steel industry? The downstream producers—rerollers, long product producers and others purchasing semifinished steel—are generally hurt by the tariffs because their costs for raw materials have increased. In some cases, these producers do not have tariff protection for their finished products (e.g., nail producers).

With this track record, the tariffs are not likely to get a good report card for all steel producers. This is hardly a surprise. Tariffs generally do not work well to improve the fortunes of mature industries. They are much more successful at nurturing developing “infant” industries. Perhaps one might characterize the minimills as an “infant” industry, which is still growing, largely at the expense of domestic integrated mills.

Lewis Leibowitz

The Law Office of Lewis E. Leibowitz

1400 16th Street, N.W.

Suite 350

Washington, D.C. 20036

Phone: (202) 776-1142

Fax: (202) 861-2924

Cell: (202) 250-1551