Market Data

July 25, 2019

Steel Mill Negotiations: Not Much Change

Written by Tim Triplett

Steel Market Update data indicates that the mills have been able to collect some, but not all, of their recent price increases. Their apparent willingness to continue negotiating on spot orders, as reported by steel buyers to SMU, casts doubt on the resolve they will need to collect the rest.

Certainly, steel prices are much firmer than they were a month ago, but negotiations between the mills and buyers have not tightened as much as expected in the past two weeks, perhaps because the mills raised prices for a third time this week for a total increase of $120 per ton, thus giving them some cushion from which they can negotiate. In Steel Market Update’s opinion, this is not necessarily a negative since our price indices show flat rolled steel prices as being higher week-over-week.

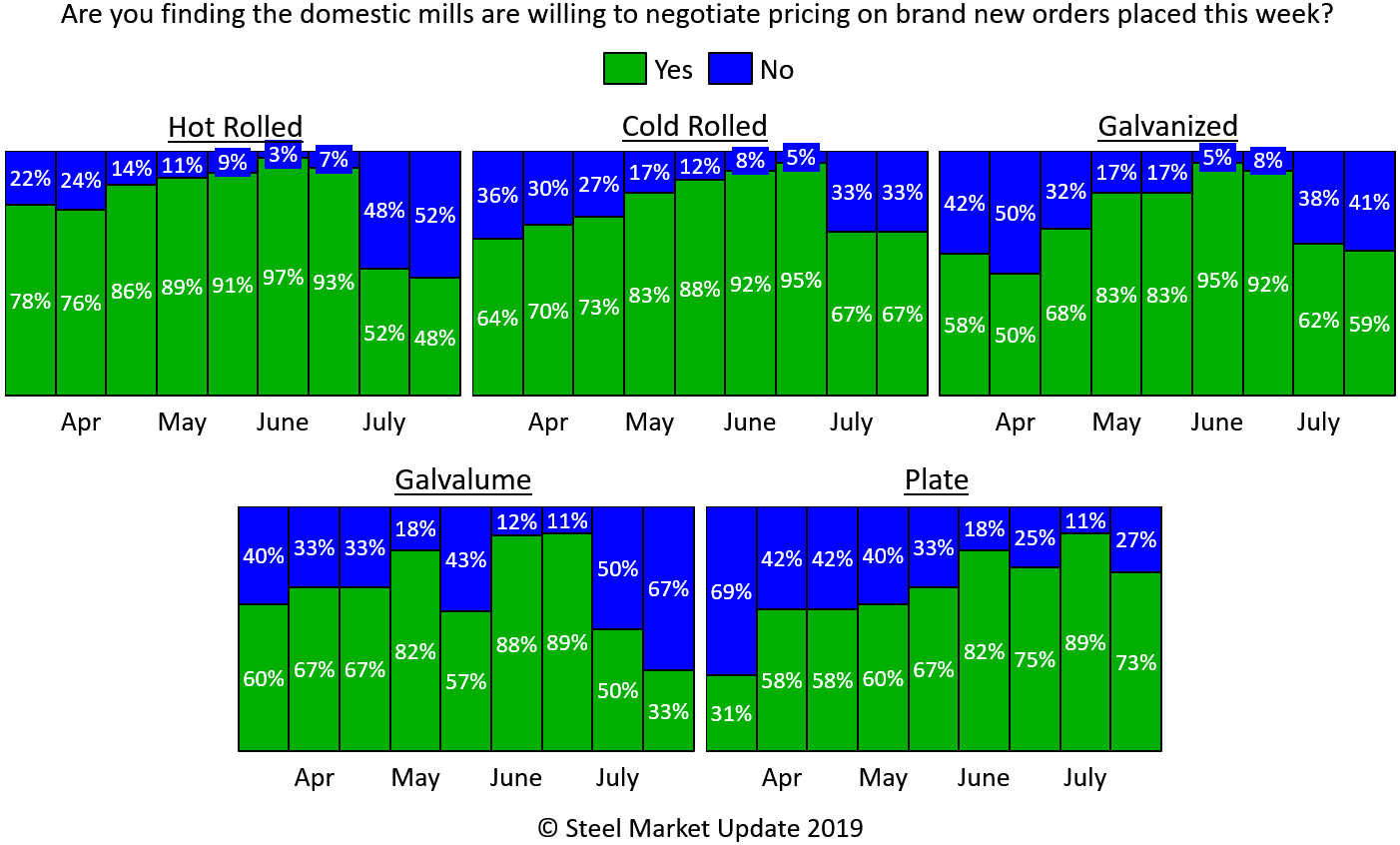

In mid-June, nine out of 10 respondents to SMU’s market trends questionnaire reported that the mills were open to compromise on pricing in order to get the order for all types of products. One month later, negotiations have tightened to varying degrees, depending on the product.

In the hot rolled segment, the majority (52 percent) of respondents said the mills are now holding the line on price. But nearly the same number, about 48 percent, said the mills were still open to price talks on HR this week.

Prices are still very negotiable on cold rolled steel, according to two-thirds of respondents. Only one-third report the mills holding firm on cold rolled prices, unchanged from two weeks ago.

Similarly, 59 percent said the mills are still open to price negotiations to close the deal on galvanized orders, down only a slight three percentage points over the past two weeks. Just 41 percent said the mills are now standing pat on galv prices. Prices are more firm for Galvalume, as two-thirds of those responding said the mills are saying no to discounts.

The bargaining for plate orders has tightened a bit, but 73 percent of buyers still report plate prices as open to negotiation.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.