Market Segment

July 23, 2019

SDI Chooses Sinton,Texas, for New Flat Rolled Mill

Written by Sandy Williams

The wait is over—Steel Dynamics has announced it will build its new $1.9 billion flat rolled steel mill in Sinton, Texas, 30 miles northwest of Corpus Christi.

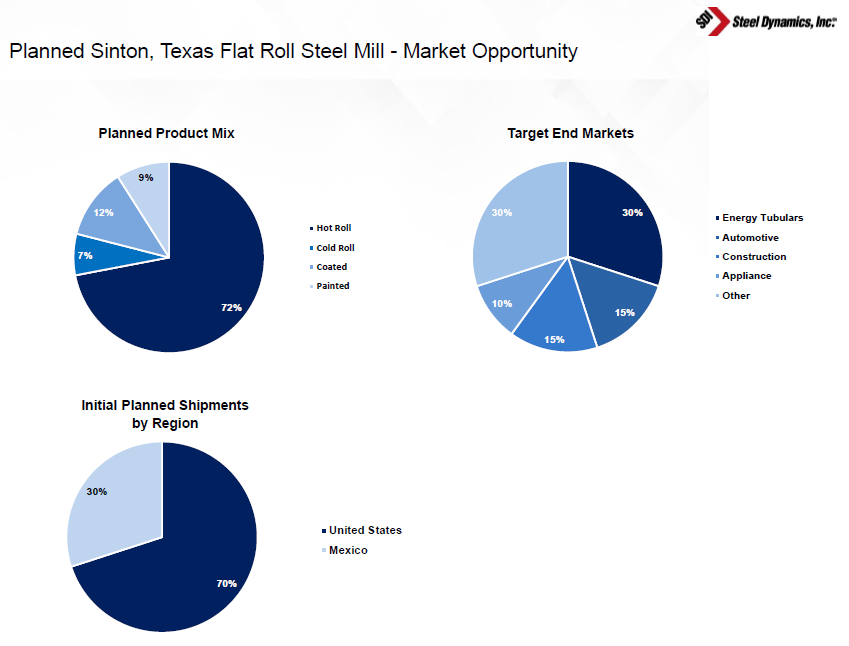

The new steel mill will serve the four-state Texas area, the western U.S. and Mexico market regions, representing approximately 27 million tons of relevant flat rolled steel consumption—7 million tons in the four-state region, 4 million tons on the West Coast and 16 million tons in Mexico. Initially, about 30 percent of production will be shipped to Mexico and 70 percent to U.S. customers.

The Sinton site offers proximity to a prime ferrous scrap market and cost-effective access to pig iron through the deep water port of Corpus Christi. Two Class I railroads are on site, with transloading opportunities for a third, as well as proximity to major U.S. highways.

“We believe a majority of the customer base will experience a significant freight savings compared to their current supply-chain configurations,” said Steel Dynamics CEO Mark Millett. He estimates customers will save $20 to $30 per ton compared to prices from their current closest domestic suppliers. Steel will be provided to customers in weeks, not months, he added.

The location is also central to the largest domestic consumption of flat rolled Galvalume and construction painted products. The expansive 2,500-acres will allow customers to locate on-site, providing further savings on logistics and steel mill volume base-loading opportunities. Several customers are already in discussion with SDI to locate on the grounds, said Millett.

The Sinton site will be SDI’s seventh EAF steel mill and its third flat-rolled facility. Annual production capacity is anticipated at approximately 3.0 million tons with the capability to produce the latest generation of advanced high-strength steel grades. The project will include value-added finishing lines, including a galvanizing line with an annual capacity of 550,000 tons, and a paint line with an annual coating capacity of 250,000 tons. Flat rolled steel products will include hot roll, cold roll, galvanized, Galvalume and painted steel, primarily targeting the energy, automotive, construction and appliance sectors.

The mill will have a casting capability of up to 84 inches wide and up to a 5.5-inch cast thickness, making it the world’s largest thin-slab facility and able to provide a steel that is currently not available domestically, the company claims. The mill will also have the capability to produce coils up to 52.5 tons.

“These advances will further reduce the gap between existing EAF and integrated steel mill production capabilities. We have already placed orders for a majority of the equipment and filed for the required permitting,” said Millett.

Some site preparation will be done this year, but true construction will not commence until permits are approved in first-quarter 2020. Production start-up is expected in mid-2021.

The timing for start-up at Sinton coincides with commissioning of a third galvanizing line at SDI Columbus. The 400,000 tons of production that will be diverted to Columbus by 2021 will be replenished by new production at Sinton.

Millett stressed that SDI is not simply adding capacity to the market but is providing differentiated products and a competitively priced alternative to imported steel. “It’s more of an import killer,” said Millett, noting that approximately 2.4 million tons of OCTG and 1.5 million tons of line pipe were imported through the Port of Houston in 2018.

“To be clear, we’re not just adding production capacity,” he said. “We have a differentiated product portfolio. We will have a significant geographic freight and lead time advantage and we have targeted customer markets.

“Our planned new EAF flat rolled steel mill will be the most technologically advanced facility existing today,” he added. “Our team has selected a suite of technologies based on our proven history of success, which should allow us to achieve steel grades previously out of reach to thin-slab casting technology, while sustaining the low-energy and low-carbon footprint that is at the core of our steelmaking operations.”

Selection of the Texas site was met with excitement by the Corpus Christi Regional Economic Development Corp., which has been hoping to add an electric arc furnace to the manufacturing renaissance in the region. More than $50 billion of industrial projects have been announced in the Corpus Christi area over the past 10 years including Tex-Isle’s $35 million steel pipe facility, Voestalpine’s $1.3 billion hot briquetted iron facility; and TPCO America’s $1 billion customized steel pipe rolling facility. A combination of state and local incentives in the $150 million to $155 million range and an ideal geographic location helped bring Steel Dynamics to the region.

The Sinton steel mill will add 600 direct jobs and numerous opportunities for indirect employment.