Prices

July 21, 2019

CRU: FOB US Midwest HRC Pricing: Market Preferences

Written by Tim Triplett

By CRU Research Manager Chris Houlden and CRU Principal Analyst Josh Spoores

FOB US Midwest HRC pricing: new research reveals market preferences

Physical market preferences for attributes of FOB US Midwest mill HR coil (HRC) prices have recently been established by independent market research.

Key findings are that weekly FOB US Midwest mill prices are regarded as more accurate than daily; a price being transaction-based is more important than being daily, including for the purpose of physical contract settlement; the reputation of the Price Reporting Agency (PRA) is important, as is the association of a physical price with a financial derivative (futures/options) contract.

Research objectives and methodology

CRU has a long-established and proud history of serving the market with its US Midwest prices, but index-based pricing has moved in and out of favour, and alternatives to CRU prices have presented themselves. CRU welcomes all forms of choice in the market. With this context, CRU commissioned third party research in order to clarify current attitudes towards price frequency, methodology and use of financial derivative contracts by the industry. We commissioned similar research in 2015 and this year we repeated and extended it to help ensure CRU’s services continue to meet market requirements.

Methodology

The scope of the survey was the FOB US Midwest mill physical HRC market, and therefore the sample was of North American physical market participants. A privately-owned independent global market research company conducted the research in February-March 2019. The research and responses were anonymous, meaning the company commissioning the research (CRU) was unknown to the research subjects. In addition, the answers given by research subjects could not be matched with the identity of the respondents. The research was conducted by means of SurveyMonkey and telephone interviews. 51% of individuals asked to participate were not CRU customers.

Results

Frequency – weekly preferred

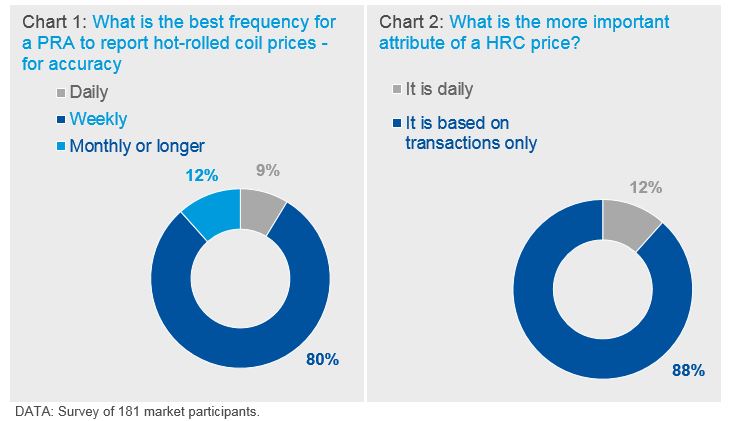

The quantitative survey results show that the physical market prefers weekly pricing for FOB mill/ex-works HRC pricing. The overwhelming majority of physical market participants prefer weekly or less frequent pricing both from the perspective of accuracy (Chart 1 below) and in terms of how the data is used in their business.

In addition, most survey participants rated a price being solely transaction-based as more important than it being daily (Chart 2).