Market Data

July 11, 2019

Steel Negotiations: Mills Begin to Hold the Line

Written by Tim Triplett

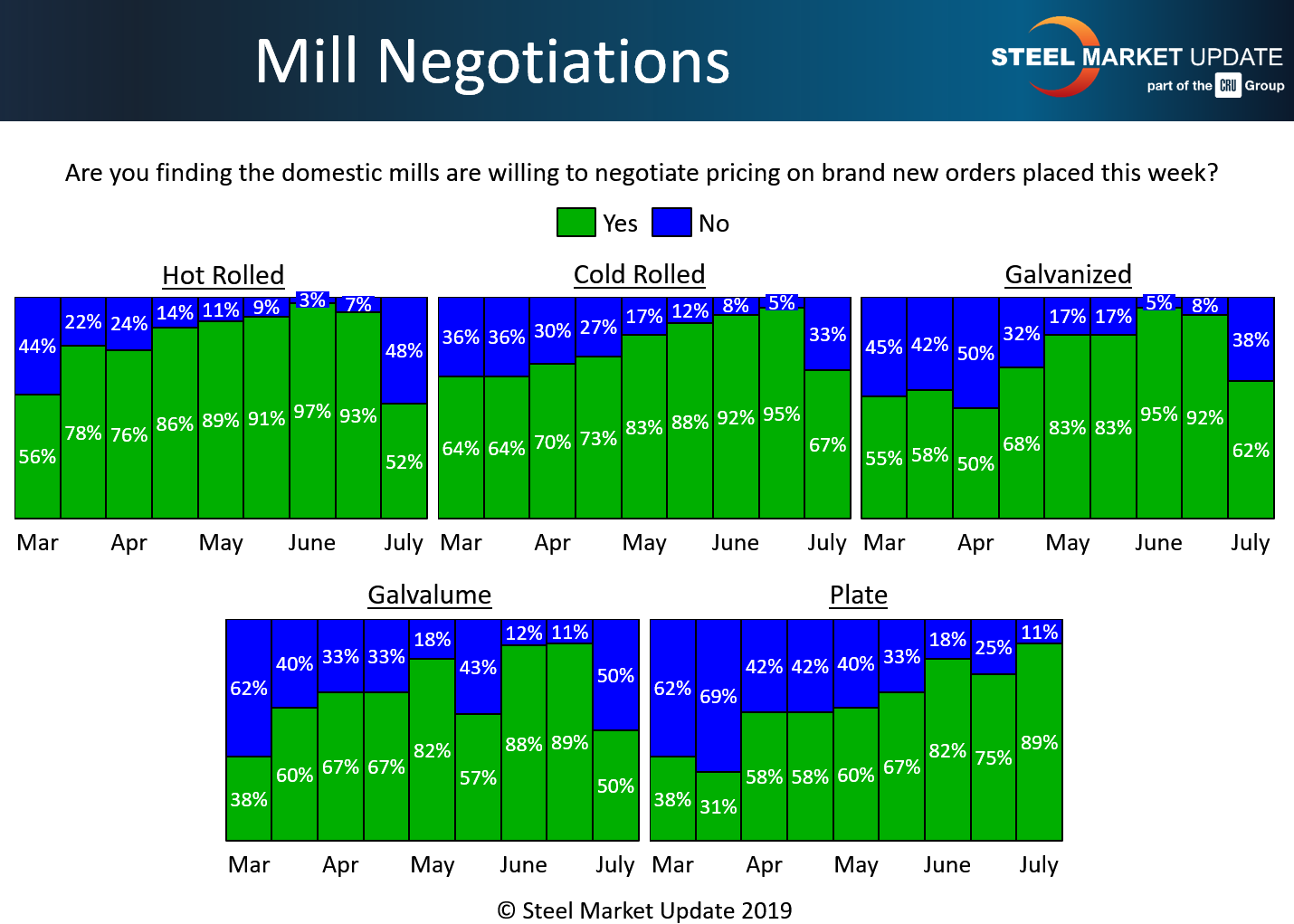

Steel price negotiations have tightened considerably as the mills have begun to hold firm in support of two $40 per ton price increases announced in the past two weeks. Note that Steel Market Update began gathering the data below on Monday, just prior to the latest mill price increase announcements on Tuesday and Wednesday.

In mid-June, nine out of 10 respondents to Steel Market Update’s market trends questionnaire reported that the mills were open to compromise on pricing in order to secure the order for all types of products. Today, depending on the product, from one-third to one-half said the mills have stopped negotiating.

In the hot rolled segment, 48 percent said the mills are now holding the line on price, a big jump from just 7 percent in the last poll. A narrow majority, 52 percent, said the mills were still open to price talks this week, down sharply from 93 percent two weeks ago.

Prices are nonnegotiable on cold rolled steel, according to one-third of respondents, up from just 5 percent last month. The other two-thirds said the mills are still flexible in cold rolled negotiations.

In galvanized, 38 percent said the mills are now standing pat on price, versus just 8 percent in mid-June. Sixty-two percent said the mills are still open to negotiation to close the deal on galvanized orders, down from 92 percent two weeks ago. For Galvalume, respondents said, it’s a 50-50 proposition to find a mill willing to talk price in the current environment.

Negotiations for plate orders have actually continued to loosen as nearly nine out of 10 buyers said the mills are flexible on plate prices today.

SMU will keep a close watch on the tenor of negotiations in the coming weeks for signs of how likely the mills are to collect higher prices.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.