Market Data

July 11, 2019

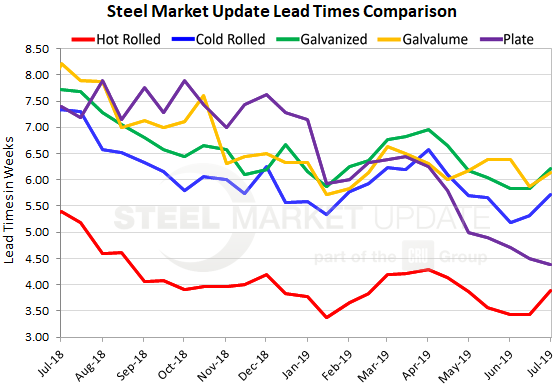

Steel Mill Lead Times: Beginning to Extend

Written by Tim Triplett

Lead times for steel delivery have moved out a bit in the past two weeks, lending support to recent mill price increases. The average lead time for hot rolled has moved up to nearly four weeks, cold rolled to nearly six weeks, and coated steels to more than six weeks. Plate lead times are bucking the flat rolled trend and are slightly lower than what we reported a couple of weeks ago.

The mills have announced two price hikes in the past two weeks totaling $80 per ton. The market is keeping a close watch on lead times to gauge the likelihood the mills will hold firm in their pursuit of higher prices. Note that Steel Market Update began gathering this data on Monday, just before the mills’ latest price increase announcements on Tuesday and Wednesday.

Lead times for steel delivery are a measure of demand at the mill level. The longer the lead time, the busier the order activity at the mills, and the less likely they are to discount prices.

Hot rolled lead times now average 3.88 weeks, up from 3.43 weeks in mid-June. Hot rolled lead times were much longer in the high-demand period this time last year at 5.39 weeks.

Cold rolled lead times, at 5.72 weeks, show an uptick from 5.32 weeks in the data from the mid-June questionnaire. Cold rolled lead times at this time last year were two weeks longer.

Average lead times for galvanized have extended to 6.22 weeks, up from 5.84 weeks in SMU’s last market canvass. Galvanized lead times were a week and a half longer in early July 2018. The current average lead time for spot orders of Galvalume has lengthened to 6.13 weeks from 5.88 weeks.

Lead times for spot orders of plate steel are moving in the opposite direction, getting shorter as demand for plate moderates after a lengthy period of high demand. Lead times for spot orders of plate now average 4.38 weeks, down from 4.50 weeks in mid-June.

If lead times don’t continue to extend over the coming weeks, that’s a sign the mills are having difficulty filling their order books at the higher prices.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.