Analysis

July 8, 2019

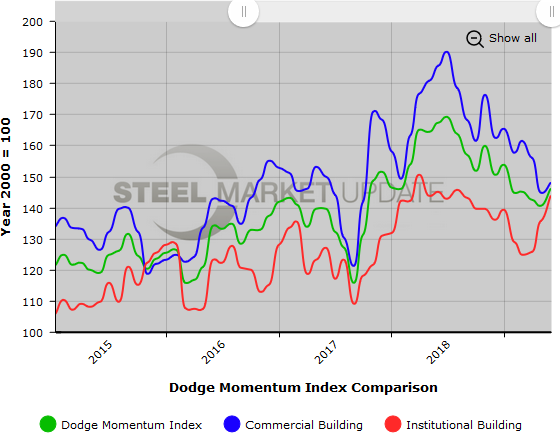

Dodge Momentum Index Jumps in June Amid General Slowdown

Written by Sandy Williams

The Dodge Momentum Index improved in June, rising 4.0 percent to 146.1 from a revised reading of 140.5 in May. The monthly index measures the first report for nonresidential building projects in planning, which has been shown to lead construction spending by a full year.

Initiation of planning for institutional building projects jumped 6.1 percent, while commercial planning rose 2.4 percent.

Dodge Data & Analytics suggests caution when reviewing the Index report.

“Despite the improvement shown by the Momentum Index in June, planning for commercial and institutional building projects has clearly stepped back from the torrid pace set during the first half of 2018. Indeed, the average of the overall Momentum Index through the first six months of 2019 was 4.3 percent lower than the same period a year ago, with the commercial component down 5.2 percent and the institutional component down 3.0 percent. What June’s improvement does affirm is that the broader pullback by the Momentum Index remains gradual, and that there are still ample projects at the planning stage to maintain stability for construction spending in the near term.”

Seventeen projects valued at $100 million or more entered the planning phase in June.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.