Market Data

July 1, 2019

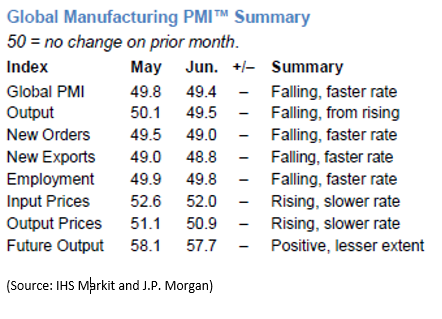

Global Manufacturing Contracts in June

Written by Sandy Williams

Global manufacturing contracted in June with manufacturing indices falling as trade tensions and tariffs impacted business conditions. At 49.4, the J.P. Morgan Global Manufacturing PMI contracted to its lowest rate in six-and-a-half years.

“The global manufacturing sector downshifted again at the end of the second quarter,” said Olya Borichevska, from Global Economic Research at J.P. Morgan. “The PMI surveys signaled that output stopped growing, as inflows of new business shrank at the fastest pace since September 2012. This impacted hiring and business optimism, with the latter at a series-record low. Conditions will need to stage a marked recovery if manufacturing is to revive later in the year.”

The Eurozone manufacturing sector remained in contraction in June with the PMI falling to a three-month low of 47.6, from 47.7 in May. Consumer goods showed improvement in June while intermediate and investment goods producers saw sharp contraction. Germany remained the poorest performing nation at a PMI of 45.0. Greece led the region at 52.4, followed by France at 51.9 and the Netherlands at 50.7. The rest of the Eurozone remained below the neutral 50 PMI. New orders continued to decline along with production and employment. Shorter lead times helped spur the first decline in input materials in three years. Eurozone manufacturers were challenged by weak economic conditions, global trade tension, political uncertainty and a decline in the auto industry in June

“Eurozone manufacturing remained stuck firmly in a steep downturn in June, continuing to contract at one of the steepest rates seen for over six years,” said IHS Markit chief business economist Chris Williamson. “The downturn is also showing no signs of any imminent end. The survey’s forward-looking indicators remained worryingly subdued in June, adding to concerns about the economy in the second half of the year.”

Trade tensions caused declining sales, export orders and production in China during June, resulting in a dip into contraction for the Caixin China Manufacturing PMI. The Index fell from 50.2 in May to 49.4 in June.

“The sub-index measuring sentiment toward future output plunged further, albeit staying in expansionary territory, a reflection of continuously weakening business confidence amid the Sino-U.S. trade conflict,” said Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group. “Overall, China’s economy came under further pressure in June. Domestic demand shrank notably, foreign demand was still underpinned by front-loading exports, and business confidence fell sharply. It’s crucial for policymakers to step up countercyclical policies. New types of infrastructure, high-tech manufacturing and consumption are likely to be the main policy focuses.”

Manufacturers in Russia saw declining orders and output in June resulting in a drop in employment and a decline in backorders. The PMI registered 48.6 last month, falling from 49.8 in May and the lowest posting in almost a year. New orders fell on weaker demand domestically and from abroad. Input prices rose on higher raw material and supplier prices, adding to output charges. Future sentiment fell for the third month, nearing a one-year low but was still above the historical trend.

New orders, exports and output contracted in Mexico during June. The manufacturing PMI posted at 49.2, falling from 50.0 in May and dragging the quarterly average below 50 for the first time in eight years, said IHS Markit. The decline was linked to “subdued client confidence, policy uncertainty, a lack of investment and trade tensions.” Business sentiment was at its second lowest level since the survey began. Firms are hoping product diversification and efficiency gains will increase output in the next 12 months.

The IHS Markit Canada Manufacturing PMI posted a 49.2 in June, up marginally from May’s low of 49.1 and marked the third month in a row below the “no growth” mark of 50. Manufacturers saw further declines in production and new orders. Export sales were unchanged last month with some manufacturers noting an uptick in export sales due to the removal of Section 232 tariffs. A sharp drop in purchasing activity eased cost pressures but failed to boost prices due to intense competition for sales.

“The latest survey results provide a clear sign that U.S.-China trade frictions are holding back the Canadian manufacturing sector,” commented Tim Moore, Economics Associate Director at IHS Markit. “New orders have now decreased for four months in a row, with survey respondents widely commenting on subdued export demand and weaker global trade volumes so far this year. Moreover, manufacturers indicated that their business optimism dropped sharply in June and was among the weakest seen since the start of 2016.”

Manufacturing in the United States was mostly stagnant in June with a slight uptick in new orders and output. The IHS Markit U.S. Manufacturing PMI posted 50.6 for the month, up from 50.5 in May and the second lowest PMI since September 2009. Firms expressed concern regarding the softening trend in new orders and the effect of tariffs on raw material prices. Higher input prices were passed through to clients by some firms while others highlighted the need to discount products in order to attract and retain customers. Large companies have been hit by deteriorating conditions in recent months and began destocking inventory in May and June in response to slowing orders.

“Although business optimism about the future lifted slightly higher, it remained close to survey lows to indicate persistent low morale,” said Williamson. “Worries centered on signs of slowing demand both at home and internationally, weaker sales, and geopolitical uncertainty. Tariffs meanwhile continued to push up prices, but weak demand often limited the ability of firms to pass higher prices onto customers, suggesting overall inflationary pressures have weakened compared to earlier in the year.”