Market Data

June 28, 2019

Global Steel Production Hits Record High in May

Written by Peter Wright

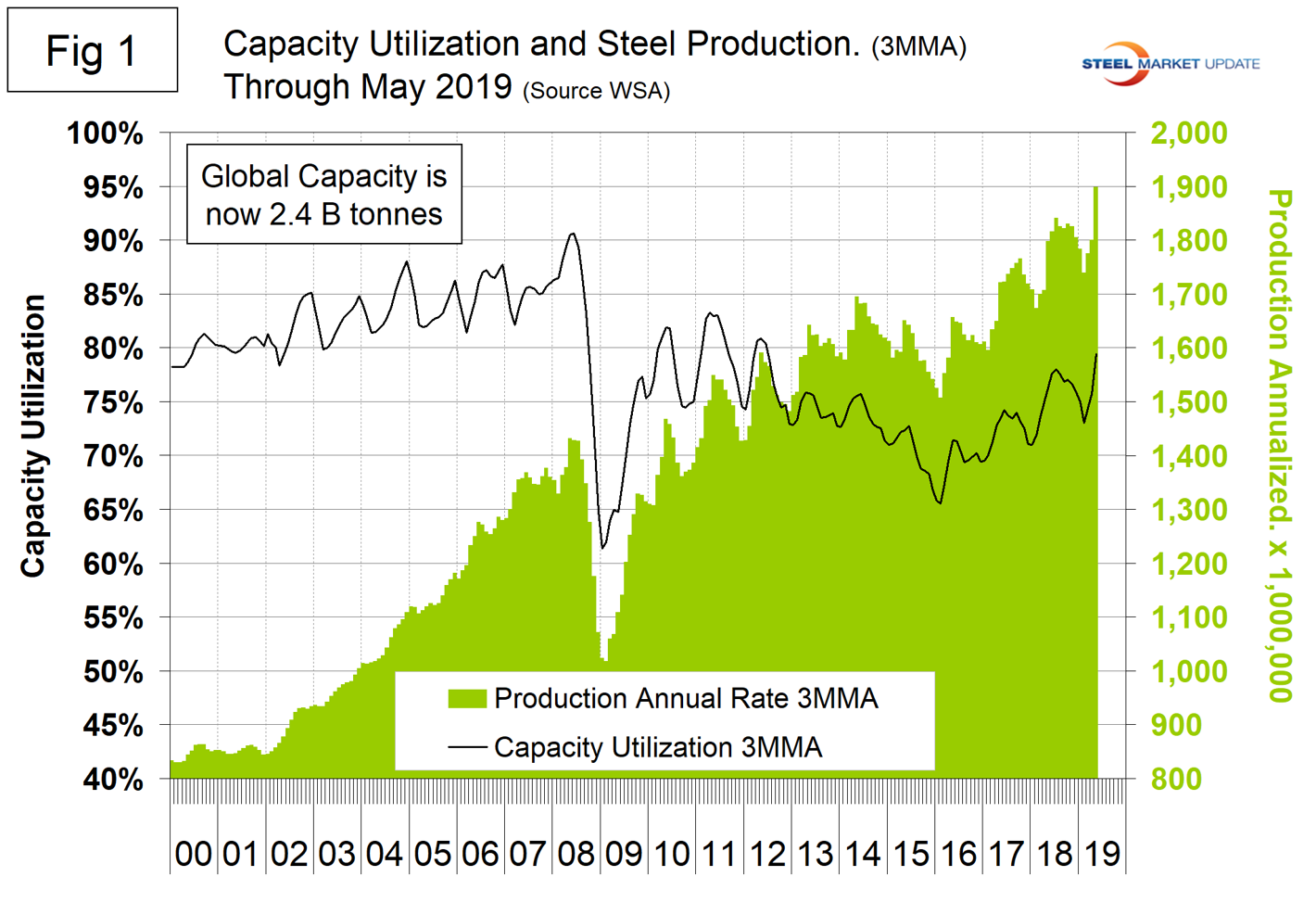

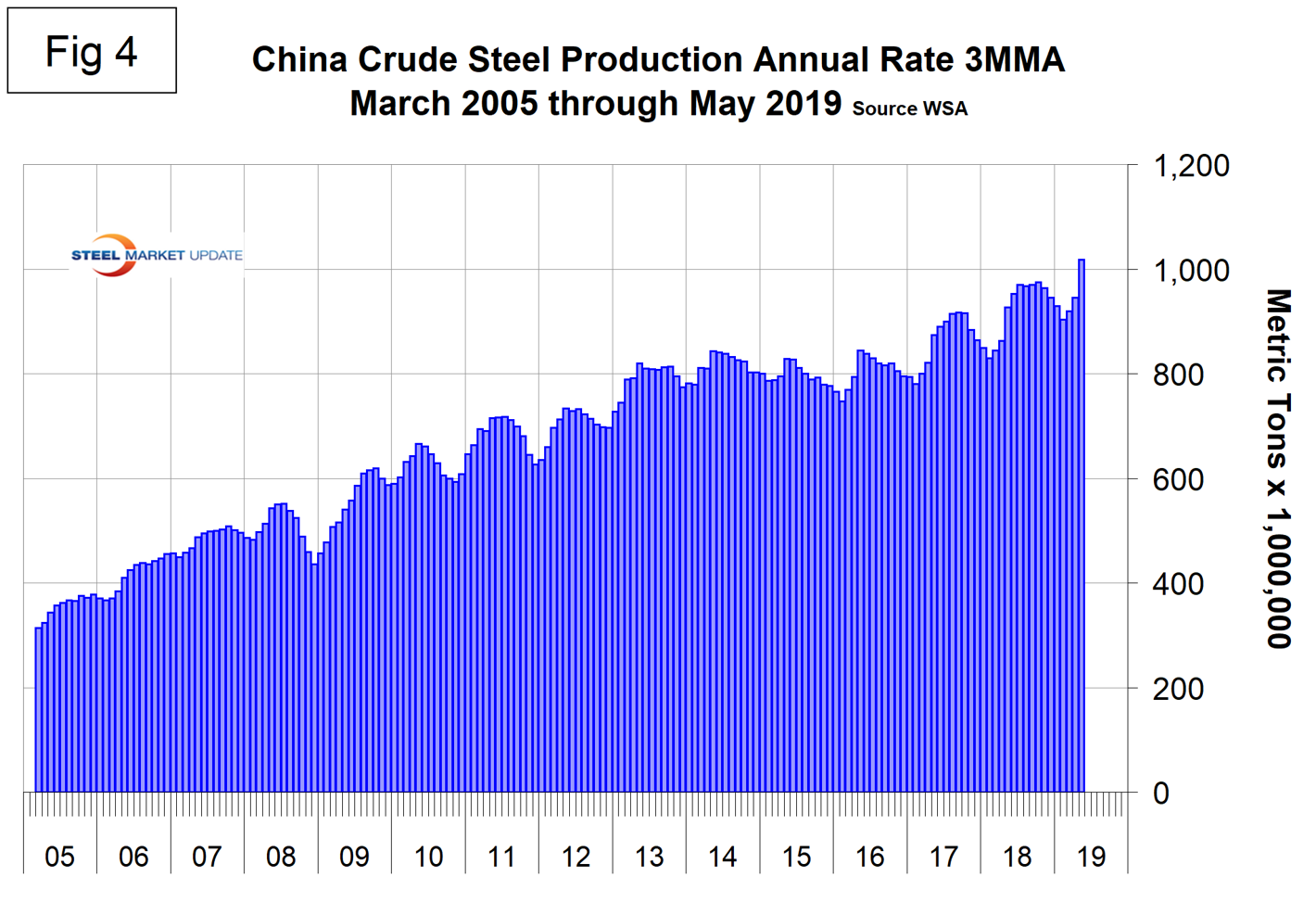

Global steel production hit an all-time high in April and that record was smashed in May. Global steel production in April achieved a new high annual rate of 1.880 billion metric tons (Mt). Production surged in May to an annual rate of 1.953 billion Mt. Capacity is calculated to be 2.4 billion Mt and capacity utilization in May was 80.0 percent, according to the latest Steel Market Update analysis of World Steel Association data. In the months of April and May, Chinese production exceeded an annual rate of one billion metric tons for the first time. In May, China produced an all-time high global share of 54.7 percent.

Figure 1 shows annualized monthly production on a three-month moving average (3MMA) basis and capacity utilization since May 2000. On a tons-per-day basis, production in May was 5.25 million Mt, another all-time high.

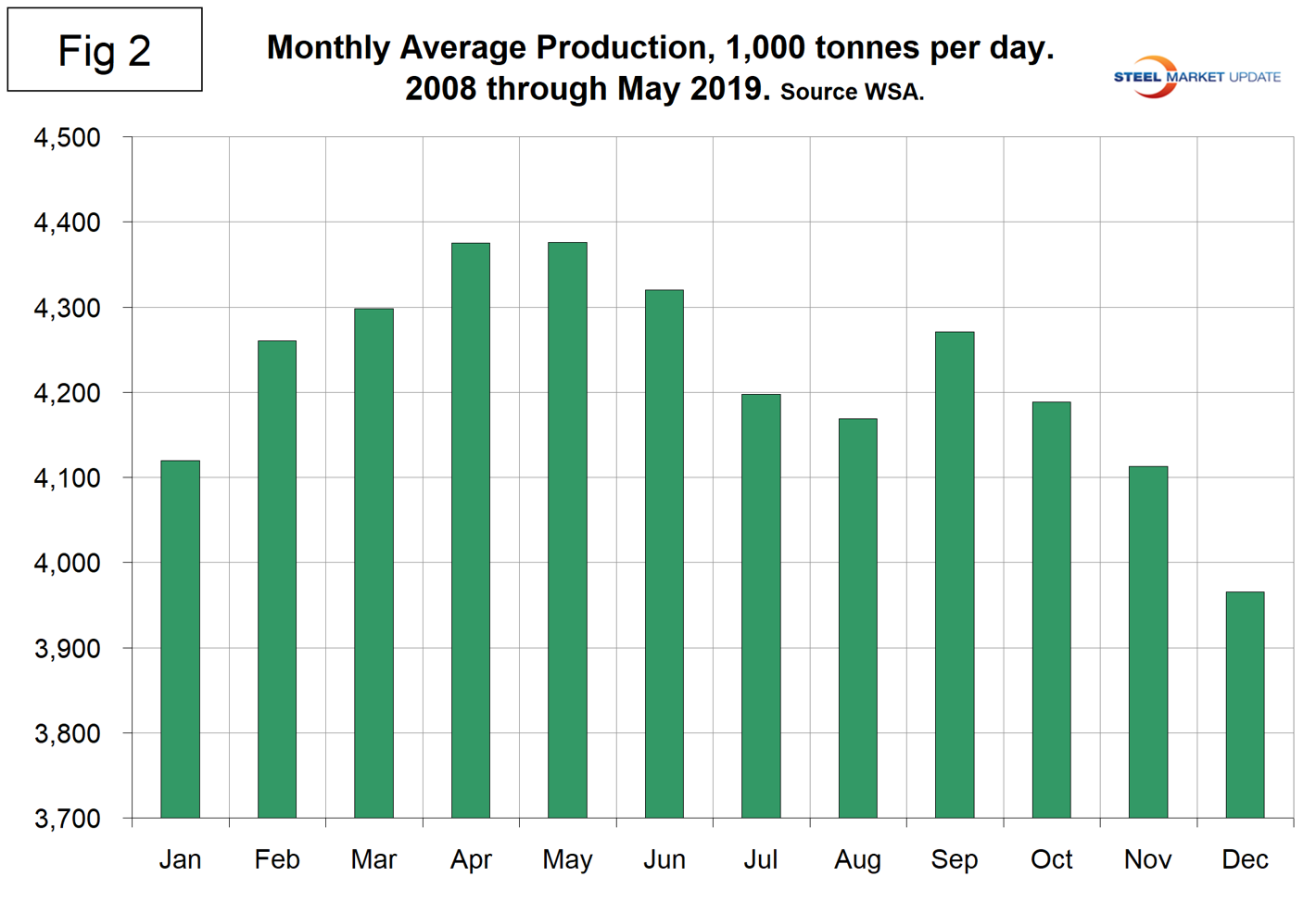

On average, global production on a tons-per-day basis peaked in the early summer in the years 2010 through 2016, but in 2017 and 2018 the second half downtrend was delayed until the fourth quarter, on a 3MMA basis. Figure 2 shows the average tons per day of production for each month since 2008. On average, May increased by 0.01 percent. This year, May increased by 0.52 percent.

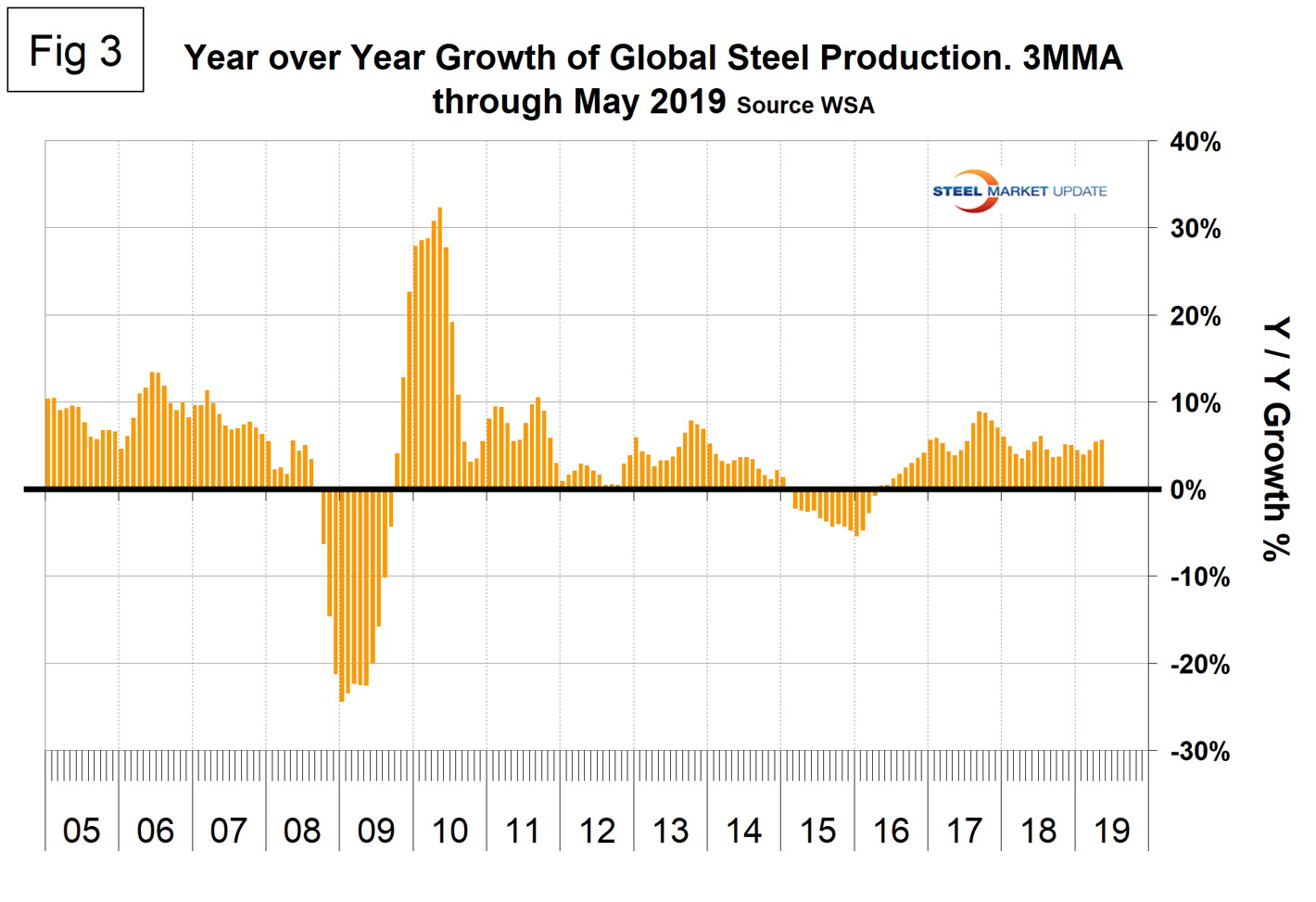

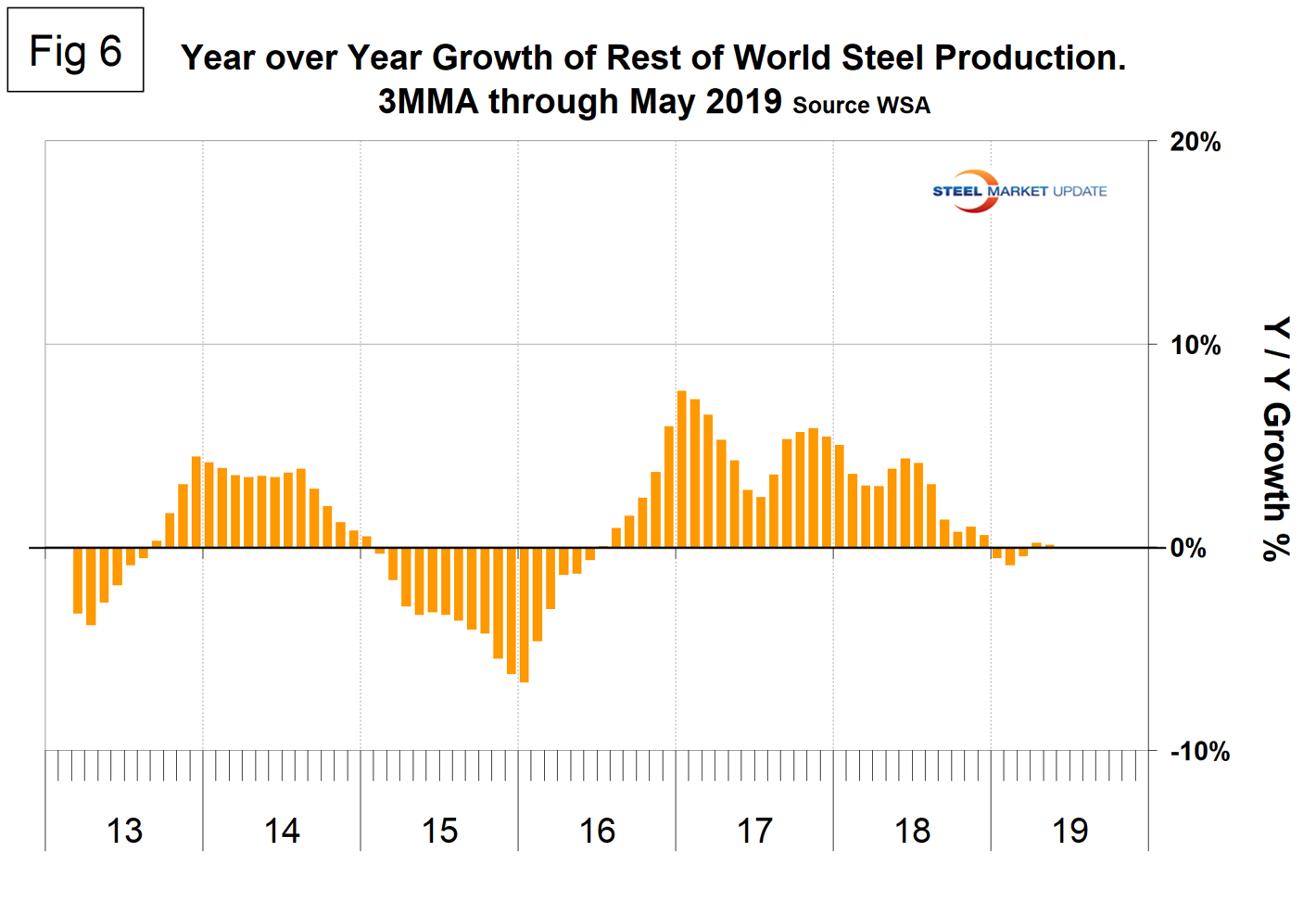

Figure 3 shows the year-over-year growth rate of global production since May 2005. Growth in three months through May was 5.6 percent, the highest growth rate since last July. The shocking statistic is that all of this growth occurred in China. Steel production in the rest of the world grew by 0.1 percent in three months through May.

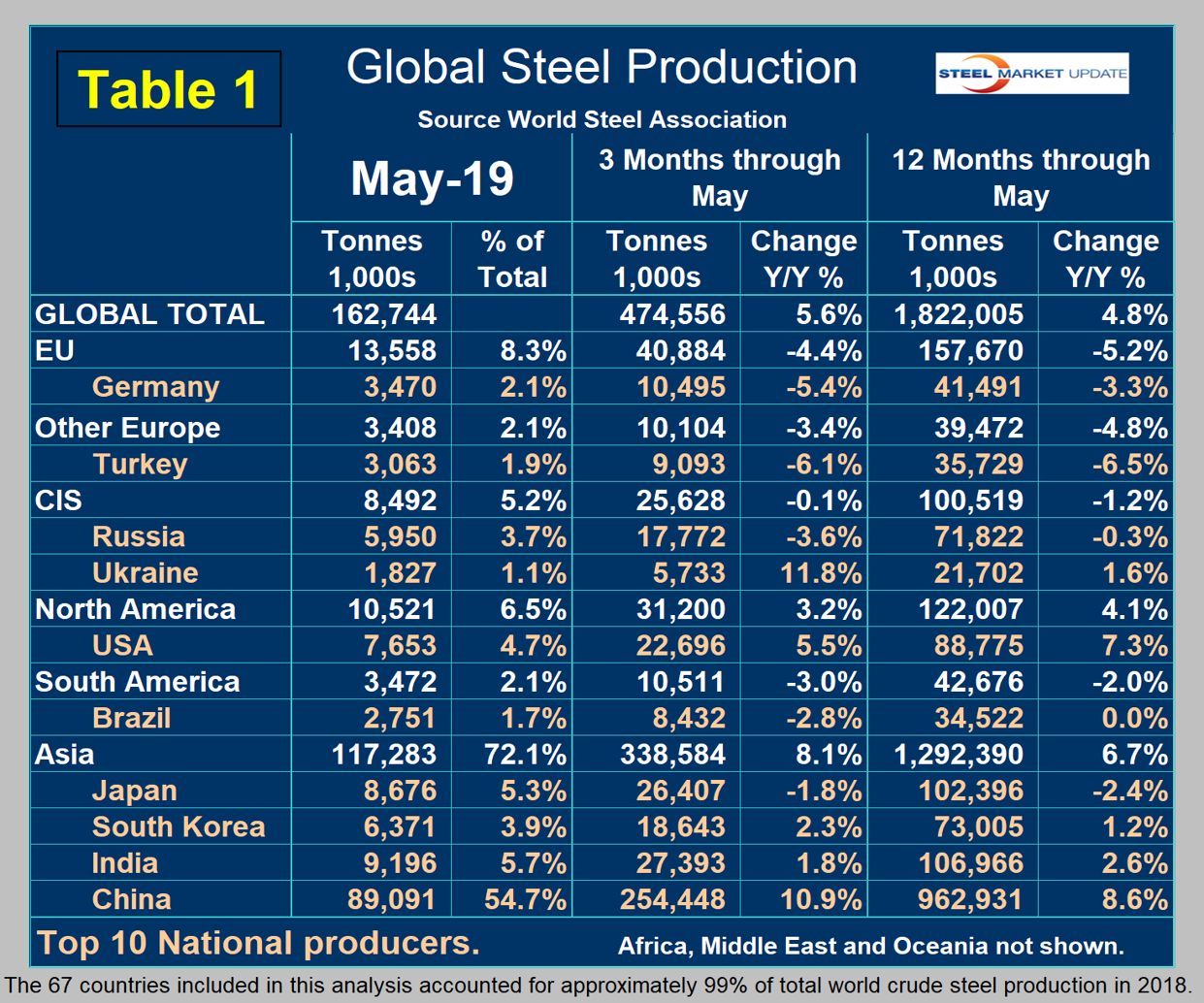

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of May, and their share of the global total. It also shows the latest three months and 12 months of production through May with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige. The world overall had positive growth of 5.6 percent in three months and 4.8 percent in 12 months through May. When the three-month growth rate is higher than the 12-month growth rate, as it was in May, we interpret this to be a sign of positive momentum. On the same basis in May, China grew by 10.9 percent and 8.6 percent, therefore also had positive momentum. All regions except North America and Asia had negative growth in three months through May year-over-year. Table 1 shows that North America was up by 3.2 percent in three months. Within North America, production was up by 5.5 percent in the U.S., up by 5.6 percent in Canada and down by 7.4 percent in Mexico. (Canada and Mexico are not shown in Table 1.)

In the 12 months of 2018, 119.9 million metric tons were produced in North America, of which 72.3 percent was produced in the U.S., 10.9 percent in Canada and 16.8 percent in Mexico.

Figure 4 shows China’s production since 2005. As just stated, global steel production was up by 5.6 percent in three months through May year-over-year and China was up by 10.9 percent, both with positive momentum. This misses the main point, though, because in the three months January through March world steel production excluding China contracted. In May, the rest of world production expanded by only 0.1 percent.

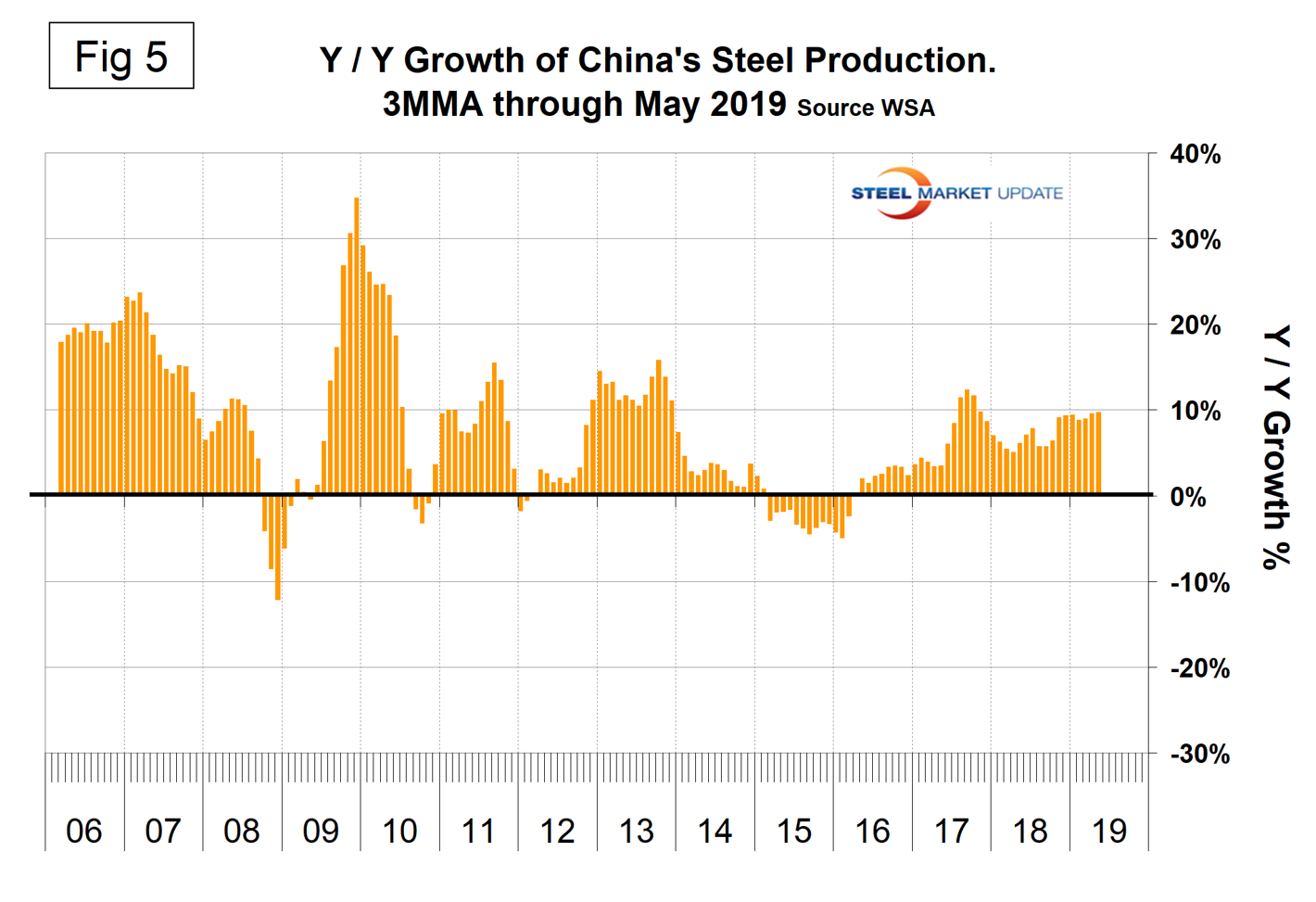

Figure 5 shows the growth of China’s steel production since January 2013 and Figure 6 shows the growth of global steel excluding China. China’s domination of the global steel market is increasing and in April and May for the first time had an annualized production rate of over one billion metric tons. The WSA is forecasting a deceleration in China’s steel production growth in 2019. The chairman of the World Steel economics committee stated recently that China is expected to experience zero growth in 2019, down from 6 percent in 2018. This is partly a result of trade tensions with the U.S. Five months into 2019 it is now obvious that this was an extraordinary conclusion.

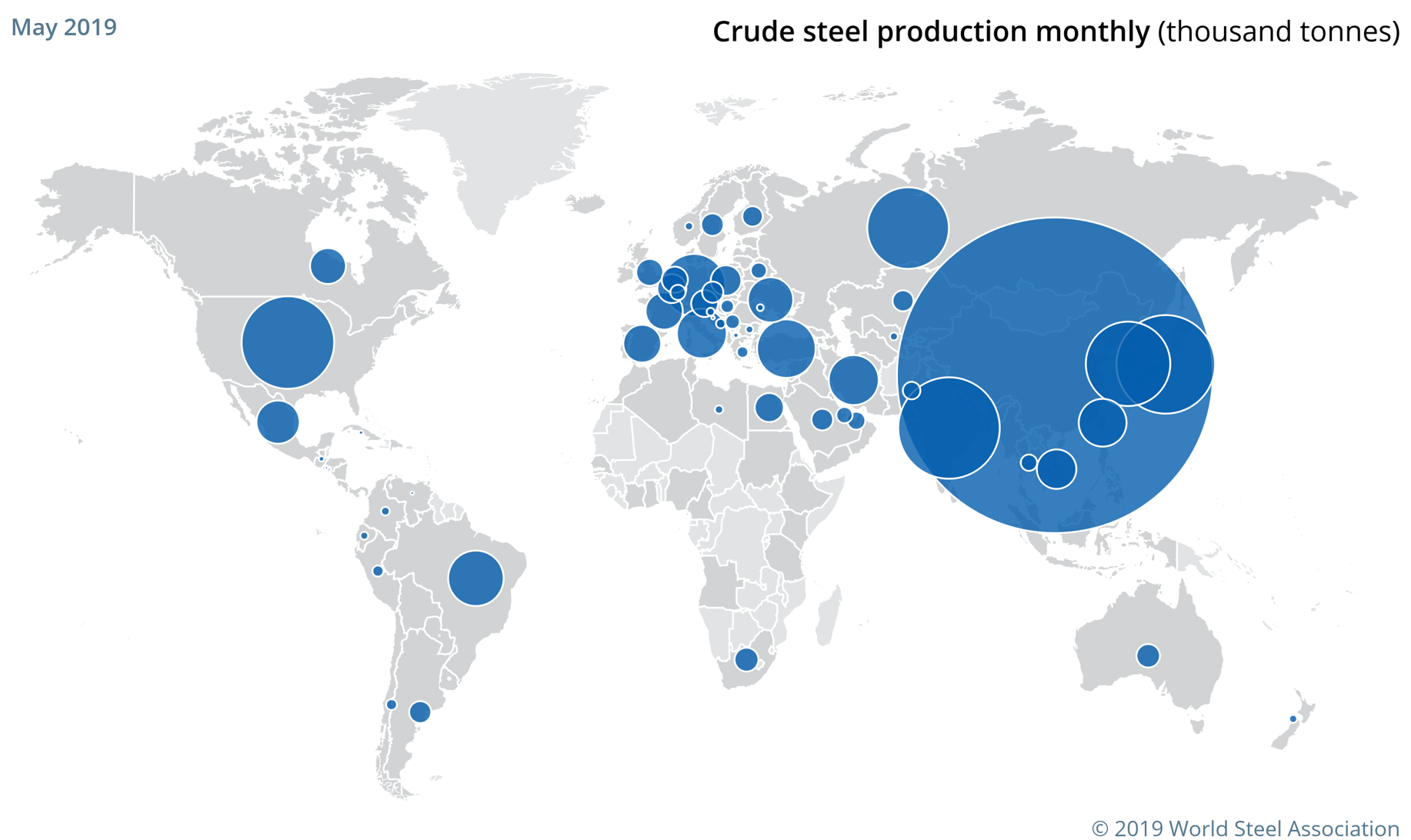

The graphic below is a visual from the WSA showing the relative size of production in various countries.

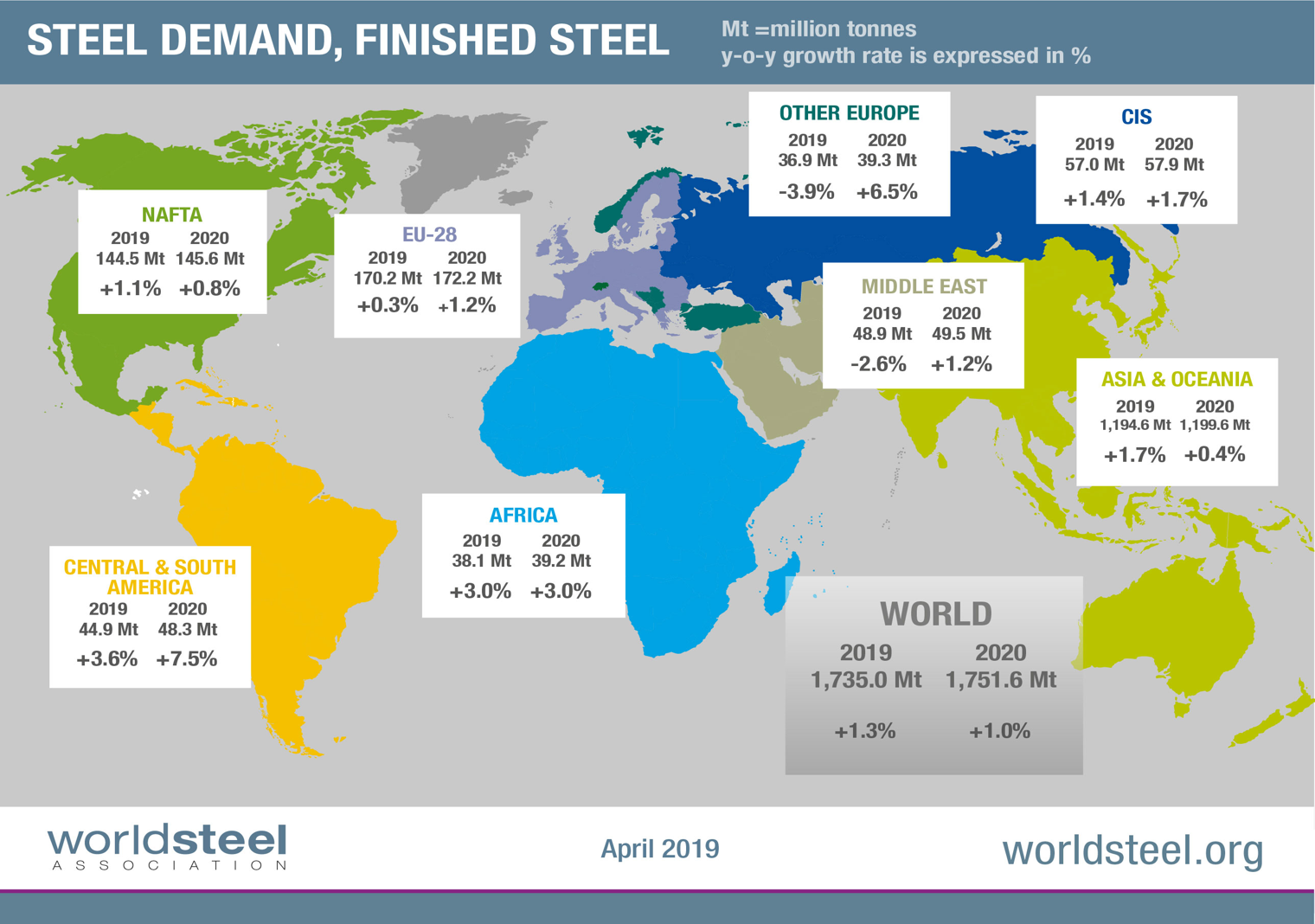

The May 2019 WSA Short Range Outlook (SRO) for apparent steel consumption in 2018 and 2019 is shown by region below. The WSA forecasts global steel demand will reach 1.735 billion Mt in 2019, an increase of 1.3 percent over 2018. (Note, the essence of this piece is crude steel production, therefore the numbers are greater than for steel consumption, which relates to rolled products.)

Commenting on the outlook, the chairman of the WSA economics committee said, “In 2017-18, steel demand in the U.S. benefitted from the strong growth of the economy driven by government-led fiscal stimulus, leading to high confidence and a robust job market. In 2019, the U.S. growth pattern is expected to slow with the waning effect of fiscal stimulus and a monetary policy normalization. Therefore, both construction and manufacturing growth is expected to moderate. Investment in oil and gas exploration is also expected to decelerate.”

SMU Comment: Each new month of data that we receive from the WSA gets worse in terms of the balance of production between China and the rest of the world. May continued that trend and the WSA continues to be complacent about it. In their October statement, they said they expected the growth of China’s steel production in 2019 to be zero. How wrong can they be! Now they are saying, “In 2020, a minor contraction in Chinese steel demand is forecasted as government led stimulus effects are expected to subside.” New plants are coming on stream in China and almost all of these are BOF-based, according to the March report by the OECD Steel Committee.

This analysis is based on data made public monthly by the World Steel Association. The WSA is one of the largest industry associations in the world. Members represent approximately 85 percent of the world’s steel production, including over 160 steel producers, national and regional steel industry associations, and steel research institutes.