Market Data

June 28, 2019

Consumer Confidence Declines in June

Written by Peter Wright

Consumer confidence as reported by The Conference Board decline sharply in June following a downward revision of the May data.

The Conference Board measure of consumer confidence is quite a volatile indicator; therefore, we prefer to smooth the data with a moving average to reduce monthly variability. The composite value of consumer confidence in June was 121.5 with a three-month moving average (3MMA) of 127.3.

![]()

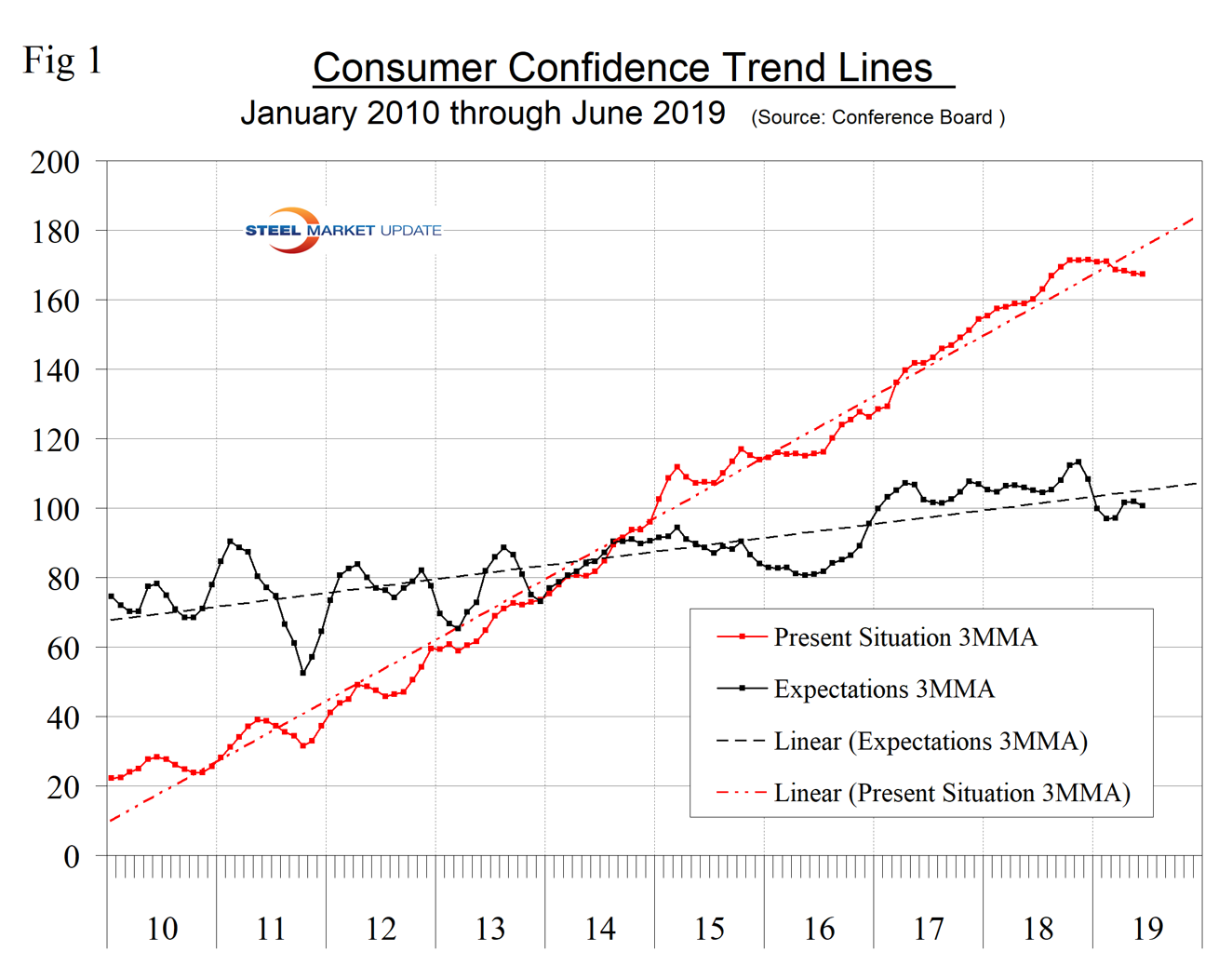

The composite index is made up of two sub-indexes: the consumer’s view of the present situation and his or her expectations for the future. Both components are currently below their nine-year trend line (Figure 1).

Moody’s Analytics Summarized as follows: “With the U.S. economy slowing fairly abruptly and the trade tensions escalating, confidence is increasingly important. If the collective psyche frays, the recent slowing could morph into something worse. The Conference Board’s Consumer Confidence Index dropped from 131.3 in May to 121.5 in June, lower than our below-consensus forecast. The good news is that confidence is still elevated, but it appears that the trade tensions are doing some damage. The details were weak across the board, as expectations dropped noticeably and are now the lowest since March. Consumers’ assessment of present conditions also declined. The labor market details were not as upbeat as seen in each of the prior two months.”

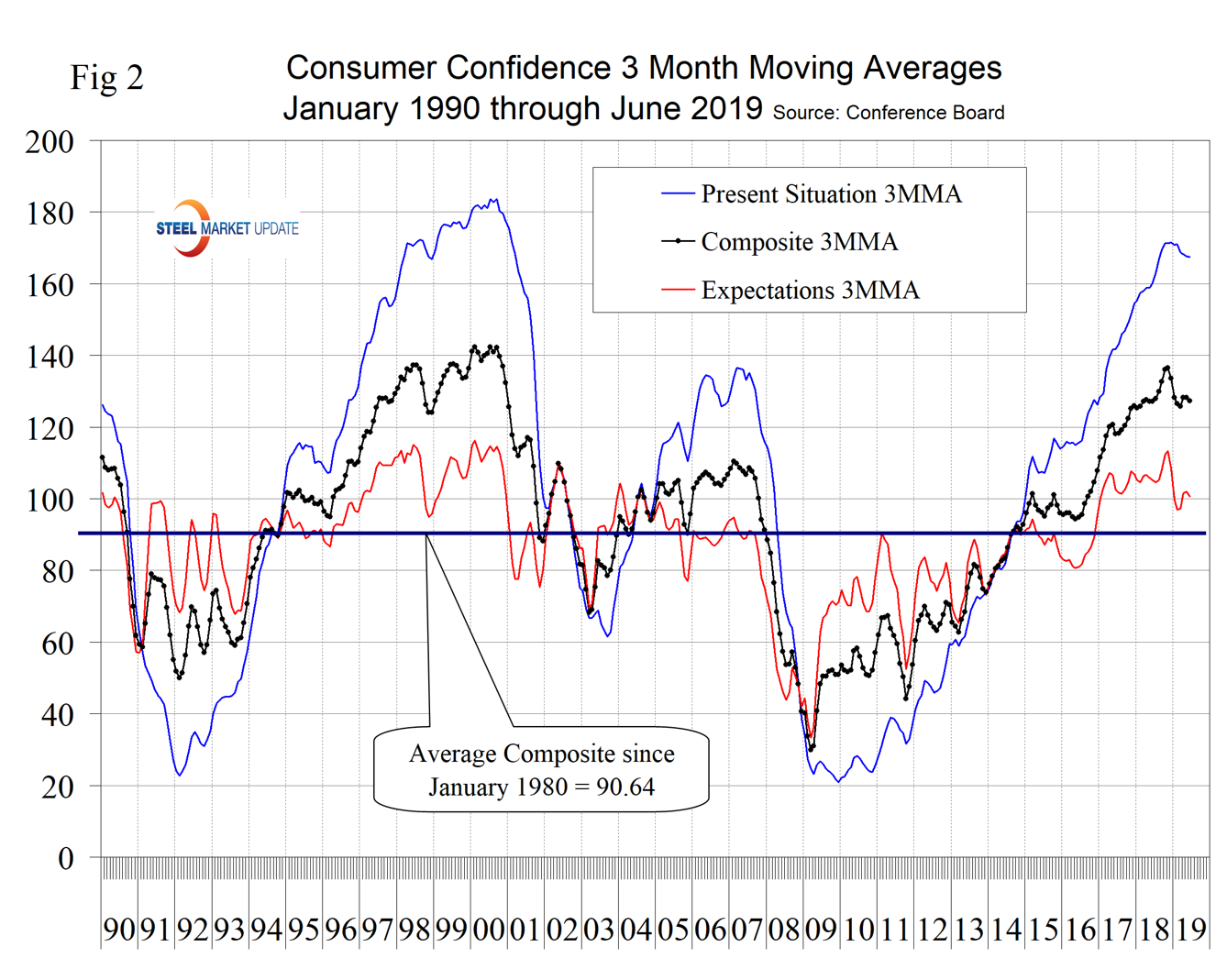

The decrease in the monthly composite in June was due to a deterioration in both the consumers’ view of the present situation and their expectations. The historical pattern of the 3MMA of the composite, the view of the present situation, and expectations since January 1990 are shown in Figure 2. All three measures are better than at any time since the pre-recession high.

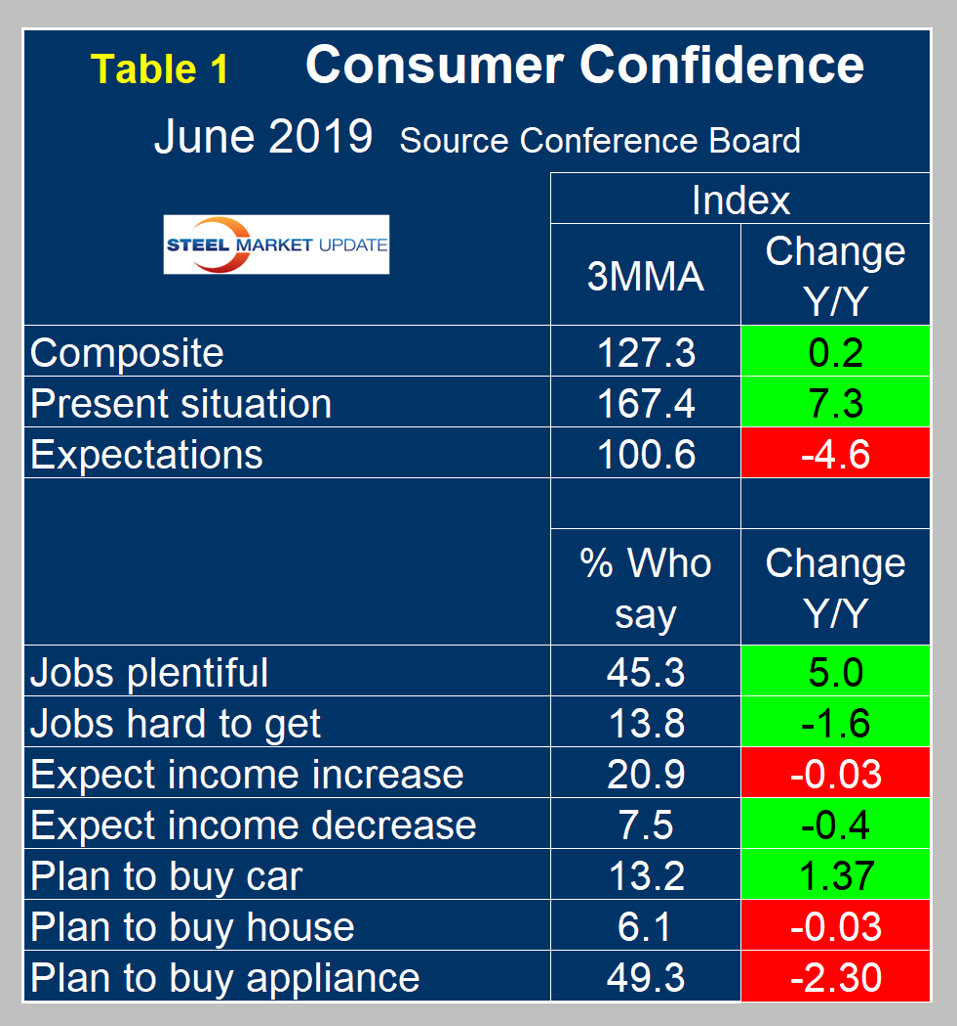

On a three-month moving average basis comparing June 2019 with June 2018, the 3MMA of the present situation was up by 7.3 points and expectations were down by 4.6 points (Table 1). The color codes showing improvement or deterioration of the individual components in Table 1 have an identical pattern to what was seen in April and May.

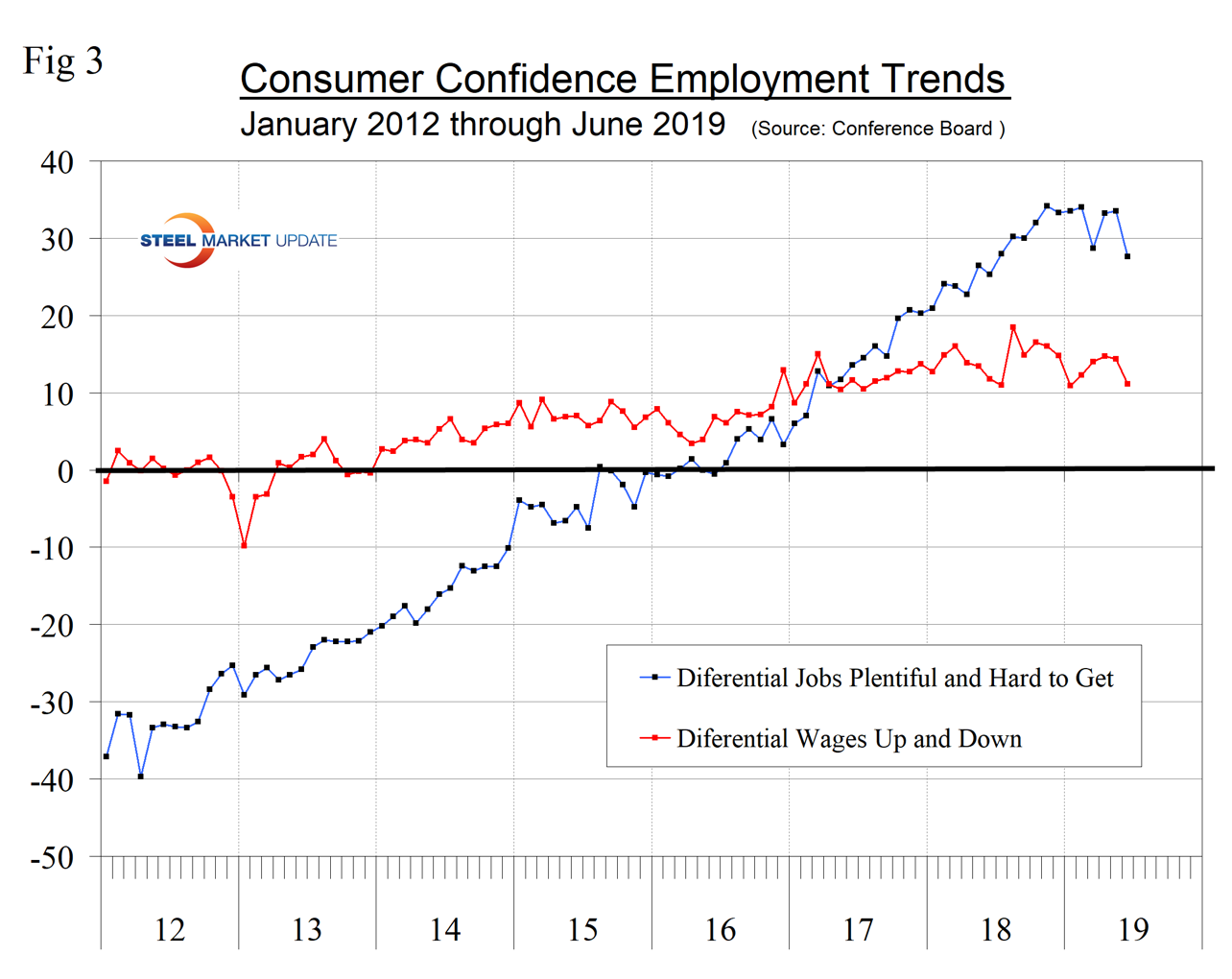

The consumer confidence report includes employment data that is still encouraging as 44.0 percent of respondents reported jobs to be plentiful and just 16.4 percent reported jobs hard to get. Expectations for wage increases were not so positive, with a slightly smaller proportion expecting an increase than was the case in June last year. In the latest data, 19.1 percent of the respondents expected an income increase and 7.5 percent expected a decrease (Figure 3).

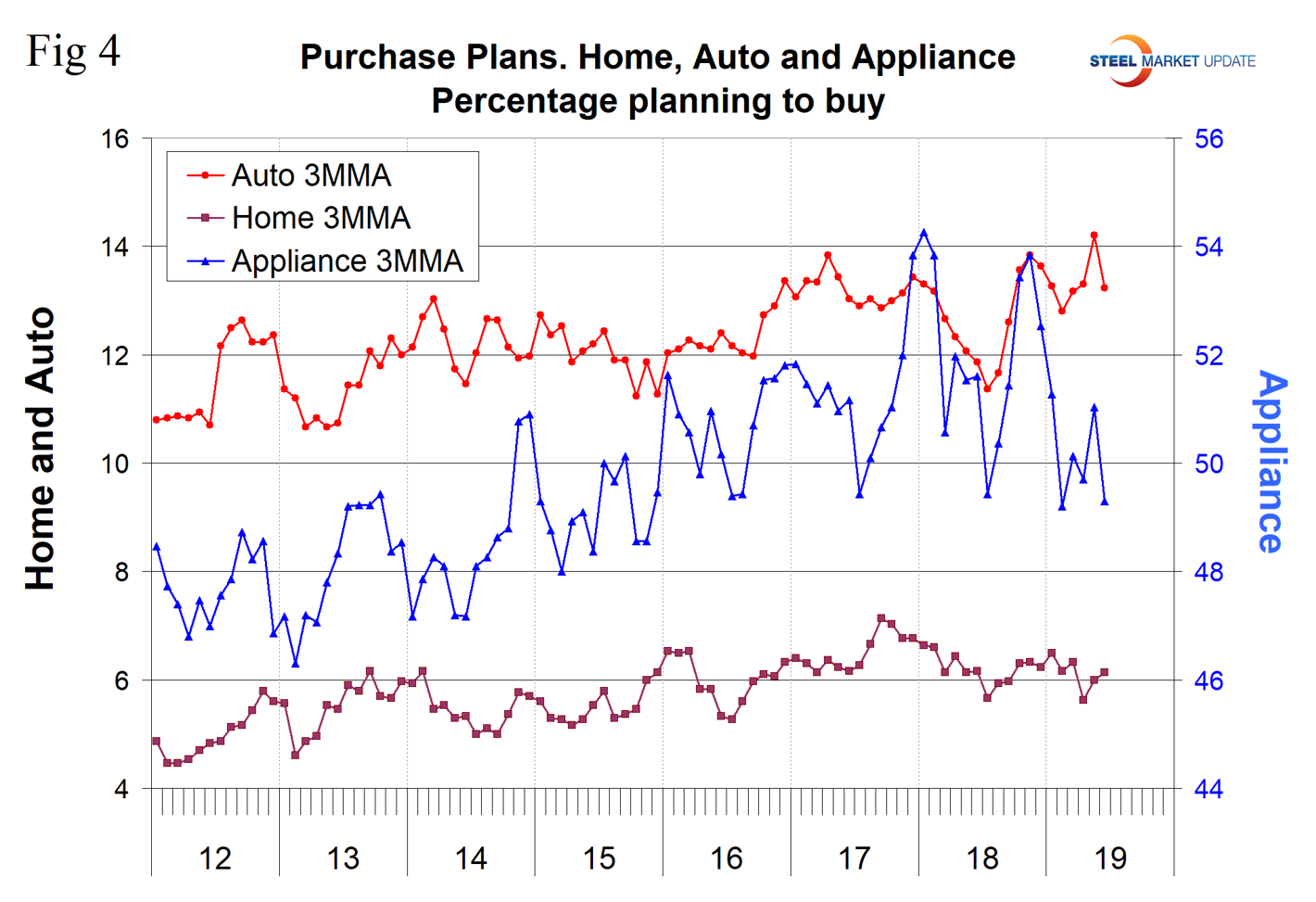

Consumer spending measures in June indicated that year-over-year plans to buy a car improved, but plans to buy a house or an appliance declined. Figure 4.

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure and must be reviewed as a three-month moving average to obtain a realistic view of trends. On that basis, it is clear that confidence is declining though not by as much as the single month of June result would suggest. Employment trends are still good though weakening. Plans to buy a car have been trending up for a year as plans to buy a house have been flat for the same timeframe. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.