Prices

June 25, 2019

Flat Rolled Mills Push for Turnaround in Prices with a $40 Increase

Written by Tim Triplett

Hoping to put an end to declining flat rolled prices, a handful of steelmakers announced $40 per ton increases today, effective immediately on unconfirmed orders.

The Nucor Sheet Mill Group was the first to announce that it is increasing base prices on new orders of hot rolled, cold rolled and galvanized steel by a minimum of $40 per ton.

Following Nucor’s lead, USS-POSCO Industries (UPI) also raised its base prices for all sheet products, including hot rolled P&O, cold rolled and galvanized, by $40 per ton. Published price book extras continue to apply, the company noted.

NLMK USA did not announced an increase per se, but released minimum base prices of $560 per ton for hot rolled, $700 per ton for cold rolled and $700 per ton for coated steels. Sources tell SMU that JSW USA intends to follow NLMK’s lead.

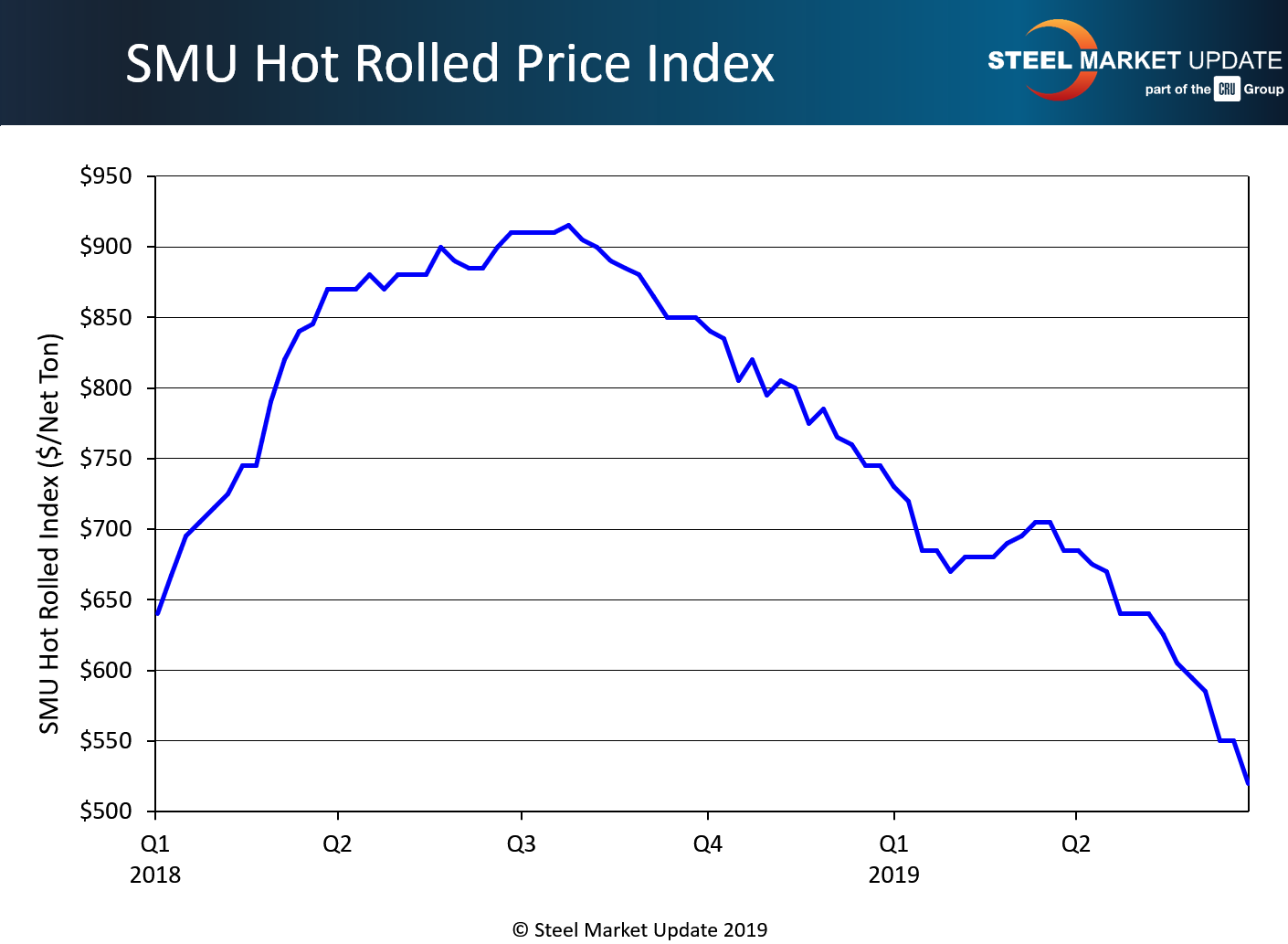

The benchmark price for hot rolled steel has declined by around 40 percent since peaking at $910 per ton last July. Steel Market Update data shows the current average hot rolled price at around $520 per ton. SMU has moved its Price Momentum Indicator from Lower to Neutral until the direction of steel prices becomes clear.

The last attempt by the major mills to raise prices was four months ago, around Feb. 20-21, when they announced a $40 price hike, but the increase failed to stick and prices have continued to slide ever since.

Observers commenting to Steel Market Update appear split on the likelihood the market has found a bottom. Some believe strongly the price increase will gain support from service centers and distributors who are tired of watching their margins shrink as the value of their inventories declines. Others are convinced steel prices will wallow until demand improves or scrap prices rebound.