Prices

June 20, 2019

Imminent Return to Surplus Weighs on Zinc’s Price

Written by Tim Triplett

By CRU Senior Analyst Helen O’Cleary

All eyes are on this month’s G20 summit in Osaka for a resolution to ongoing trade tensions between the USA and China, and markets are braced for U.S. tariffs on a further $300 billion of Chinese goods if negotiations do not progress to the USA’s satisfaction. News that Trump and Xi had a pre-meeting phone call on Wednesday, June 19, was enough to boost base metals prices (with the exception of nickel), briefly lifting zinc’s price by $50/t and reversing its decline towards a year-to-date low.

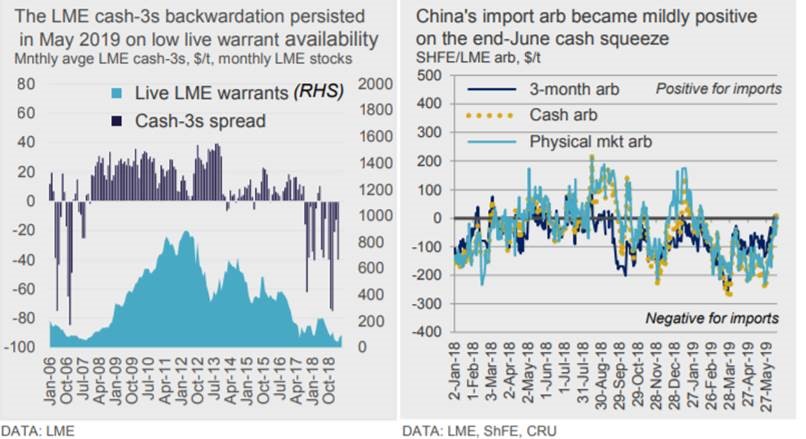

If China can avoid the next round of U.S. trade tariffs it will certainly boost market sentiment, but the IMF recently stated that current U.S. and Chinese tariffs could knock 0.5 percent off global GDP growth this year, suggesting that any benefit could be short-lived in the face of global economic headwinds. Zinc’s price movements so far this year have been largely trade-related. The low level of LME stocks is helping to support cash prices, but the market’s reaction to LME stock changes has been relatively muted. The LME’s Commitments of Traders reports show that non-risk-reducing net longs (which we take to mean speculative) have steadily declined in recent months and now stand at 30,918 lots (772,950t), compared to a year-to-date high of 59,027 lots (1.47 Mt) in late February 2019. We still expect the refined market’s imminent return to surplus to hasten zinc’s price decline in 2019 H2, although the prospect of only a gradual increase in LME live warrant availability suggests that the cash price could remain supported.

ShFE cash prices fluctuated significantly in the run up to the last prompt date in the current cash transaction period and the squeeze contributed to the widening of the cash to 3-month backwardation from RMB300-400/t in May to RMB900-1,000/t in mid-June, although it narrowed to RMB 595/t on the final prompt date. Market participants believe that relatively low inventory levels make another cash squeeze likely in July. The backwardation pressured premia lower and the arb became mildly positive, but traders reported that import trading was unprofitable due to the backwardation and that the import market remained lackluster.

Net inflows into LME warehouses of 48,875t in the second quarter to date (to June 14) have reduced net outflows so far this year to 28,850t. Rotterdam has seen the most stock activity so far in Q2, with inflows of 42,350t against outflows of 9,450t, although with 31,425t of cancelled warrants we are likely to see outflows from Rotterdam picking up in the coming weeks.

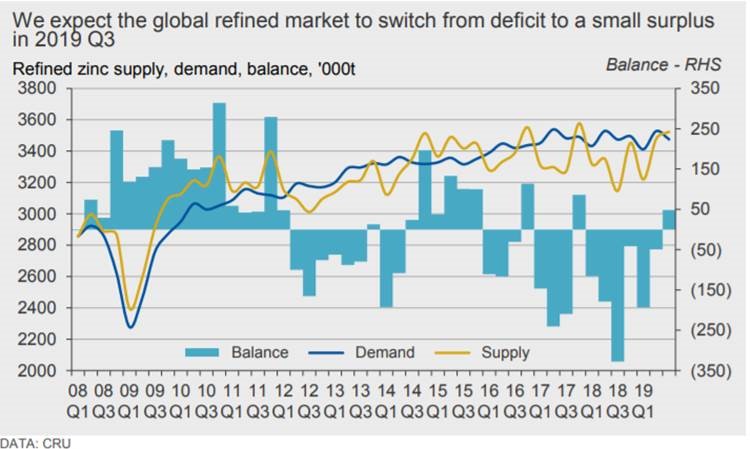

Global Refined Market Will Switch to Surplus in Q3

We now believe that the 2019 H1 deficit will be 240,000t, which is somewhat larger than we were previously expecting. Not only have Chinese smelters been slower to ramp up than anticipated, but output disappointed in Europe and India, too. In view of our slightly ambitious estimates of 2019 H1 smelter output, we have thoroughly revised our full-year numbers and still expect the market to switch to surplus in Q3. At 48,000t it is perhaps not a convincing return to surplus, but we expect this to be built on in Q4. Our estimates of demand in 2019 H1 remain largely unchanged, with China contracting by around 1 percent and the world ex-China registering marginal growth. In 2019 Q3, we expect Chinese demand to increase marginally and for ex-China demand to remain flat. Declining vehicle output is a theme across the major regions due to a combination of factors, both regulatory and economic.