Analysis

June 8, 2019

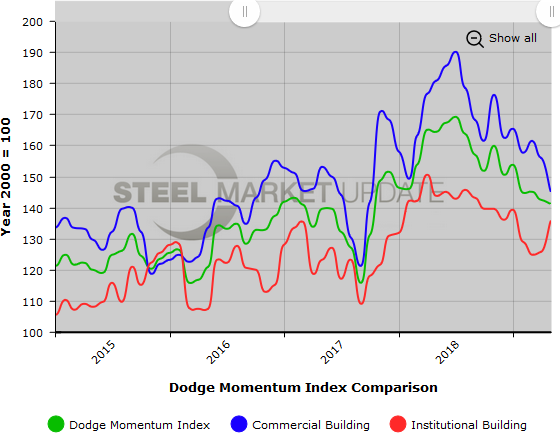

Plans for Commercial Construction Pull Dodge Momentum Index Down

Written by Sandy Williams

The Dodge Momentum Index, a monthly measure of the initial report for nonresidential buildings in planning, slipped 1.4 percent in May to a reading of 141.0 from a revised reading of 142.4 in April.

The commercial component of the index dropped 6.9 percent while the institutional component rose 8.1 percent. On a year-over-year basis, the index declined 9.2 percent as a 16 percent dive by the commercial component outweighed a 1.8 percent gain in institutional planning.

“Although the trend for the overall Momentum Index is downward, so far the pullback has been measured, suggesting that there remain enough nonresidential building projects in the pipeline to support near term stability for construction activity,” said Dodge Data & Analytics. “This is particularly true for the institutional side of nonresidential building.”

Fourteen projects valued at $100,000 or more entered the planning stage in May.

The Dodge Momentum Index is published by Dodge Data & Analytics and is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.