Market Data

June 3, 2019

Consumer Confidence Posts Another Gain in May

Written by Peter Wright

The Conference Board’s measure of consumer confidence in May was the highest since last November. This is quite a volatile indicator; therefore, we prefer to smooth the data with a moving average to reduce monthly volatility. The composite value of consumer confidence in May was 134.1 with a three-month moving average (3MMA) of 129.2.

![]()

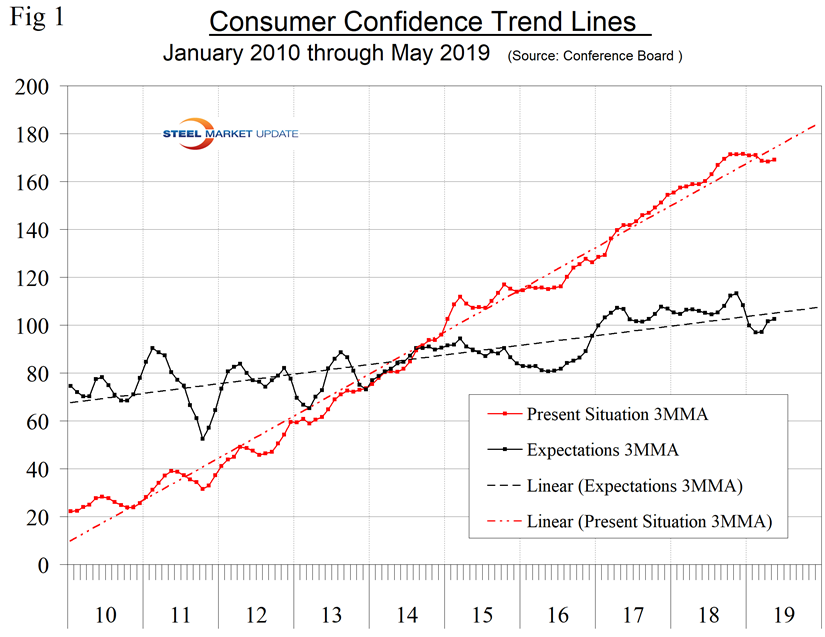

The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. Both components are currently below their nine-year trend line (Figure 1).

“Consumer confidence posted another gain in May and is now back to levels seen last fall when the Index was hovering near 18-year highs,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The increase in the Present Situation Index was driven primarily by employment gains. Expectations regarding the short-term outlook for business conditions and employment improved, but consumers’ sentiment regarding their income prospects was mixed. Consumers expect the economy to continue growing at a solid pace in the short-term, and despite weak retail sales in April, these high levels of confidence suggest no significant pullback in consumer spending in the months ahead.”

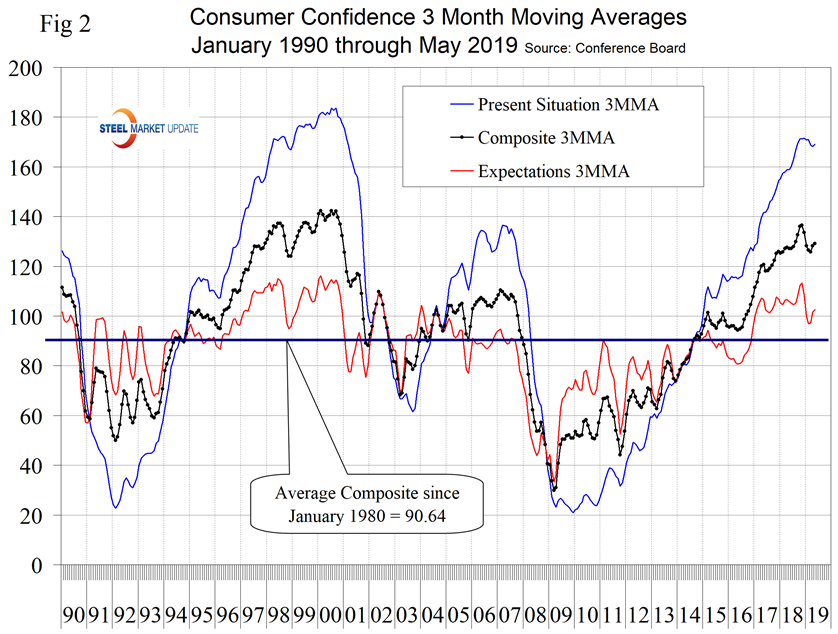

The increase in the monthly composite in May was due to an improvement in both the consumer’s view of the present situation and their expectations. The historical pattern of the 3MMA of the composite, the view of the present situation, and expectations since January 1990 are shown in Figure 2. All three measures are better than at any time since early 2001.

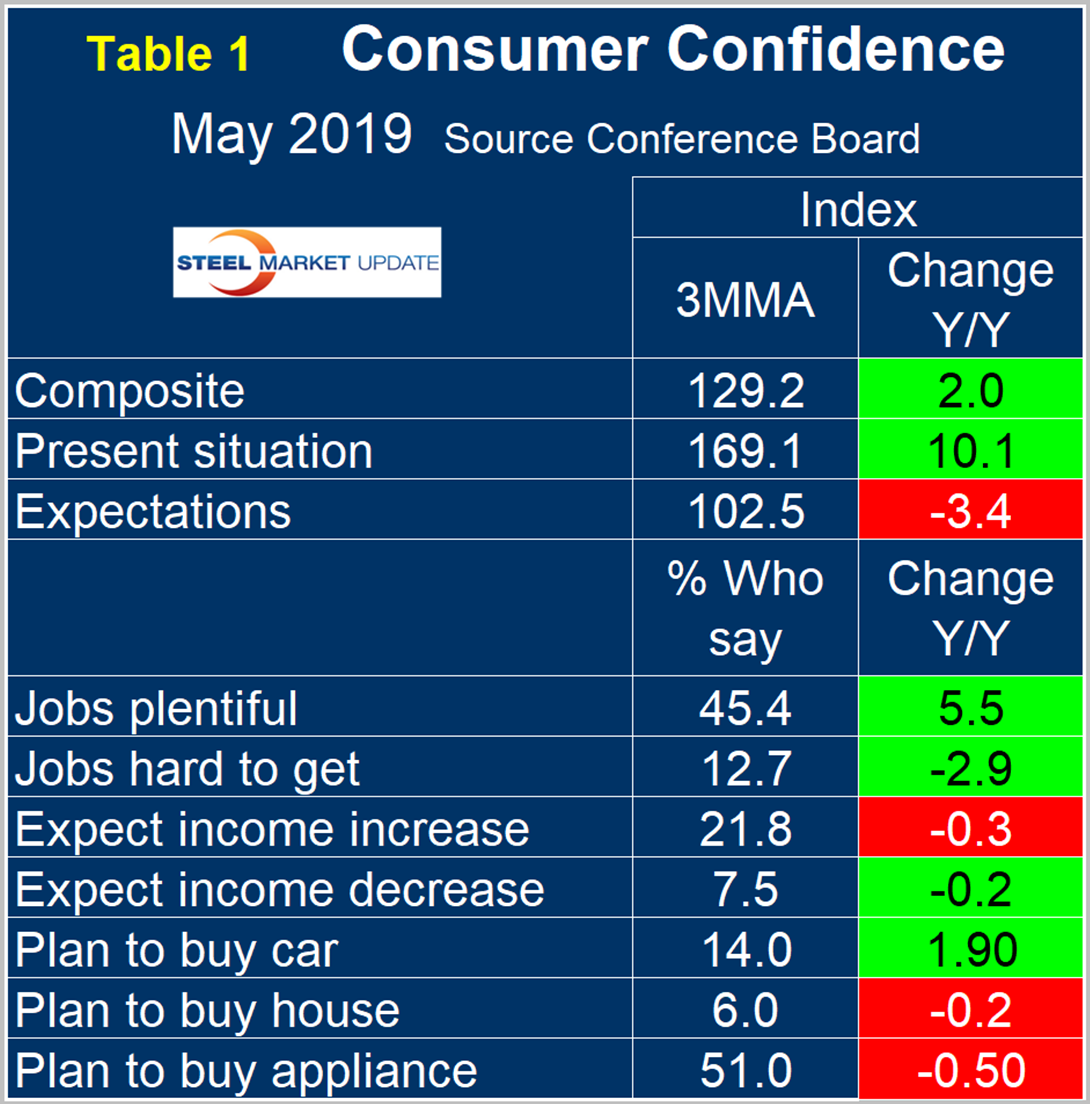

On a three-month moving average basis comparing May 2019 with May 2018, the 3MMA of the present situation was up by 10.1 points and expectations were down by 3.4 points (Table 1). The color codes showing improvement or deterioration in Table 1 (May) have an identical pattern to Table 1 (April), but in all instances the May results are better.

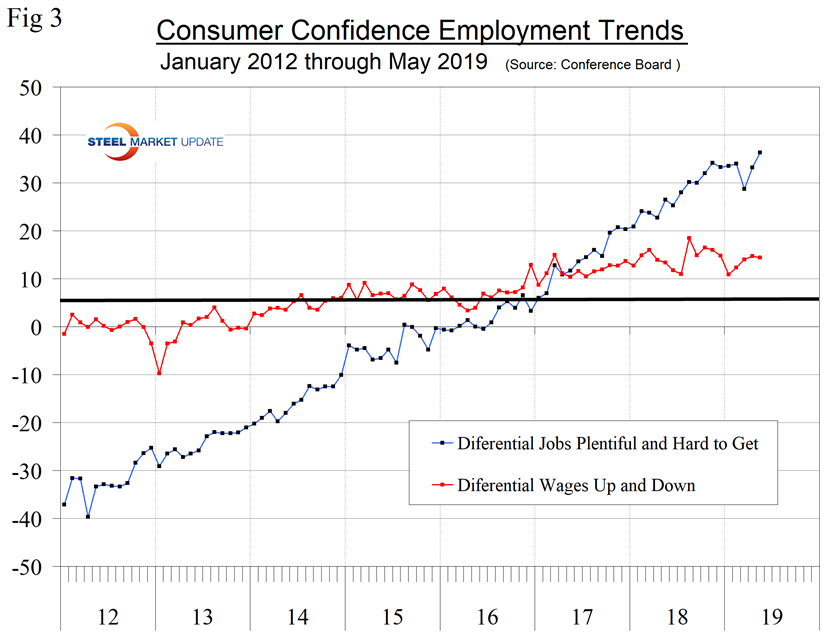

The consumer confidence report includes encouraging data on job availability as 45.4 percent of respondents reported jobs to be plentiful and 2.9 percent reported jobs hard to get (Figure 3). Expectations for wage increases were not so positive, with a smaller proportion expecting an increase than was the case in May last year.

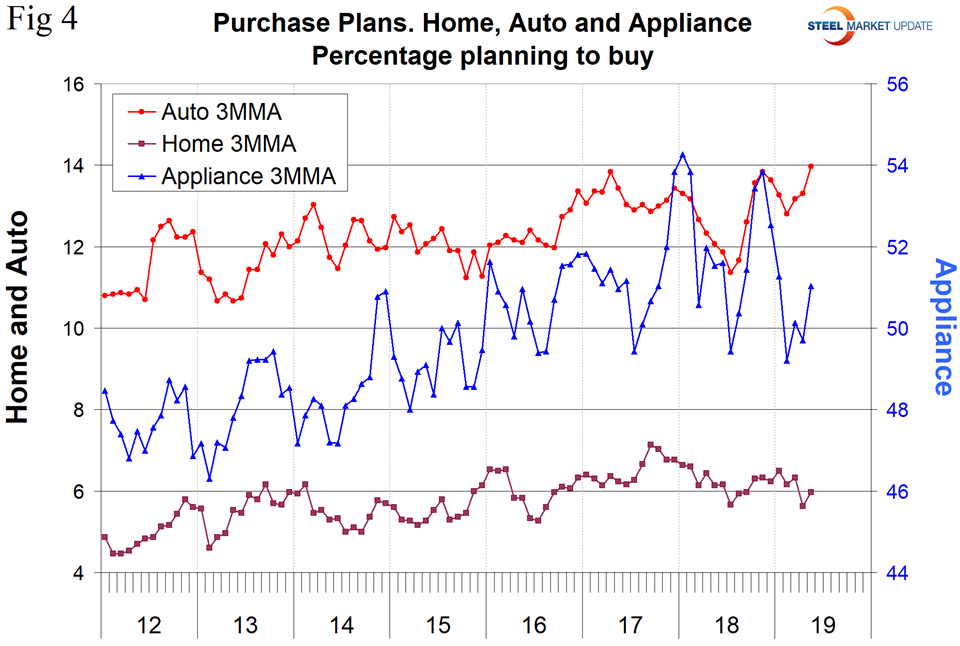

Consumer spending measures in May indicated that year-over-year plans to buy a car improved, but plans to buy a house or an appliance declined. In March, plans to buy a house were positive (Figure 4).

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure if the state of the economy and at first glance we thought this was a great report. However, on a 3MMA basis, both the present and expectations components are still below their long-term trend line. This report says that plans to buy a car have been trending up since 2012. Plans to buy an appliance have been trending down for over a year and plans to buy a house have been trending down since September 2017. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.