Prices

May 14, 2019

Impact of USMCA on Metal Fabricators

Written by Sandy Williams

Metal fabricators are worried about how content provisions in the U.S.-Mexico-Canada Agreement will impact their industry. The proposed trade agreement for North America includes provisions on steel and aluminum regional content for automobiles, but may extend to other manufacturing sectors.

“Too many people view NAFTA as just about cars when the agreement impacts virtually every aspect of the manufacturing sector,” said Omar Nashashibi, founding partner with The Franklin Partnership and a lobbyist for the Precision Metalforming Association (PMA) in Washington, D.C. “If the new NAFTA takes effect, you could see significant changes in supply chains for agribusiness, electrical, and other industries as multinationals examine expanding operations in Mexico and domestic companies re-examine their steel and aluminum sourcing to meet regional value content requirements. At PMA, we are advising our members in the U.S. to watch for increased competition from Mexico and additional demands from customers.”

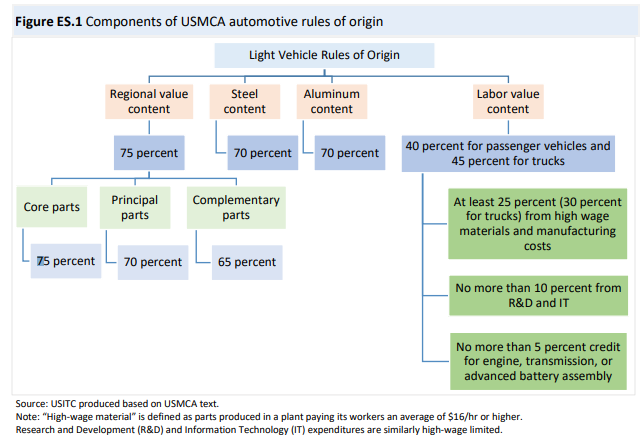

The USMCA requires that autos be made with 75 percent regional value content, up from 62.5 percent under NAFTA. The requirement covers all inputs to a vehicle, including plastic and glass, but is primarily an incentive to increase the use of domestic aluminum and steel.

A USITC report on the impact of the U.S.-Mexico-Canada Trade Agreement refers briefly to the rules of origins (ROOs) requirements for other sectors in manufacturing:

“In addition to the automotive steel and aluminum requirements, the USMCA ROOs contain a number of new RVCs or content provisions for certain sectors. Those ROOs encourage greater use of North American-produced steel, adding RVC or steel weight requirements to goods that only needed changes in tariff classification to qualify for preferential tariff treatment under NAFTA.”

How these requirements will affect metal fabricators and non-automotive steel and aluminum products remains unclear.

“Despite the overall ambiguity as it applies to manufacturing sectors, some metal product categories have been specified in the agreement as areas of focus,” said Stephen Barlas, a contributing writer for The Fabricator. “They include certain welded tubes and pipes, fittings, and tool joints; iron and steel structures and parts thereof; and nails, tacks, drawing pins, corrugated nails, and staples. They have some transition period to meet a standard of either 70 percent steel or 75 percent RVC. So these nonautomotive sectors likely will be industrial ones, not consumer ones, such as refrigerators and HVAC products.”