Market Data

May 9, 2019

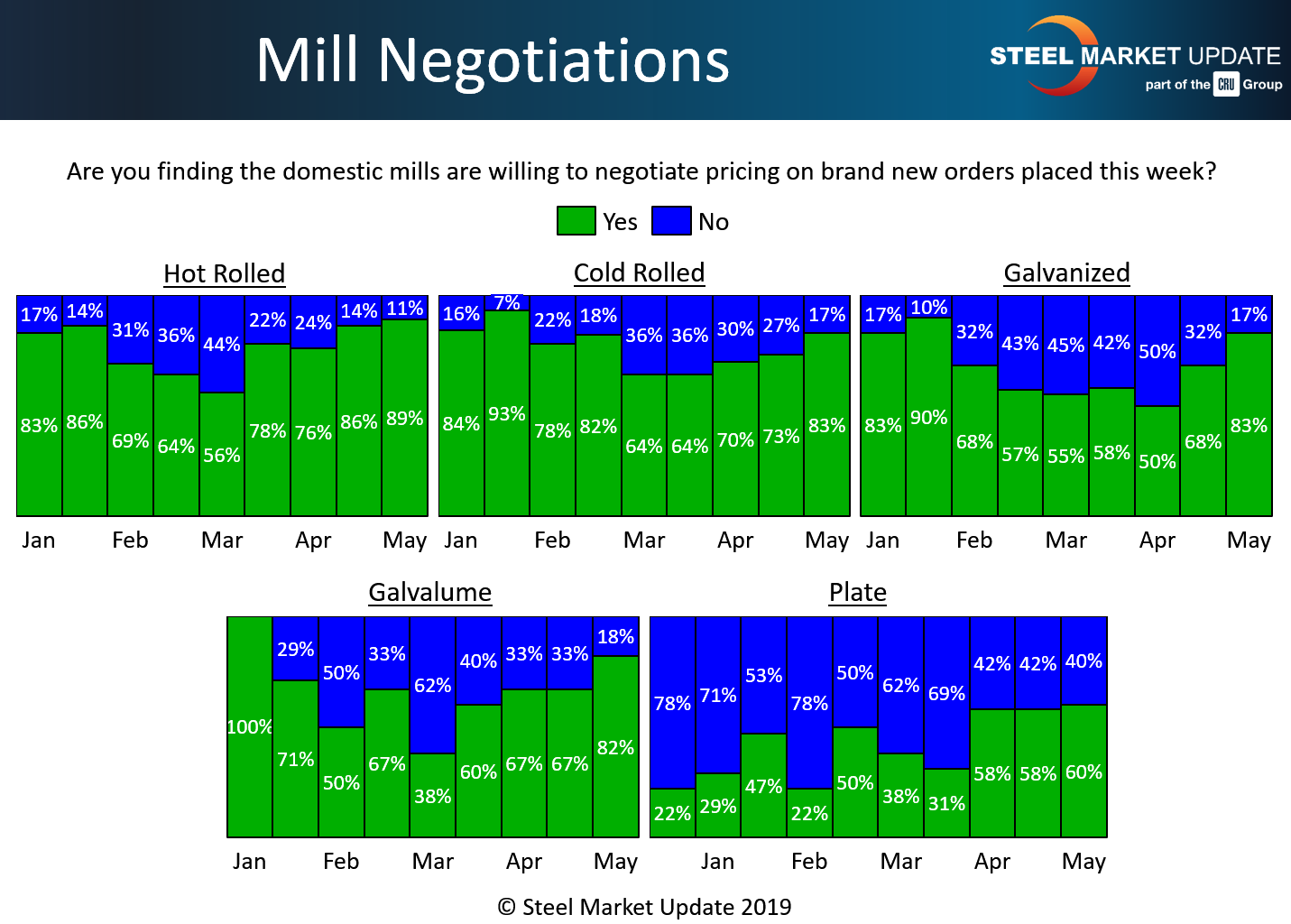

Steel Mill Negotiations: Pricing's on the Table

Written by Tim Triplett

With steel prices moving down or sideways and demand softening in some markets, it’s no surprise that most mills are willing to talk price to win business in the current environment. Eight out of 10 of the flat rolled steel buyers responding to Steel Market Update’s questionnaire this week report that prices are in play on hot rolled, cold rolled and coated steels. As seen by the upward slope of the green bars in the chart below, negotiations on steel products have been loosening up since March.

About 89 percent of respondents said the mills are open to price negotiations on hot rolled, up from 86 percent two weeks ago. Just 11 percent said the mills are currently holding the line on HR.

In the cold rolled segment, 83 percent now report the mills open to price negotiations, up from 73 percent two weeks ago. Just 17 percent report current cold rolled prices as firm.

In the galvanized sector, 83 percent said the mills are flexible on price, a big jump from just 68 percent in the last poll. Just 17 percent report that galvanized prices are now nonnegotiable. Nearly the same percentage said the mills are now willing to talk price on Galvalume as well.

Even negotiations on plate have loosened a bit, with 60 percent of buyers now reporting some flexibility in plate prices.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.