Analysis

May 7, 2019

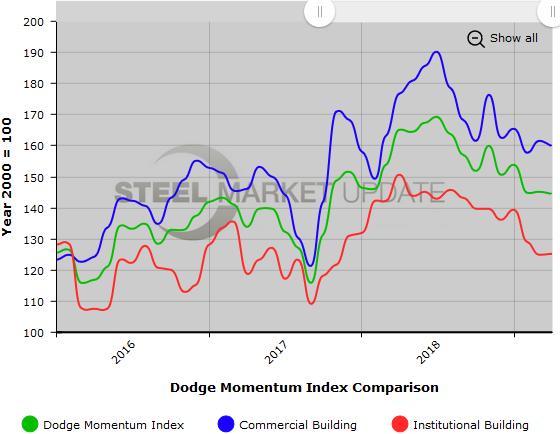

Dodge Momentum Index Slips in April

Written by Sandy Williams

The Dodge Momentum Index, a measure of the initial report for nonresidential building projects in planning, slipped 0.5 percent in April to a reading of 144.3. The Index has been shown to lead construction spending for nonresidential buildings by a full year.

April’s slide was due to the commercial component falling 1.0 percent, while the institutional component barely grew at 0.2 percent.

“The Momentum Index has clearly lost some impetus over the last 12 months,” said Dodge Data & Analytics. “The overall Momentum Index is down 8.5 percent since April 2018, with the commercial component 4.7 percent lower and the institutional component 13.9 percent lower. However, over the past several months the Momentum Index has moved in a crab-like fashion with neither strong gains nor losses. This suggests that there continues to be a reasonably healthy number of projects in the planning pipeline to support a moderate level of construction activity in the coming months.”

There were 18 projects valued at $100 million or more that entered the planning phase in April.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.