Market Segment

May 4, 2019

U.S. Steel: Pivoting to Offense

Written by Sandy Williams

U.S. Steel’s first-quarter earnings call was dominated by the news of the steelmaker’s planned $1.2 billion investment at Mon Valley Works to build an endless casting and rolling facility at its Edgar Thomson Plant and a cogeneration facility at its Clairton Plant.

CEO David Burritt called the project “transformative” for U.S. Steel, putting the company in a premier position as a supplier of lightweight, thin, wide and formable hot rolled steel for the automotive industry. The line will be able to produce coils as thin as 0.030 gauge and as wide as 77 inches.

The company stressed that the new project is not adding any capacity to the U.S. domestic supply, but instead is providing a range of products currently unavailable from other U.S. producers as well as providing a $35 per ton reduction in operating costs. The new line is a proven and reliable technology used by foreign producers but not yet utilized in the United States.

“We have all seen the headlines,” said Burritt. “Some in this call have even said U.S Steel’s competitive position has weakened; U.S Steel can’t compete with the recently announced capacity additions. We know the competition, we live it, and we welcome it. We don’t fear it, but we respect it. We love to compete.

“We are now pivoting from playing defense to offense,” he added.

The investment at Mon Valley is expected to free up the Gary facility to make thicker, wider, heavy gauge products. When asked why U.S. Steel chose the Mon Valley site for the investment, Sara Greenstein, Senior VP of Consumer Solutions, said Mon Valley is already the company’s lowest cost producer and will move it even further down the cost curve.

Said Greenstein, “It upgrades a 1938 vintage hot strip mill and takes us from being more limited in what we can do to being the most capable steel producer in terms of thinner, wider, stronger product in this country. And finally, it enhances the number of markets that we can and will serve.”

Burritt added that as an integrated steel mill, U.S. Steel has a cost advantage from the mining side and from its coke making. “Where we’ve had trouble is providing the extra variety of steel, the extra capability,” he said. The new steel process and cost reduction will make U.S. Steel “if not the leader, certainly one of the leaders in the U.S.”

Burritt was asked if the Trump administration has provided any assurances that the beneficial import environment will continue.

“As far as assurances, nobody can give anybody assurances on any of these things, but we’ve enough contacts and enough connection here that we just can’t imagine this administration blinking at a time like this,” responded Burritt.

“We feel strongly that the [Section] 232 will continue and we’re going to continue to operate our facilities and our business to the best we can within the current environment and also continue to be more nimble, and take costs out, so that if it does change, we’re still going to be able to generate value,” said Burritt.

He added, “We absolutely think that there will always be some type of appropriate measure, maybe moving more toward quotas than tariffs for the USMCA, but we will have to wait and see.”

In regard to the denial of exemptions for California Steel and NLMK USA, Burritt said, “We are open for business and so if anybody needs slabs, we can certainly provide that.” U.S. Steel is currently providing substrate for its joint venture with Posco on the West Coast.

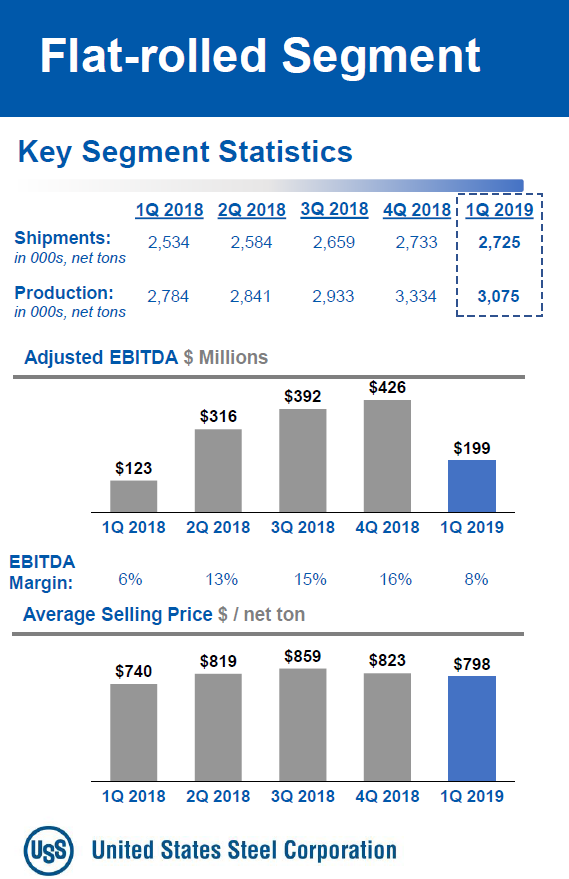

U.S. Steel’s strong earnings report supported the announced investment at Mon Valley and exceeded analysts’ estimates. The company reported net earnings of $54 million for the first quarter of 2019, compared to $18 million in the first quarter of 2018. Net sales totaled $3.5 billion on 4.0 million tons of shipments.

The raw steel capacity utilization rate for flat-rolled was 73 percent during the quarter compared to 66 percent a year ago. Flat rolled metrics include: raw steel production of 3.0 million tons and flat-rolled shipments of 2.7 million tons. The Tubular segment posted shipments of 207,000 tons in Q1.

U.S. Steel expects flat rolled steel shipments in North America to increase in the second quarter while shipments in Europe decrease.

Scheduled maintenance outages for the second quarter include Mon Valley blast furnace No. 3, Great Lakes split, B2 furnace, and a short outage at the Gary No. 14 furnace.