Analysis

May 3, 2019

Auto Sales Slip in April

Written by Sandy Williams

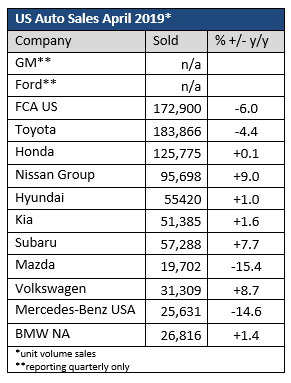

U.S. auto sales slipped 2.3 percent in April for a seasonally adjusted annual rate of 16.41 million, according to data by AutoWeek. The April rate was well below the sales rate of 17.42 million in March and 17.25 million in April 2018. Higher vehicle prices and difficulty securing financing may be keeping consumers from dealer lots.

“Forecasters have been expecting the market to slow as higher vehicle prices and higher borrowing costs squeeze many potential buyers,” said Charlie Chesbrough, senior economist for Cox Automotive. “And indeed, the sales lion that surprised many in March became a much weaker lamb in April, as revealed in today’s numbers. Robust employment conditions and a strong stock market didn’t seem to be enough to lift sales last month.”

Toyota and FCA both saw year-over-year sales decline. Automotive News estimates General Motors sales fell 2.6 percent and Ford 4.7 percent. The two Detroit automakers only report results quarterly and FCA plans to join that trend in June.