Market Segment

May 2, 2019

Olympic Steel Looking Forward to Stronger Second Quarter

Written by Sandy Williams

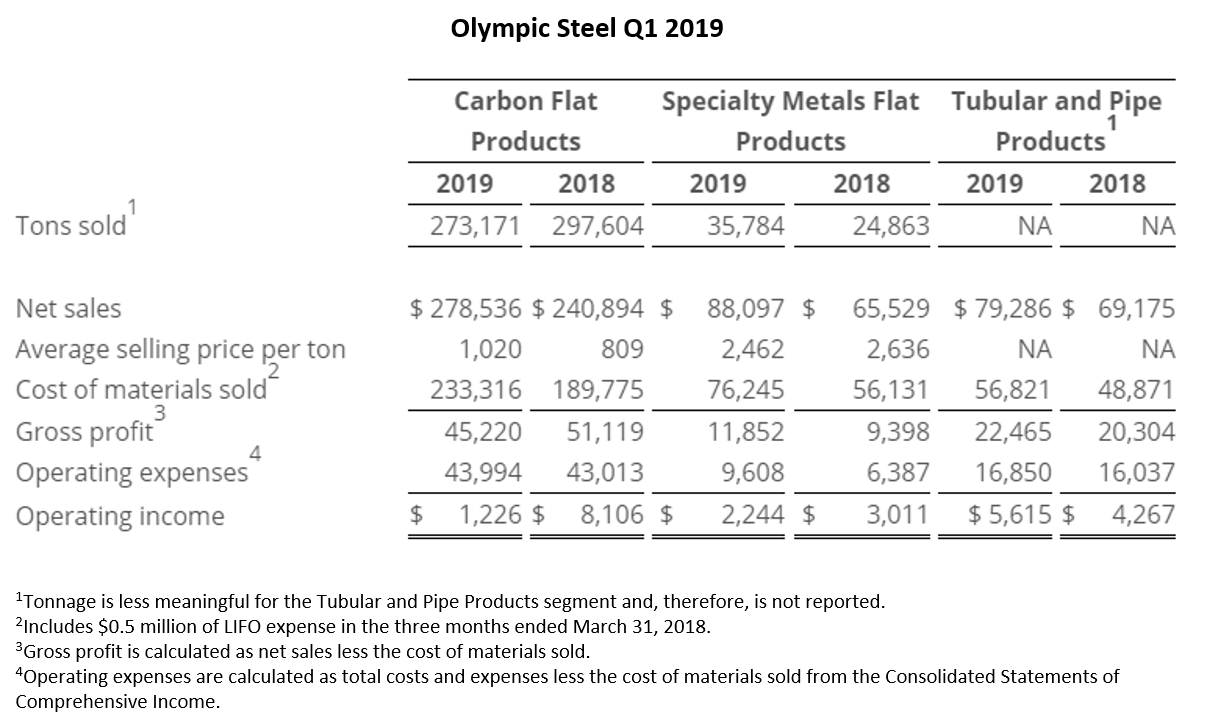

Olympic Steel reported a 19 percent increase in its first-quarter sales, netting $446 million, thanks in part to its January acquisition of manufacturer McCullough Industries. Net income for the quarter totaled $2.1 million, down from 7.6 million in the same quarter of 2018.

Returns from Olympic’s manufacturing segment are considerably higher than service center margins, noted Olympic President David Wolfort. Olympic supplies raw materials to McCullough from its Cleveland facility, while utilizing Olympic’s own truck fleet, which enhances the acquisition’s profitability. Olympic expects to add other manufacturing companies to its portfolio as opportunities arise.

Olympic’s product sales mix in the first quarter was 62 percent carbon flat, 20 percent specialty metals and 18 percent pipe and tube, the same percentages as in fourth-quarter 2018. “The decline in steel pricing that started in July 2018 continued to put pressure on margins, particularly on carbon flat products,” said CFO Rich Manson. Olympic’s flat rolled inventory turnover was 4.7 times, an improvement over 4.3 times in Q4 2018.

The company saw higher average selling prices and increased volumes in its specialty metals and pipe and tube segments. Olympic’s focus on tube distribution in the Southeast resulted in record sales and earnings in the first quarter. The pipe and tube segment has seen strong demand and pricing overall, said the company.

Olympic expects a second slitter added at its Streetsboro, Ohio, facility and a new specialty metals cut-to-length line at Schaumburg, Ill., to be at full capacity in the second quarter.

Flat rolled shipments have been on the decline as customers lower their inventories. “The discomfort and tightness in the market early on in ’18 influenced a lot of our large OEMs to carry heavier inventory then they would have liked. We are seeing a lot of deleveraging of that inventory in anticipation of prices continuing to move downward,” said CEO Rick Marabito. Much of that deleveraging has already taken place and a steadier order pattern is beginning to emerge, he added.

Looking ahead, Marabito said the demand environment is relatively steady. The carbon side looks flat quarter-over-quarter, while the company expects another solid quarter for pipe and tube and a slight pickup in specialty metals. “Seasonally, the second quarter is typically stronger than the first quarter, and we are optimistic about contributions from successful execution of our recent capital investments. We will remain focused on controlling our operating expenses and improving inventory turnover throughout the year.”

Olympic announced the opening of a new distribution center near Birmingham, Ala., this week. The facility will offer improved deliveries of sheet and plate products.