Market Segment

April 25, 2019

Reliance Steel and Aluminum: Generally Healthy Demand

Written by Sandy Williams

Reliance Steel & Aluminum posted a good first quarter with net sales of $2.96 billion, increasing 7.2 percent year-over-year and 4.1 percent from the fourth quarter. Net income jumped 122 percent from the fourth quarter to $190.1 million.

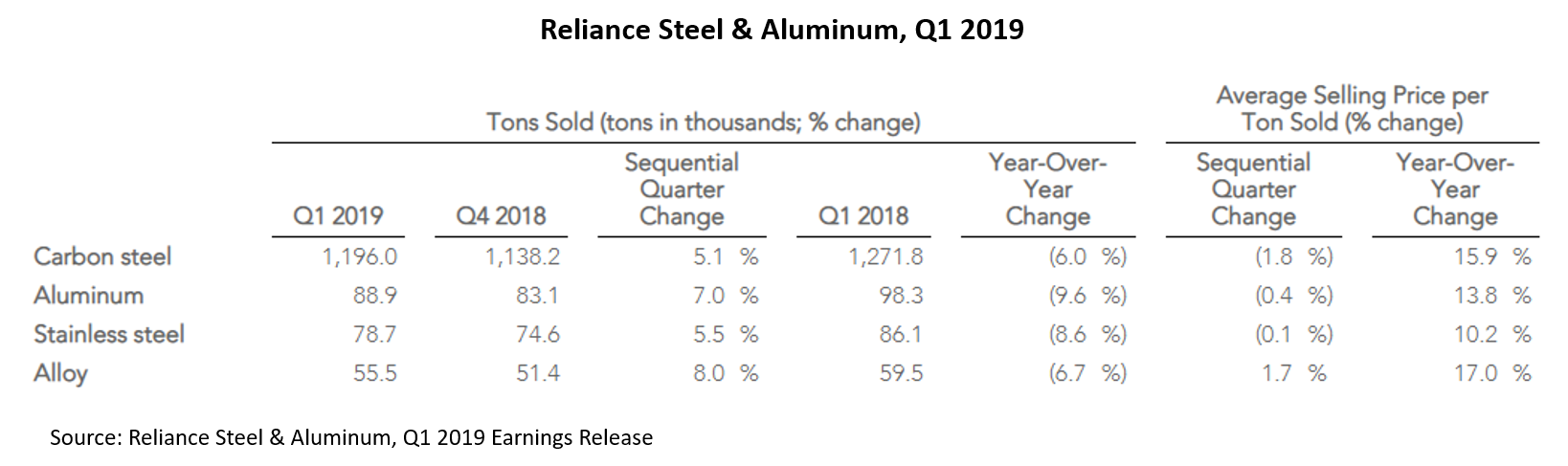

Tons sold increased 5.2 percent from the fourth quarter to 1.5 million tons, but were slightly below the company forecast of 6-8 percent and 5.9 percent below tons sold in Q1 2018.

Pricing conditions were positive and demand generally health, said CEO James Hoffman. Average selling price per ton increased 13.6 percent year-over-year, although softening by 0.4 percent from the fourth quarter.

Markets that Reliance participates in are doing well except for the semiconductor sector, which continues to soften. Toll processing is strong for the automotive markets in the U.S. and Mexico. Demand in the nonresidential construction (including infrastructure), heavy industry and energy (oil and gas) sectors remains steady.

Reliance looks forward to steady demand and pricing in the second quarter with some downward pressure on gross margin profit. Tons sold are expected to be down 1 percent to up 2 percent compared to the first quarter, and prices flat to down 1 percent.

During the earnings call, Hoffman was asked to comment on recent tariffs on imported fabricated beams. Beams have been in a “slow burn upwards” since the crash in 2009 and will do even better if infrastructure spending kicks in, said Hoffman. The trade cases have already resulted in benefits to the company, with two fairly large orders awarded to Reliance that would have gone to Mexico or Canada with Chinese product, he added.

Commenting on carbon steel plate pricing, Hoffman said prices have fallen from a very high level and are now where they should be. “The activity and capacity at the mills are strong and, if you look at all these things combined, there really shouldn’t be a price erosion, but there has been.”

Aerospace plate is on the tight side and is expected to remain that way through the year. Reliance has not been affected by the Boeing issues with its 737 Max aircraft.