Market Data

April 18, 2019

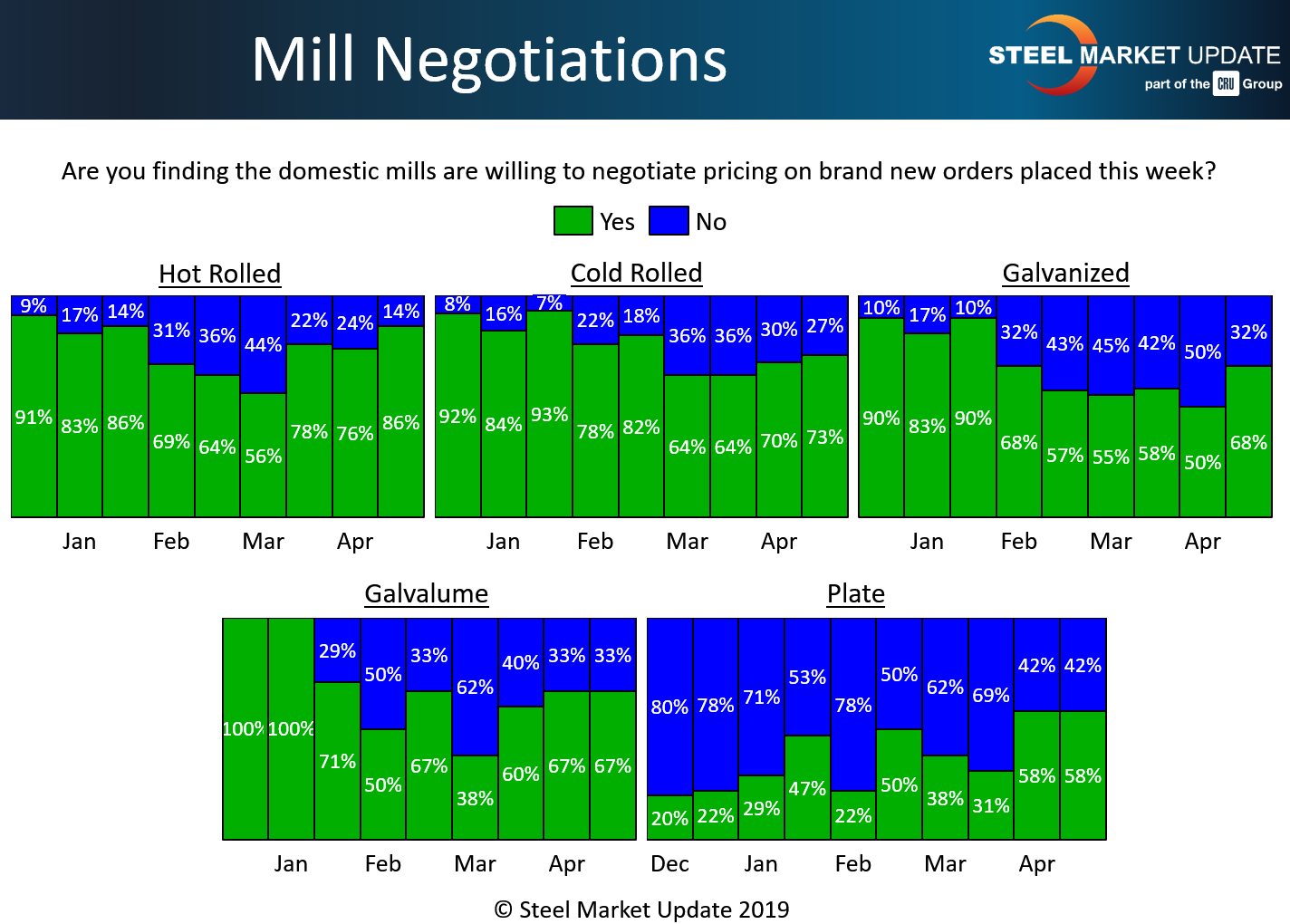

Steel Mill Negotiations: Prices in Play on All Products

Written by Tim Triplett

Mills are willing to talk price on all types of steel products to get the orders, report the vast majority of buyers responding to Steel Market Update’s questionnaire this week. Corroborating the trend, SMU data shows steel prices moving downward or sideways, raising questions about current steel demand.

About 86 percent of respondents said the mills are open to price negotiations on hot rolled, up from 76 percent two weeks ago. Just 14 percent said the mills are currently holding the line on HR.

In the cold rolled segment, 73 percent now report the mills open to price negotiations, up from 64 percent one month ago. Just 27 percent report current cold rolled prices as firm.

In the galvanized sector, 68 percent said the mills are flexible on price, up 18 points from the 50 percent in the last poll. Just 32 percent report that galvanized prices are now nonnegotiable. Two out of three respondents said the mills are now willing to talk price on Galvalume.

Negotiations in the plate market saw little change in the past two weeks as the majority of buyers, 58 percent, are now reporting plate prices in play.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.