Prices

April 18, 2019

Hot Rolled Futures: Saying Goodbye to an Upside?

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge a www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

Steel futures have in the past few weeks seen increased selling pressure. The market, in late February, showed signs of a possible move up for HRC prices in the U.S. with April contract levels trading as high as $740 back in February.

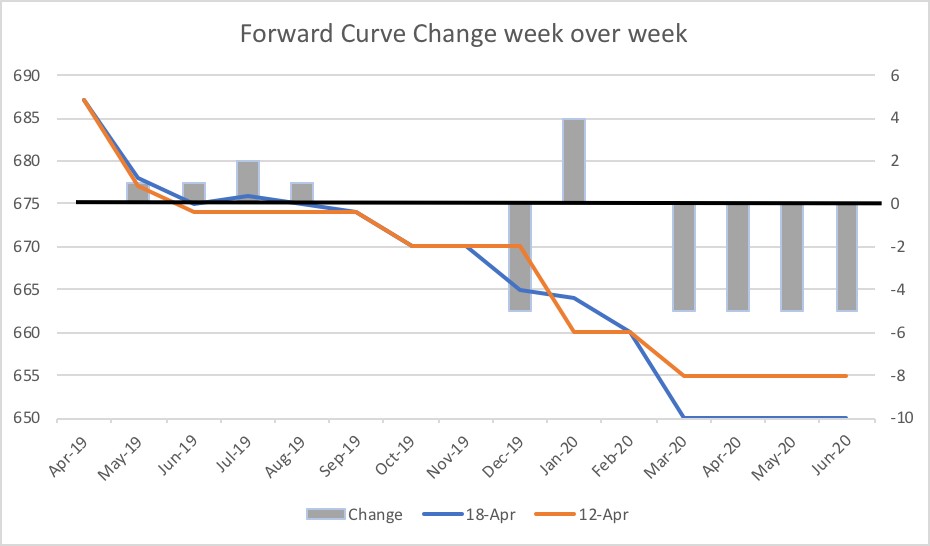

Now, with April month to date average at $691 and the April contract at $686 (chart below), it is evident that the market players are expecting lower prints going forward.

The change in the forward curve levels (secondary axis) shows relatively little action in the front. The push down in months Mar-Jun 2020 is also driven by small volume. There are perhaps two competing explanations for why the curve seems stuck for now.

One theory is plain and simple—“confusion.” Buyers are perplexed by lower physical prices. In some cases, they argue whether buying physical will be the right option. The sellers are not able to see the rumored cheap physical numbers reflected in the index assessment. The outcome is confusion.

The other theory is an interesting one—“equilibrium.” I find this one interesting. I can see how range bound markets give the illusion of being in a balance. Commodity markets are a multi-player game. The expectation to find a point of balance where an optimal solution balances things out is seemingly improbable. We certainly can go through periods where lack of action persists. This lack of action in part of buyers wondering whether to buy more or not and that of sellers wondering whether they should drop prices to get those additional tons makes us believe we are in a state of balance. In reality, those are markets that can be the calm before the storm.

Interestingly, despite the weakness in the U.S. market, the international steel offers are still higher than “CRU minus contract discount levels.”

On the raw material front, scrap in Turkey continues to be moving lower as Turkish mills struggle to find end-markets. The lack of export demand has clearly impacted Turkish steel fundamentals and their appetite for scrap. Since many people in the U.S. markets watch scrap prices closely, May scrap settlements will be an important price level to watch. Any further weakness will likely be another point of bargain for the buyers who continue to sit on the sidelines.

On another subject, CRU and CME held a webinar to talk through the markets, volatility and growth in market liquidity. The speakers did a great job talking about the need to be ready to use futures even if you aren’t actively trading it. After all, who knows when the “equilibrium” goes away.