Market Data

April 16, 2019

WSA: Global Steel Demand to Grow, Even as Economy Slows

Written by Tim Triplett

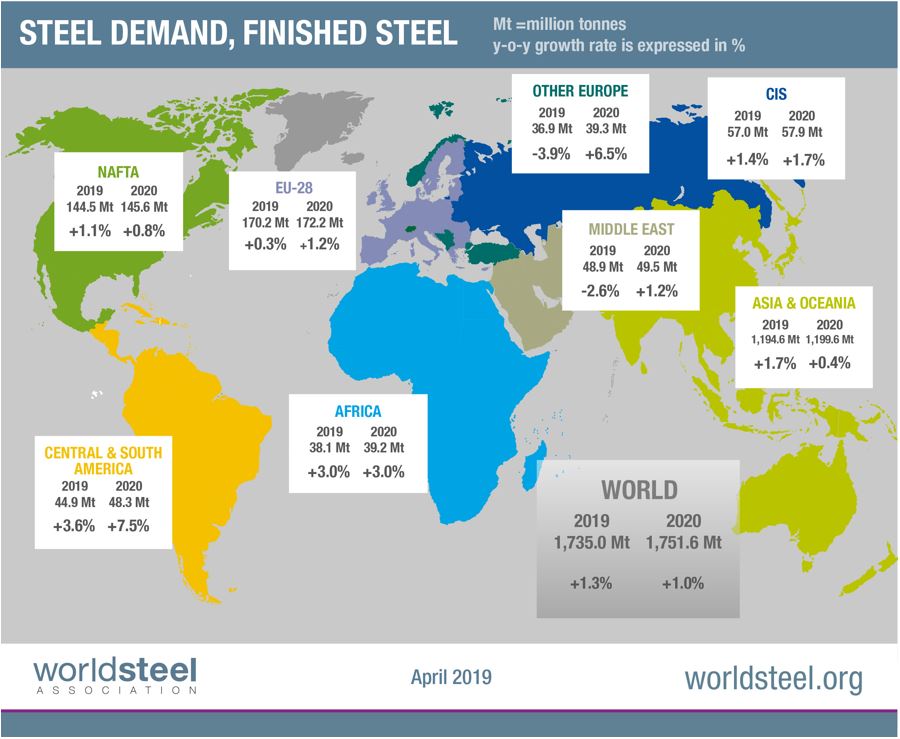

Global steel demand will top 1.75 billion metric tons by the end of next year, despite economic headwinds in many parts of the globe, predicts the World Steel Association in its April 2019 Short Range Outlook.

Worldwide, steel demand will increase by 1.3 percent this year to 1,735 Mt, followed by further 1 percent growth in 2020 to 1,752 Mt, according to the latest worldsteel forecast.

“In 2019 and 2020, global steel demand is expected to continue to grow, but growth rates will moderate in tandem with a slowing global economy,” said Al Remeithi, chairman of the trade association’s economics committee. “Uncertainty over the trade environment and volatility in the financial markets have not yet subsided and could pose downside risks to this forecast.”

Growth in Steel Demand Remains Positive

In 2018, global steel demand increased by 2.1 percent (after adjusting for China induction furnace closures), growing slightly slower than in 2017. In 2019 and 2020, growth is still expected, but in a less favorable economic environment. China’s deceleration, a slowing global economy, and uncertainty surrounding trade policies and the political situation in many regions suggest a possible moderation in business confidence and investment.

Chinese Steel Demand Remains Robust Owing to Government Stimuli

Chinese steel demand continues to decelerate as the combined effect of economic rebalancing and trade tension is leading to slowing investment and sluggish manufacturing performance. Mild government stimulus cushioned the economic slowdown in 2018. In 2019, the government is likely to heighten the level of stimulus, which is expected to boost steel demand.

In 2020, a minor contraction in Chinese steel demand is forecasted as the stimulus effects are expected to subside.

Steel Demand in the Developed World Reacts to a Weaker Trade Environment

Steel demand in the developed economies grew by 1.8 percent in 2018 following a resilient 3.1 percent growth in 2017. We expect demand to further decelerate to 0.3 percent in 2019 and 0.7 percent in 2020, reflecting a deteriorating trade environment.

In 2017-18, steel demand in the U.S. benefitted from the strong growth of the economy driven by government-led fiscal stimulus, leading to high confidence and a robust job market. In 2019, the U.S. growth pattern is expected to slow with the waning effect of fiscal stimulus and a monetary policy normalization. Therefore, both construction and manufacturing growth is expected to moderate. Investment in oil and gas exploration is expected to decelerate as well, while a boost in infrastructure spending is not expected.

The EU economies also face the deteriorating trade environment and uncertainty over Brexit. We expect slower growth in demand for steel in the major EU economies (especially in those more export dependent) in 2019. Steel demand growth is expected to improve in 2020, dependent on a reduction in trade tensions.

Japan recorded growth in steel demand in 2018, supported by a favorable investment environment and continued construction activities as well as a boost in consumer spending prior to the consumption tax increase. In 2019 and 2020, steel demand is likely to contract slightly due to a moderation of construction activities and decelerating exports despite the support provided by public projects.

Steel demand in Korea has been contracting since 2017 due to reduced demand from two major steel using sectors, shipbuilding and automotive. Steel demand is expected to continue declining in 2019 due to toughened real estate market measures and a deteriorating export environment. A mild recovery is expected in 2020.

Developing Economies (Excluding China) Present a Positive But Mixed Picture

Steel demand in the emerging economies excluding China is expected to grow by 2.9 percent in 2019 and 4.6 percent in 2020.

Asia: Having overcome the shocks of demonetization and the Goods & Services Tax (GST) implementation, the Indian economy is now expected to achieve faster growth starting in the second half of 2019 after the election. While the fiscal deficit might weigh on public investment to an extent, the wide range of continuing infrastructure projects is likely to support growth in steel demand above 7 percent in both 2019 and 2020.

Steel demand in developing Asia excluding China is expected to grow by 6.5 percent and 6.4 percent in 2019 and 2020, respectively, making it the fastest growing region in the global steel industry. In the ASEAN region, infrastructure development supports demand for steel.

MENA: Economic diversification efforts in the GCC continue in reaction to a low oil price environment, but fiscal consolidation is still suppressing construction activities. Steel demand is expected to continue to contract in 2019, with a minor recovery expected in 2020.

Iran’s steel demand will also contract in 2019 as the reinstatement of U.S. sanctions causes a recession in the economy.

The situation in North Africa looks brighter, with Egypt recovering strongly after the structural reforms of 2017. Investment in energy and a recovery in the real estate market are expected to drive Egyptian steel demand. Other North African economies are also expected to show resilient growth in steel demand backed by strong investment activities.

CIS & Turkey: Despite improved oil prices, growth in steel demand in Russia will continue but is expected to be constrained by structural issues. The growth outlook for Ukraine is stable and improving, supported by domestic consumption.

The Turkish economy is still reacting to the currency crisis of August 2018, which led to contraction in steel demand. This is expected to continue into 2019, with some stabilization in 2020.

Latin America: A broad recovery in steel demand across Latin America is expected to continue despite internal and external uncertainty. Recovery in Brazil is in its third year with the construction sector expected to mildly improve in 2019. On the other hand, steel demand growth in Mexico is expected to be moderate, influenced by weak mining investment, fiscal budget constraints, policy uncertainties and a slowing U.S. economy.

The political situation in Venezuela and its impact on the region is unclear.

Automotive & Construction: As pent-up demand and government stimulus measures subsided, the automotive industry saw a sharp slowdown in growth in 2018 in many countries, in particular in the EU, Turkey and China. The largest declines were observed in Turkey (-9.0 percent) and in the UK (-5.5 percent). As a result, global auto production growth decelerated to 2.2 percent in 2018 from 4.9 percent in 2017. In 2019, global auto production will continue to decelerate to 1 percent growth with stabilization expected in 2020. However, in Latin America, especially in Brazil, auto production will buck the trend and continue to show a steady rebound.

The momentum of construction activities is also expected to moderate a bit in the developed economies, but thanks to the rebound in the developing economies, global growth will be maintained at a 3 percent level in 2019-20. However, in China, Turkey, South Korea and Argentina, construction activities are expected to continue to contract in 2019. With weakening investment and a worsening trade environment, the global machinery sector is expected to show a steady deceleration that will last until 2020, which will be more pronounced in major production hubs such as Germany, Japan and China.

World Steel Association members represent approximately 85 percent of the world’s steel production, including over 160 steel producers with 9 of the 10 largest steel companies, national and regional steel industry associations, and steel research institutes.