Market Data

April 15, 2019

BLS: Employment by Industry for March

Written by Peter Wright

U.S. manufacturing lost jobs in March, but has had strong job growth in the last 12 months.

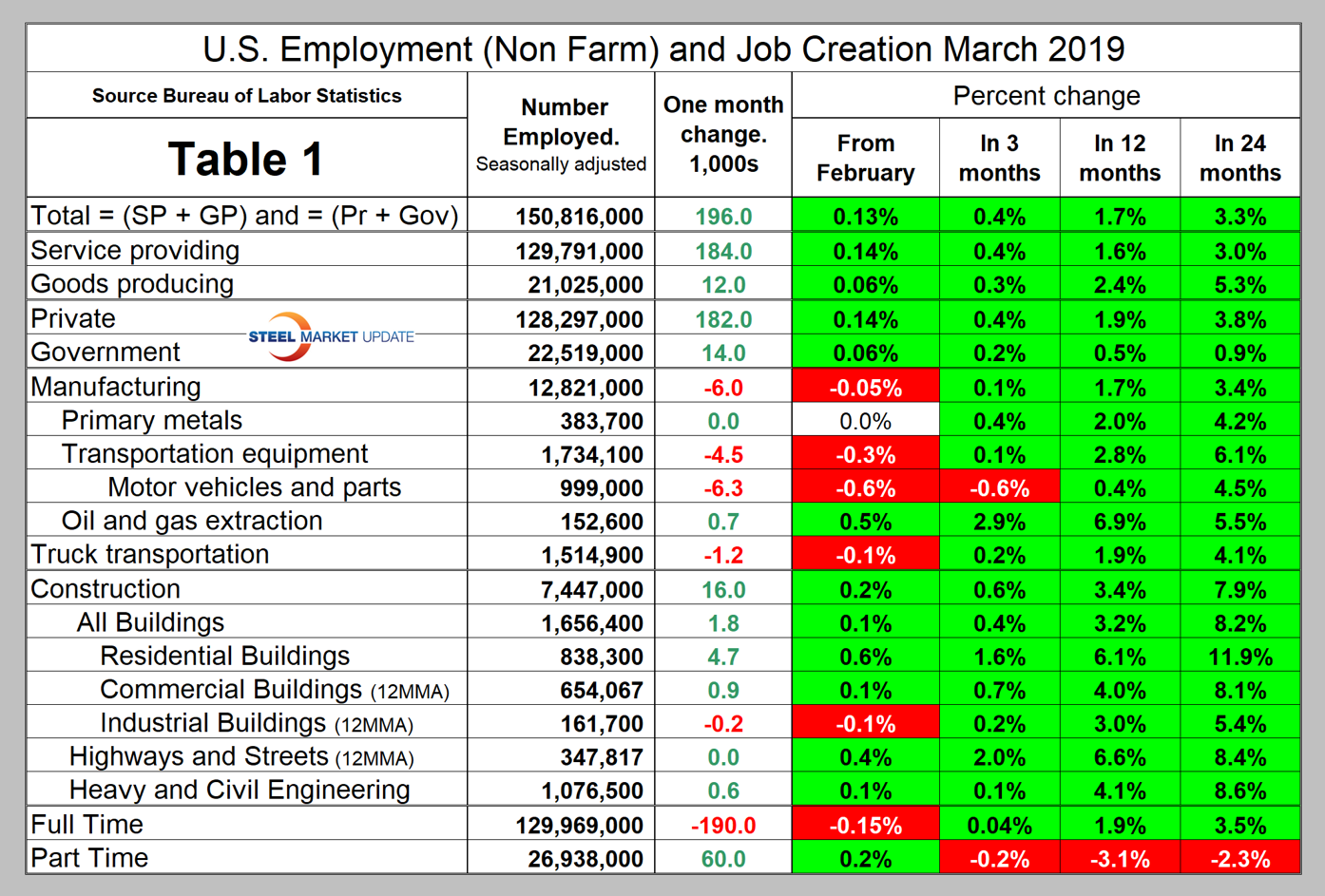

In March, 182,000 jobs were created in the private sector and government added 14,000, reports the Bureau of Labor Statistics. Table 1 breaks total employment down into service and goods-producing industries and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction and the components of these two sectors of most relevance to steel people are broken out in Table 1.

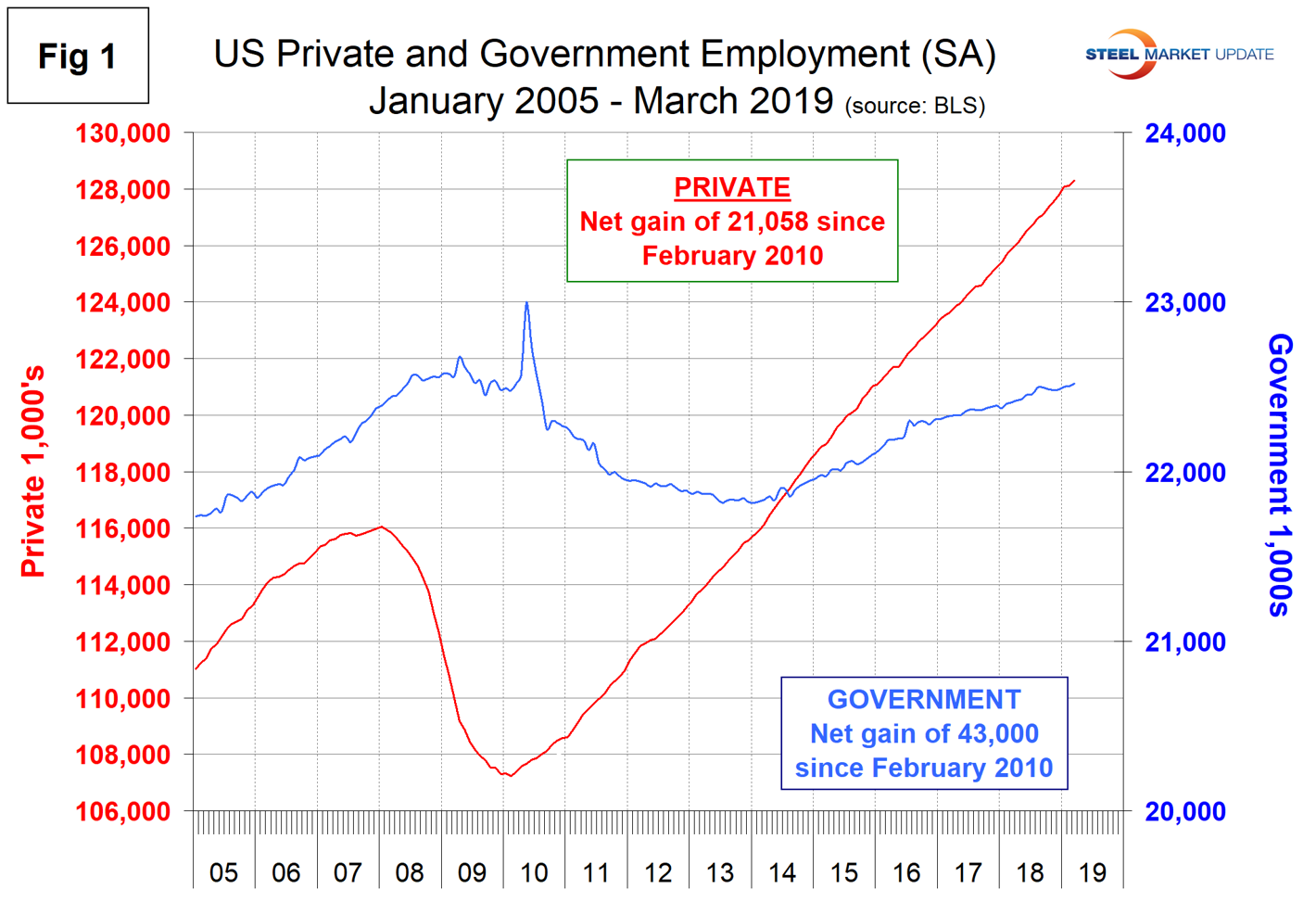

The number employed by the federal government in March declined by 2,000. State governments gained 41,000 and the local level gained 12,000. Since March 2010, the low point of total nonfarm payrolls, private employers have added 21,058,000 jobs as government has gained 43,000 (Figure 1).

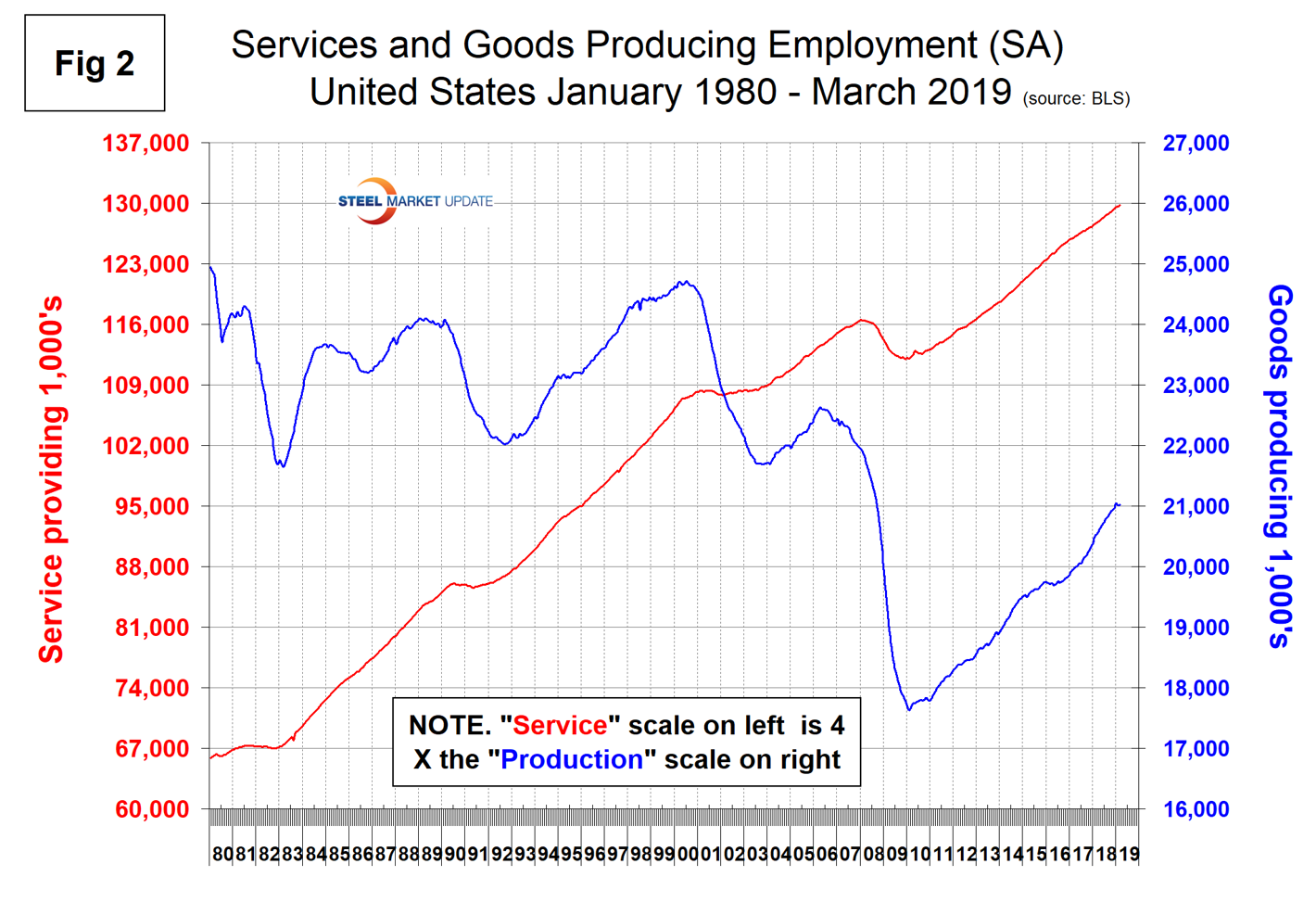

In March, service industries expanded by 184,000 jobs as goods-producing industries, driven by construction, gained 12,000 (Figure 2). Since March 2010, service industries have added 17,703,000 and goods-producing 3,398,000 positions. This has been a drag on wage growth since the recession as service industries on average pay less than goods-producing industries such as manufacturing. The good news is that in the last 24 months the rate of job creation in goods-producing industries on a percentage basis has been half as much again as in service industries.

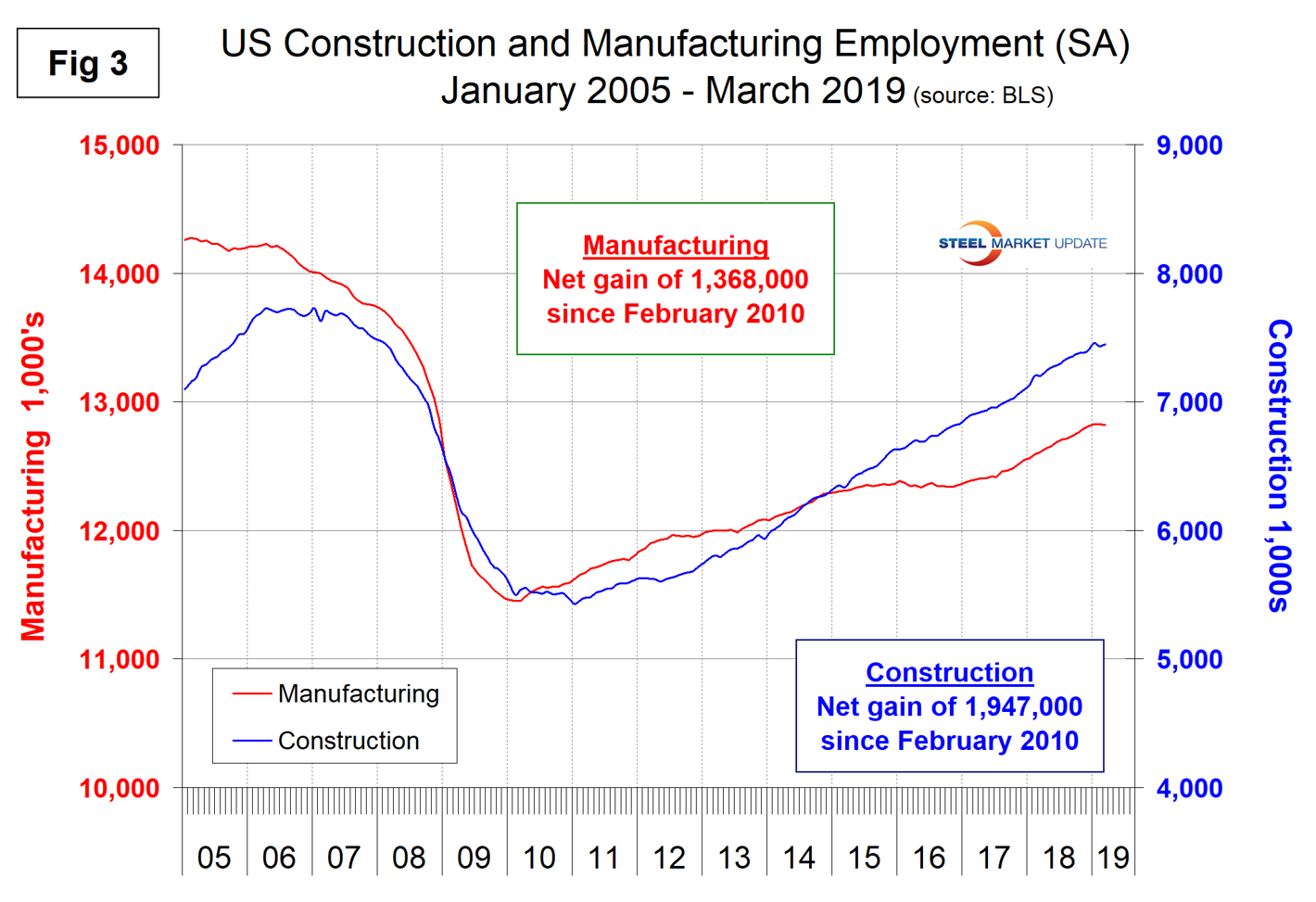

Construction was reported to have gained 16,000 jobs in March and manufacturing to have lost 6,000. Ken Simonson, chief economist of the Associated General Contractors of America, reported: “The average workweek in construction was at a record high in March and the number of unemployed jobseekers with construction experience was at all-time lows. These data suggest that contractors are having a hard time finding qualified workers even though the industry pays better than the private sector as a whole.”

Manufacturing is trailing construction as a job creator and had negative job growth in March. This was the first contraction since July 2017. In 12 months through March, manufacturing gained 229,000 jobs. Figure 3 shows the history of construction and manufacturing employment since March 2005. Construction has added 1,947,000 jobs and manufacturing 1,368,000 since the recessionary employment low point in February 2010.

Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

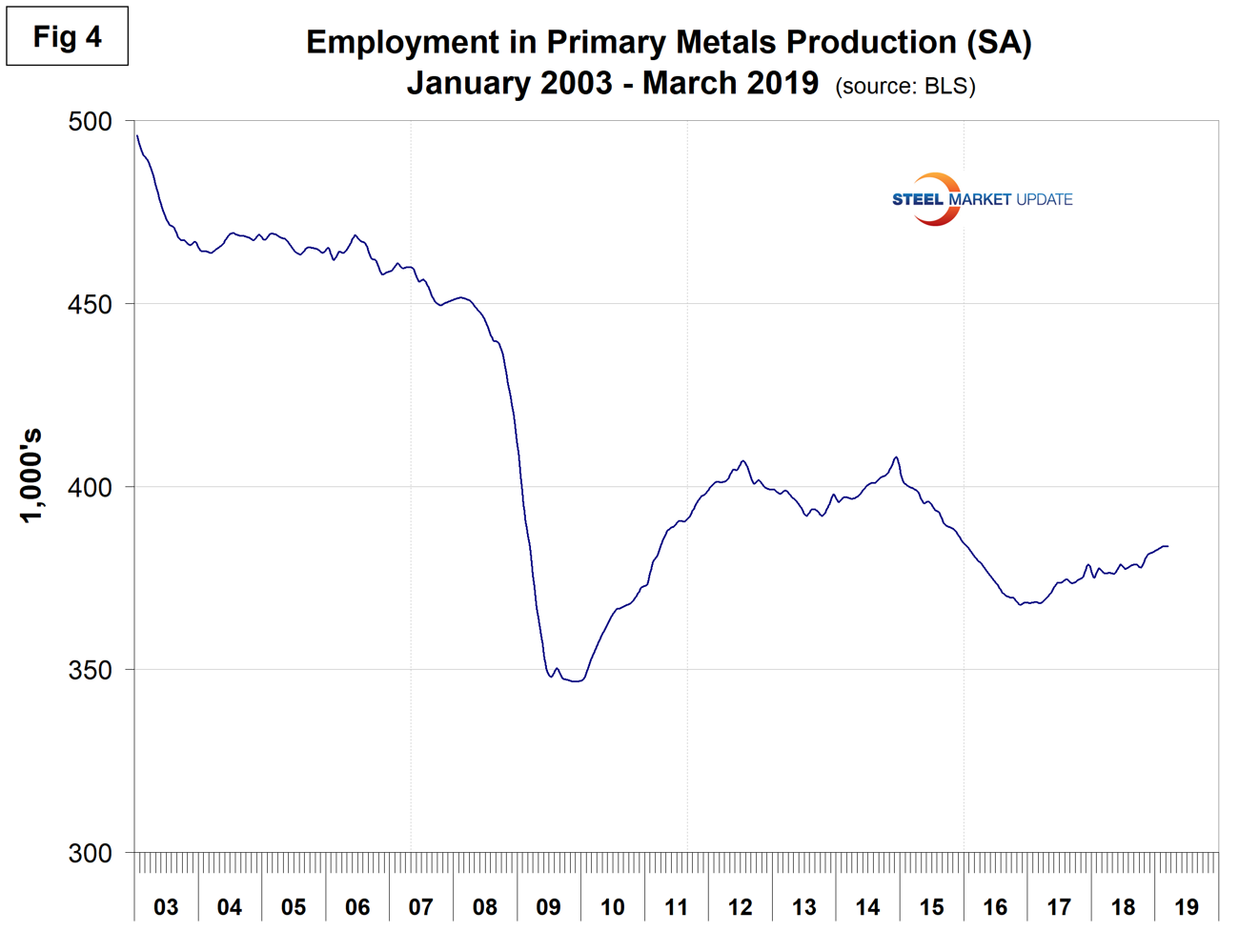

Table 1 shows that primary metals broke even in March with zero jobs created, and in the last 24 months gains on a percentage basis were a little better than for total manufacturing. Figure 4 shows the history of primary metals employment since January 2003.

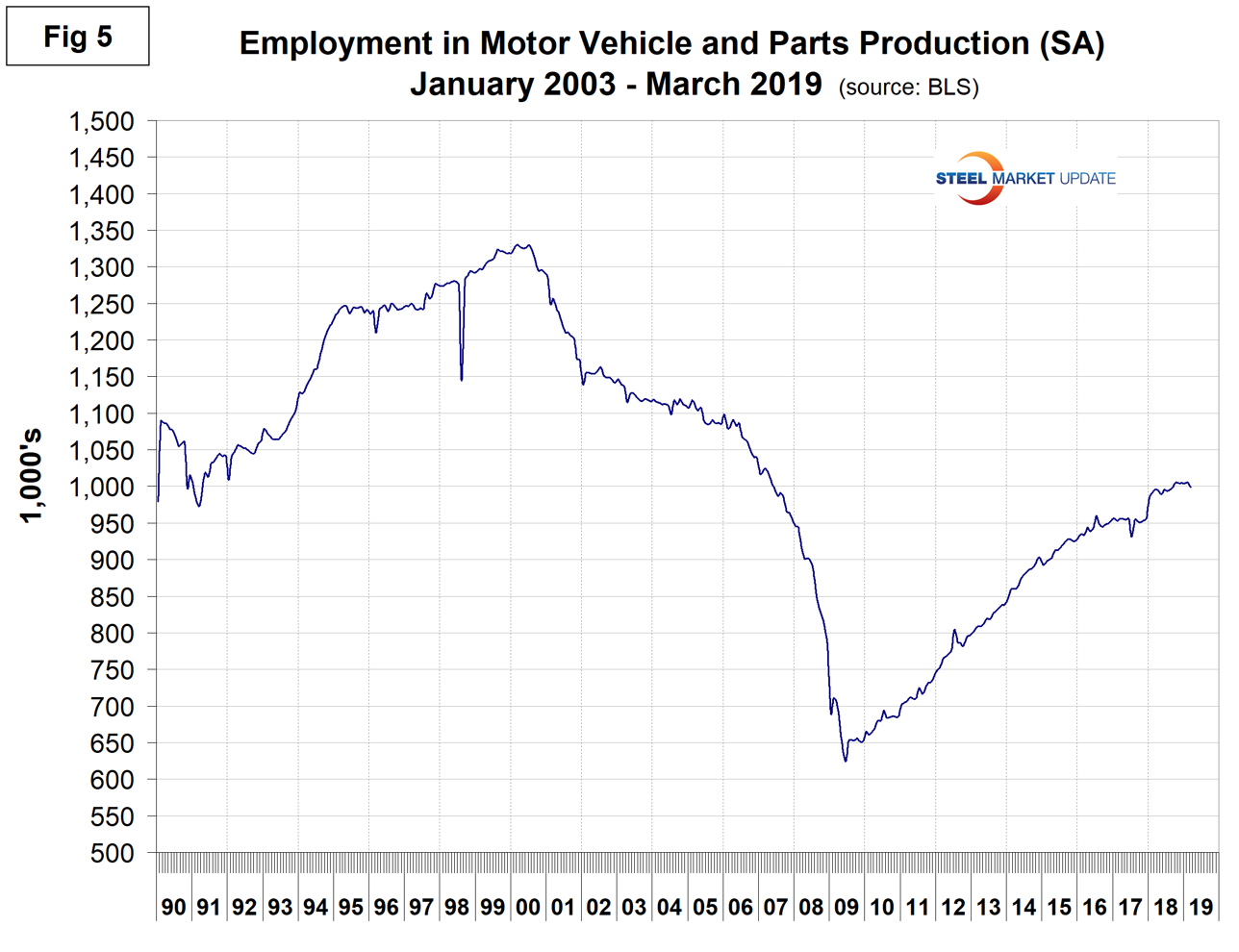

Motor vehicles and parts industries were reported to have lost 6,300 jobs in March reducing the 12-month gain to only 4,000. Figure 5 shows the history of motor vehicles and parts employment.

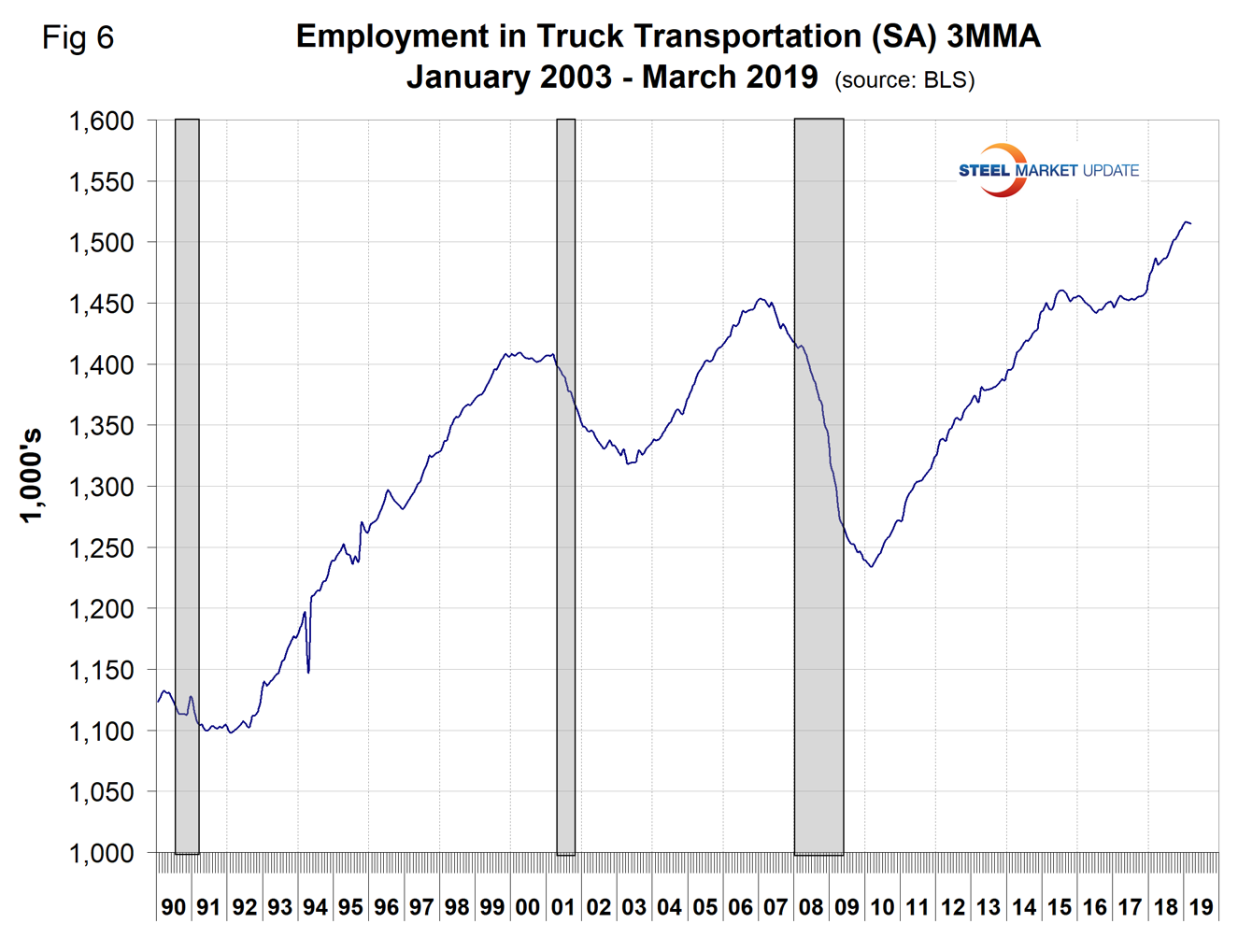

Trucking lost 1,200 jobs in March, resulting in a 12-month gain of 29,000. Employment in truck driving is one of SMU’s recession monitors and Figure 6 suggests that the economy is still on a roll.

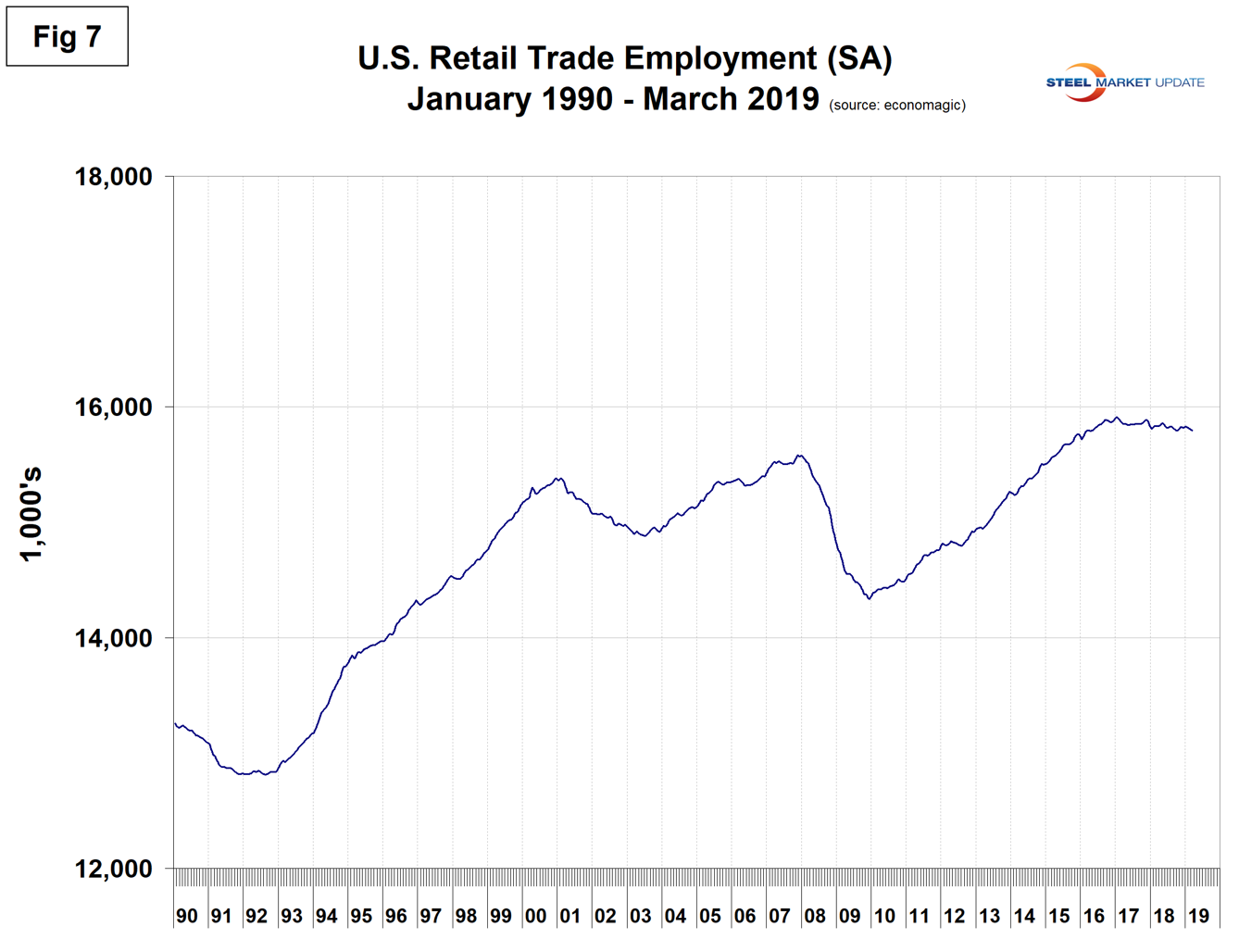

In this and our previous report we’ve described employment in retail sales. Retail sales is undergoing a massive restructuring that will increasingly affect the neighborhoods in which most of us live and is a precursor of what will happen to our own businesses in the future. Retailers that are planning to stick around are spending vast amounts of money building out their online operations and their e-commerce fulfillment infrastructure, including warehouses and delivery operations. Figure 7 shows total retail employment and a decline of 114,400 since the peak in January 2017. Our point here is that the retail industry is in the throes of an employment revolution and this is a precursor of what will happen in manufacturing as robotics, 5G and AI pick up steam. An imminent example is truck driving. There is a huge cloud on the horizon for truck drivers; this is autonomous vehicle technology, which will probably take off in trucks long before it does in automobiles. The nature of work is changing faster than at any time since the industrial revolution and our public K-12 education system is floundering. Employers must have a strategy to deal with this mismatch.

SMU Comment: The March employment report showed the February result to be a statistical anomaly. Manufacturing employment growth in March was disappointing, but it will be a couple more months before any trend is revealed. Manufacturing and construction had solid employment gains last year, which bodes well for steel consumption in at least the first half of 2019.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.