Market Data

April 11, 2019

Distributor Spot Pricing Support Drops

Written by John Packard

Steel Market Update conducted an analysis of flat rolled and plate steel market trends last week. One of the key trends we watch closely is the relationship between how service centers are handling spot prices to their customers and what support is being given to domestic steel mill price increases. With the two increases announced in January and February on flat rolled, the analysis is quite telling, and we believe is an indicator of where flat rolled steel prices will go from here.

When we do our service center spot pricing analysis, we look at what manufacturing companies are telling us and then compare that against the service centers. We do this because service centers have a tendency to be more optimistic than what may actually be happening. However, we find the trend is almost always confirmed by the end users. The question is to what degree are prices being raised or lowered?

Manufacturing companies are seeing an erosion of support for higher spot prices out of their service center suppliers. After late January, there was an uptick in price support, which you can see in the green bars on the lower right-hand side of the graphic below. We saw 38 percent and then 42 percent of the manufacturing respondents to our survey reporting distributors as raising prices. At the same time those reporting eroding prices out of their distributors dropped from 59 percent in mid-January to a low of 14 percent one month later. Since mid-February, a higher percentage of the OEMs are reporting more discounting by their service center suppliers. Last week, 20 percent reported spot prices as declining and 25 percent reported prices increasing. The balance report stable spot pricing.

Service centers, who report independently from their manufacturing customers, were more optimistic in that a much lower percentage reported spot pricing as being in decline (7 percent) than the 20 percent reported by the manufacturing companies. However, there was agreement that the move to support higher spot prices was dwindling as 25 percent of the distributors reported their company as raising spot prices, which is down from the 37 percent and 41 percent reported at the middle and beginning of March, respectively.

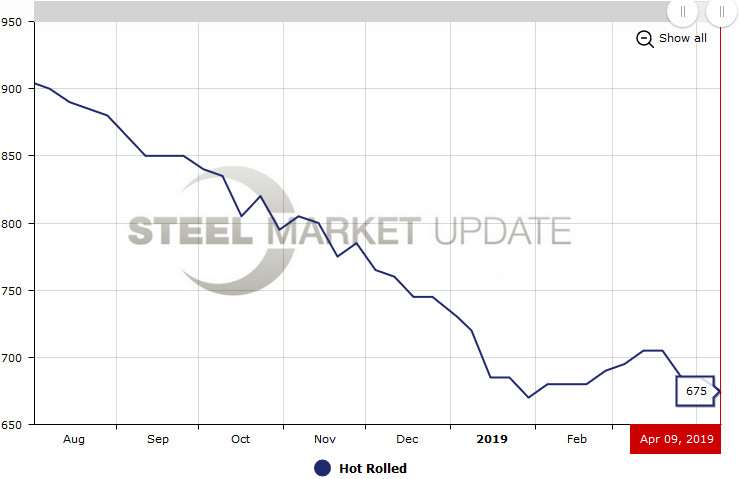

The red ovals at the top of the graphic above represent Nucor price increase announcements. As you can see, there have been two announcements (January and February). In the graphic below (which was taken from the SMU website this morning), you can clearly see how the tepid support by the service centers has impacted benchmark hot rolled steel prices out of the domestic steel mills. As support dwindles, you can expect further pressure on pricing.

If you go back to the graphic above and look at the red bars and then compare the pricing graphic below (you can get an even longer view by clicking on this link to our website – must login to access data) you can view the relationship between our service center spot and the impact on mill spot numbers. HRC prices bottomed on Jan. 29, 2019, at $670 per ton. With the price announcements by the domestic mills, the spot mill price average improved by $35 per ton to $705 per ton (March 12 and March 19). Since then support has slid and the numbers have dropped to the current level of $675 per ton average ($650-$700 range).