Market Data

April 7, 2019

SMU Steel Buyers Sentiment Index: Slight Uptick in Optimism

Written by Tim Triplett

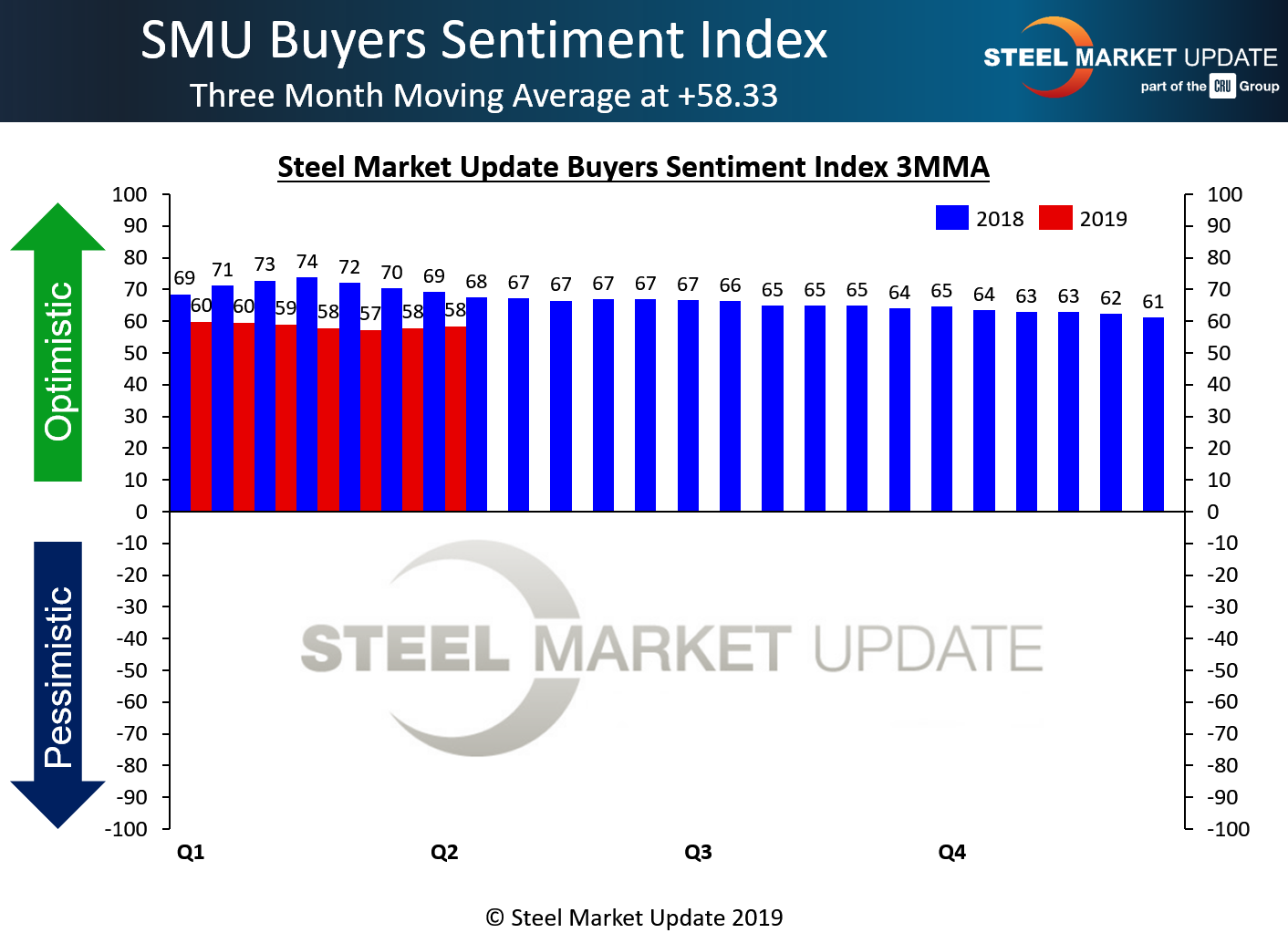

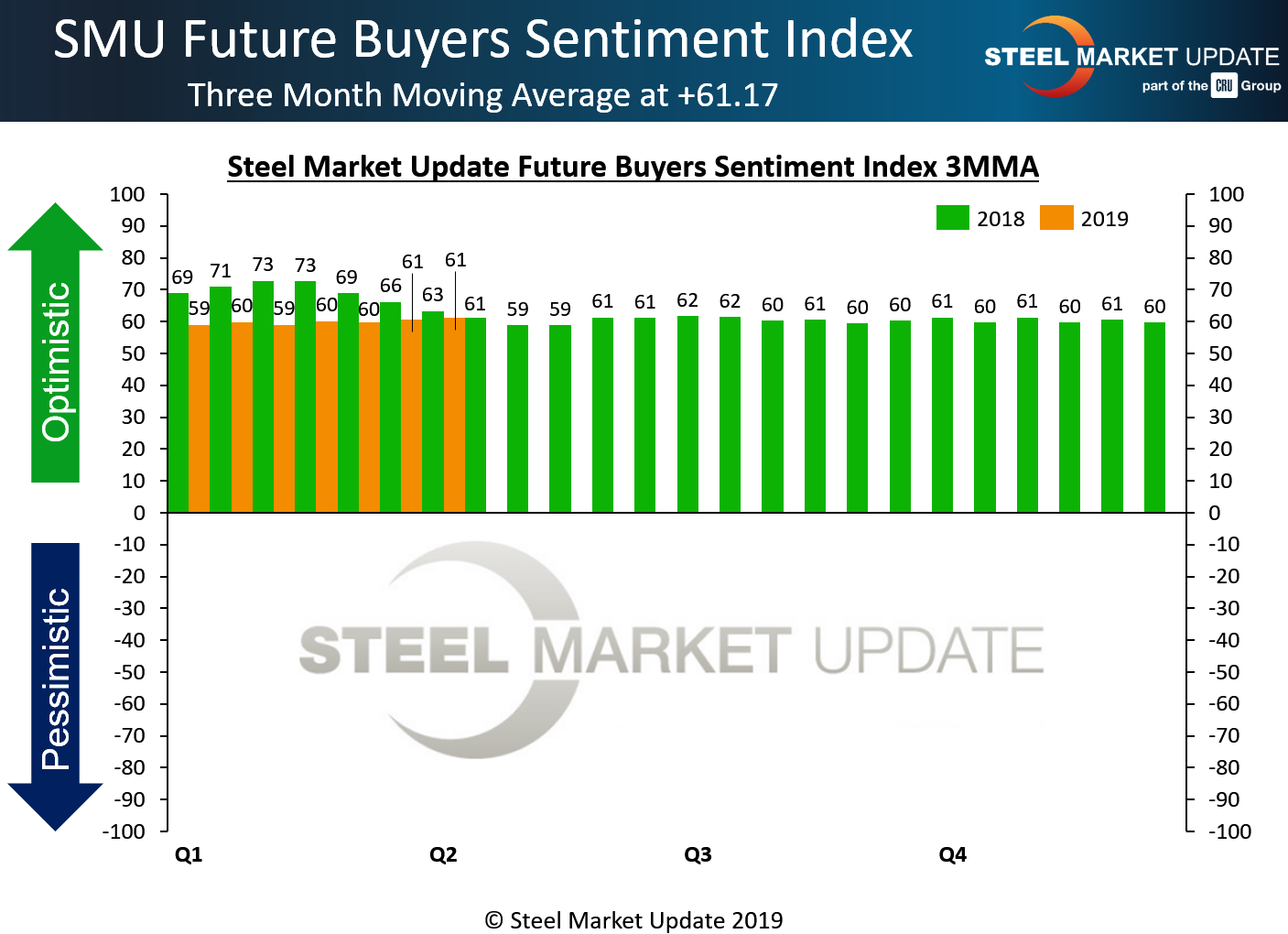

Data in Steel Market Update’s Steel Buyers Sentiment Index were slightly more optimistic this week, though comments from respondents reflect concerns in the market about trade issues, steel demand and the economy. We also continue to see Current Sentiment as being less optimistic than at this time one year ago. However, our Future Sentiment Index is now on par with what we saw at this time last year.

The goal of the index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Index), as well as three to six months into the future (Future Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend. Sentiment among industry executives remains well within the optimistic half of the scale.

Current Sentiment measured as a single data point registered +61 in the latest data, up slightly from where it has been for most of the year so far. Measured as a 3MMA, Current Sentiment averaged 58.33, up from 57.83 in mid-March.

Future Sentiment

Respondents were asked to assess their chances for success in three to six months. Measured as a single data point, Future Sentiment registered +65, up 4 points from a couple weeks ago. Measured as a 3MMA, the Future Index averaged 61.17, up from 60.50 in SMU’s March 15 canvass. Both measures showed slight improvement and remain well within the optimistic half of the range.

What Our Respondents Had to Say

“Business is stable. Normally I would have said excellent, but there a lot of political variables.”

“March was quite disappointing as demand was weak across the board.”

“Still working through higher cost inventory.”

“Concerns about overall demand.”

“Too much uncertainty on trade restrictions. Section 232 and potential future trade cases is making business very difficult.”

“Increasing worries about general demand coupled with the administration doing everything they can to damage the economy have led us to revise our year downwards by a good bit.”

“Weather and a potential trade deal are keys to watch.”

“As an importer, we’re clearly hindered by the tariff structures at present; however, we expect relief on the Mexico/Canada 232 front shortly.”

“Contract business is insanely competitive.”

“It depends on metal pricing and demand. There’s lots of talk about a pullback or recession.”

“Expecting the slow economy to slide into recession.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 37 percent were manufacturers and 49 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.