Market Data

April 6, 2019

Manufacturing Sector Loses 6,000 Jobs in March

Written by Sandy Williams

The U.S. manufacturing sector lost 6,000 jobs in March primarily due to employment losses in the auto industry. In February, the sector gained 1,000 jobs, but was far below the average of 22,000 jobs gained per month in the prior 12 months.

Alliance for American Manufacturing President Scott Paul said of the latest employment figures:

“The disappointing manufacturing jobs number for March tells an all-too-familiar tale for factory workers: Plant closings have devastating impacts. The General Motors shutdown will continue to have a ripple effect throughout impacted communities and suppliers, in addition to the thousands of autoworker families facing uncertain futures.

“There are some things the president and Congress can do right now to brighten the days ahead for manufacturing: Conclude a meaningful China trade deal; pass a robust infrastructure plan to rebuild America with our own workers, iron, and steel; and enhance skills training and apprenticeship opportunities for the makers of the future.”

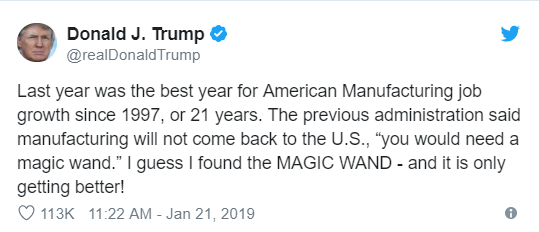

Economists are starting to see less “fairy dust” emanating from the “Magic Wand for manufacturing” that Trump touted on Twitter in January.

Manufacturers have been hit hard by higher costs caused by tariffs, trade wars and waning global demand. Additionally, the benefits from the Trump tax cuts are starting to dwindle. Friday’s job report from the Labor Department ended 19 consecutive months of employment gains, making it just short of the longest run for factory employment since the mid-1980s.

Manufacturing remains generally strong, however. Businesses are still optimistic despite talk of a slowdown. The Institute for Supply Management reported that the manufacturing PMI for March rose 1.1. points to 55.3 after posting a downward trend in recent months. ISM’s break-even point for growth for the sector is 55, but the three-month trend appears promising for now.