Analysis

April 5, 2019

Dodge Momentum Index Inches Up in March

Written by Sandy Williams

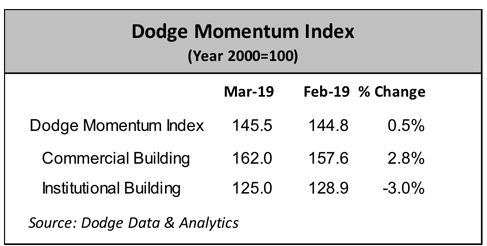

The Dodge Momentum Index rose a slim 0.5 percent in March to 145.5. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Institutional planning fell 3.0 percent last month, leaving the commercial component of the index to provide the uptick with an increase of 2.8 percent.

“The overall Momentum Index has essentially moved sideways and stayed within a very narrow band of activity since the fall of last year,” said Dodge Data & Analytics. “This is highly indicative of where building markets currently are at in this late stage of the construction cycle. While economic growth is expected to ease from 2018’s strong pace, relatively healthy real estate market fundamentals and continued support for public projects such as a schools and transportation terminals should enable planning activity to remain close to recent levels for the near term.”

Six projects with a value of $100 million or more entered the planning phase in March.

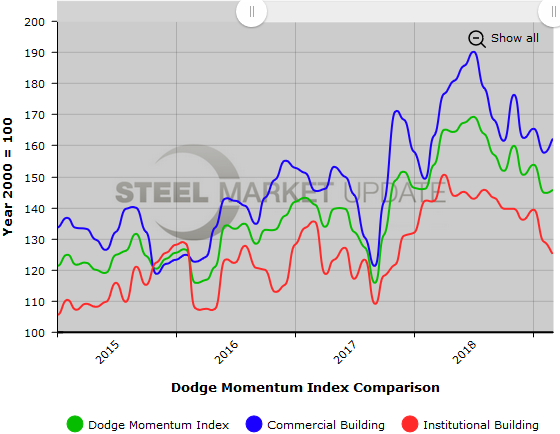

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.