Market Data

March 31, 2019

CRU Economist: Momentum's Slowing But Activity Remains Solid

Written by Tim Triplett

By CRU Principal Economist Lisa Morrison

Data released for Q1 2019 have been largely positive.

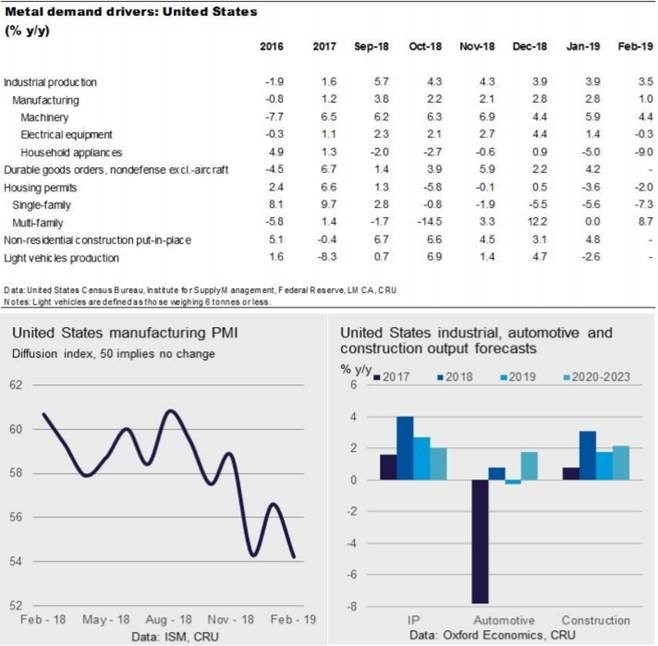

The ISM Manufacturing survey reflects a moderating rate of expansion, but the reading of 54.2 in February shows a solid level of manufacturing activity with new orders, output, employment and backlogs squarely in “expansion” territory.

Housing disappointed in 2018, but 2019 may be better; although unadjusted starts for Jan/Feb are on par with 2018, the permits data are on pace with our forecast of 1.29 M total units (slightly better than 2018). In Q4 2018, total nonresidential construction spending declined q/q, but the forward-looking surveys point to continued expansion in commercial and institutional building during H1 2019 in y/y terms.

Total vehicle production rose by 0.8 percent in 2018 to 11.43 M units and is expected to total ~11.4 M in 2019. Flat vehicle output, along with a smaller expansion in oil production than we saw in 2018, will slow the rate of IP growth to 2.7 percent this year from 4.0 percent in 2018.

Consumer sentiment remains elevated due to the strong job market, which is good news for personal outlays. Although several different measures of business confidence declined in Q4, optimism around the U.S.-China trade negotiations as well as lagged positive impacts from the 2018 tax cut could allow investment spending to surprise to the upside.

The Fed has signaled that interest rates are on hold for the rest of 2019, thereby helping housing affordability and consumer durables spending. GDP growth came in just shy of 2.9 percent in 2018 and we continue to expect a moderation to 2.2 percent this year given that the impact of 2018’s stimulus will fade, eventually.

Explore this topic further with CRU.