Market Data

March 29, 2019

Consumer Confidence Grows in April Following March Decline

Written by Peter Wright

Steel Market Update is sharing this Premium content with Executive-level subscribers in this issue. For more information on upgrading to a Premium-level membership, email info@SteelMarketUpdate.com

In April, consumer confidence gained back most of the March decline. The Conference Board’s measure of consumer confidence declined each month from November through January, surged in February, gave back most of that gain in March, and in April made up most of the March loss.

![]()

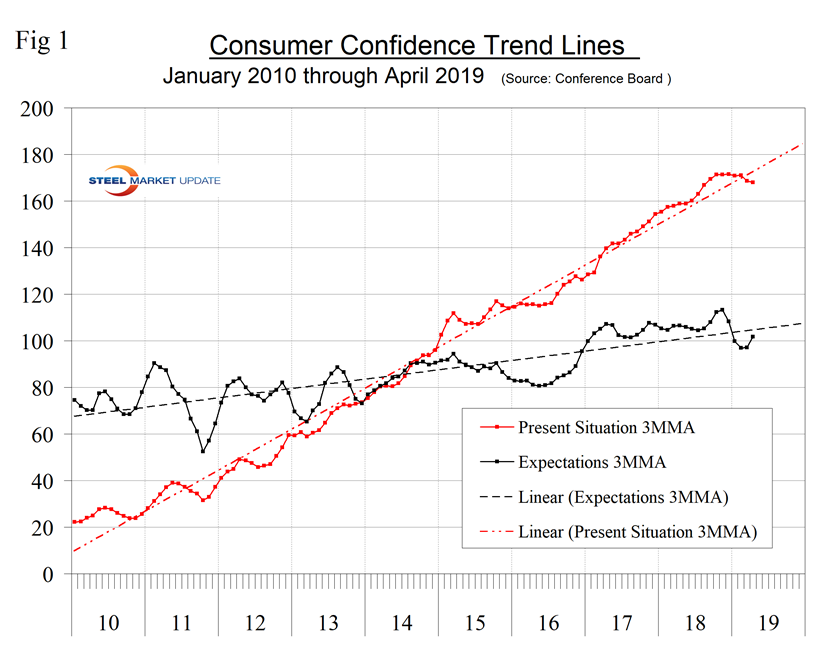

This is why we prefer to smooth the data with a moving average to reduce monthly volatility. The composite value of consumer confidence in April was 129.2 with a three-month moving average (3MMA) of 128.3. The 3MMA in January was 128.2. The composite index is made up of two sub-indexes—the consumer’s view of the present situation and his or her expectations for the future. Both components are now below their nine-year trend line (Figure 1).

The Conference Board summary statement read: “Consumer confidence partially rebounded in April following March’s decline, but still remains below levels seen last fall,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index, which had decreased sharply last month, improved in April, as did consumers’ short-term outlook. Overall, consumers expect the economy to continue growing at a solid pace into the summer months. These strong confidence levels should continue to support consumer spending in the near-term.”

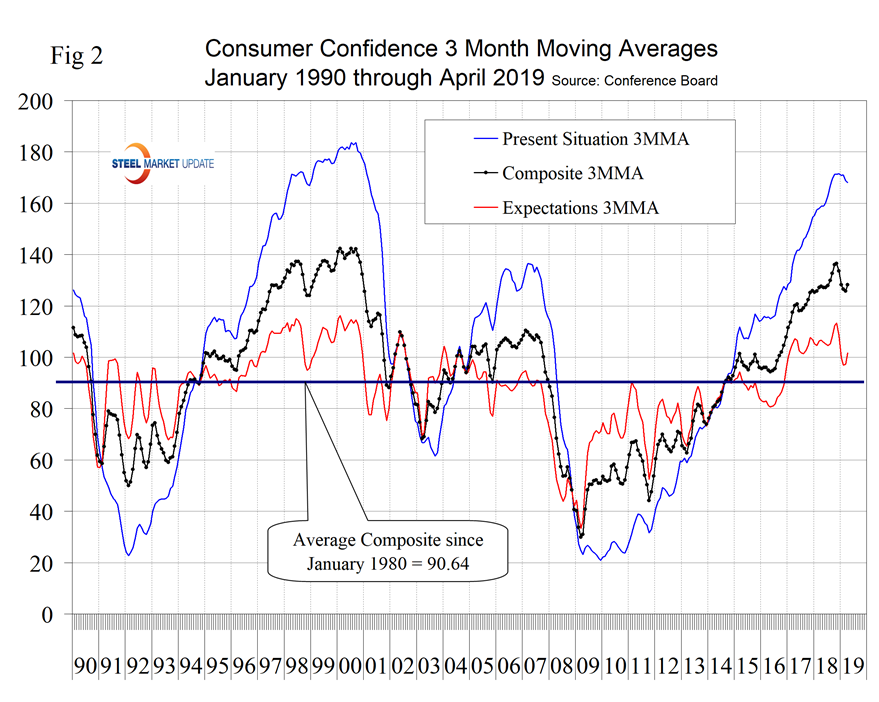

The increase in the monthly composite in April was due equally to an improvement in both consumers’ view of the present situation and their expectations. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2. All three measures are better than at any time since early 2001.

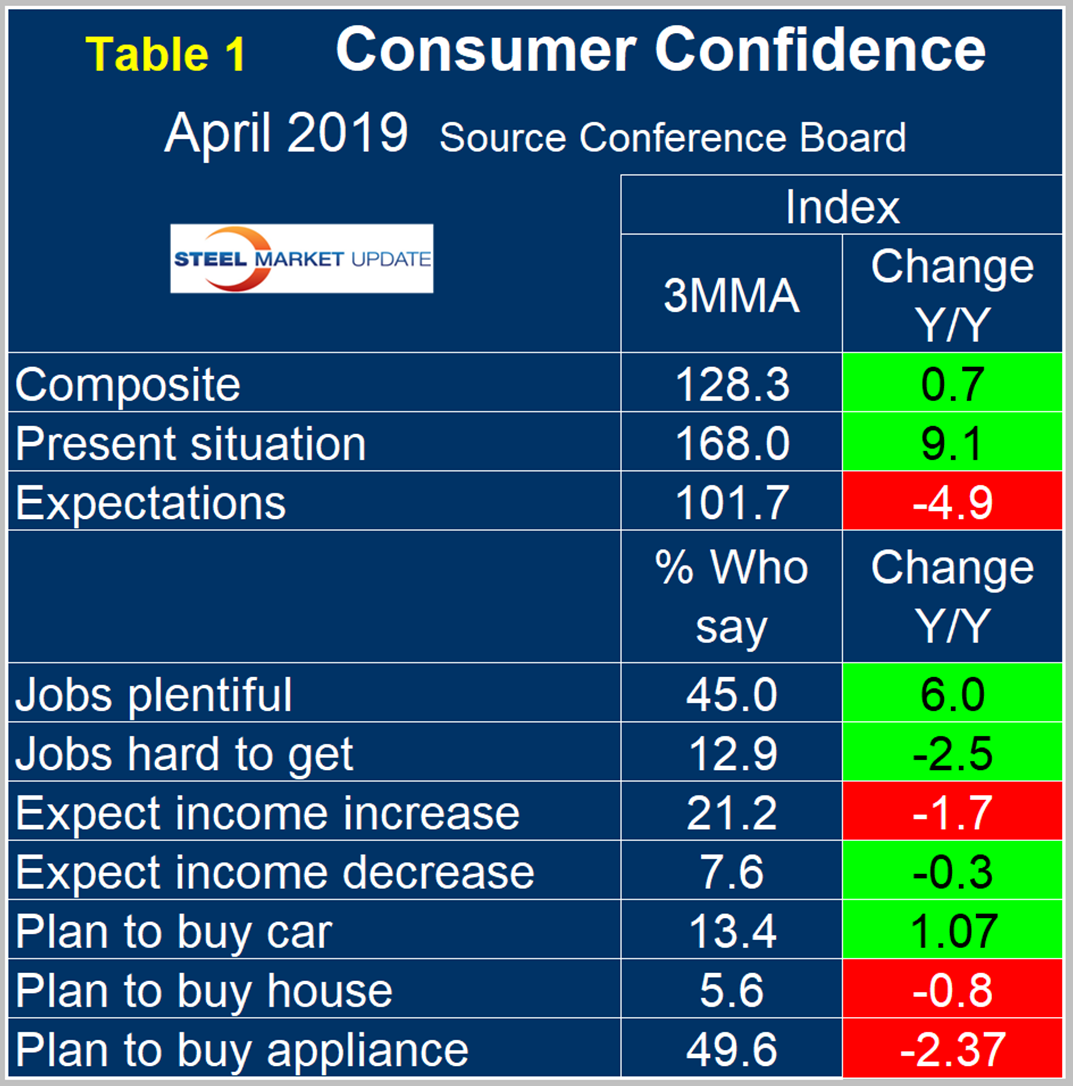

On a three-month moving average basis, the expectations component is now lower than it was a year ago. The consumer’s view of the present situation is better than it was a year ago. Comparing April 2019 with April 2018, the 3MMA of the present situation was up by 9.1 and expectations were down by 4.9 points (Table 1).

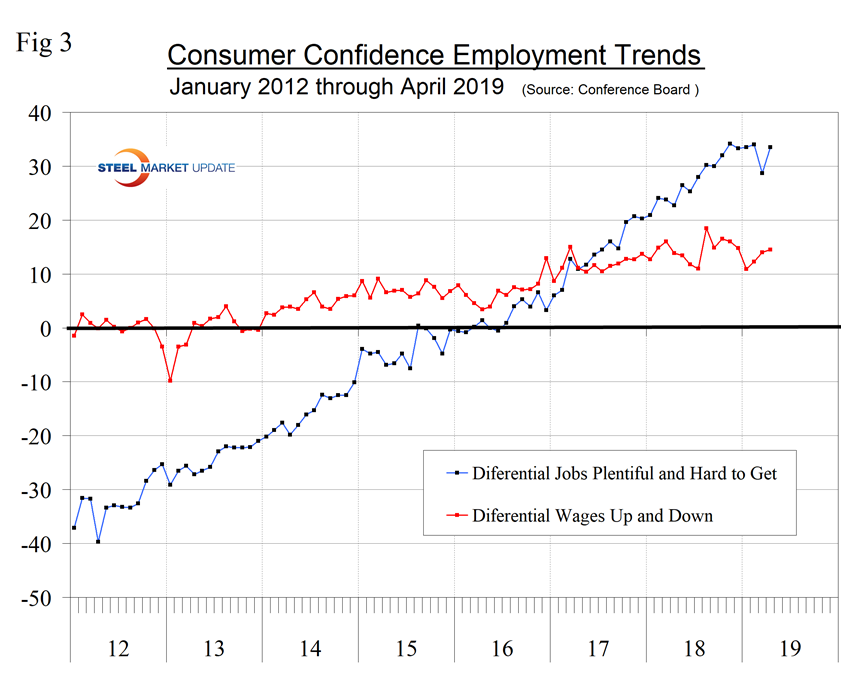

The consumer confidence report includes encouraging data on job availability as 46.8 percent of respondents reported jobs to be plentiful and 13.3 percent reported jobs hard to get. Expectations for wage increases were not so positive, with a small net increase in the proportion of respondents expecting an increase.

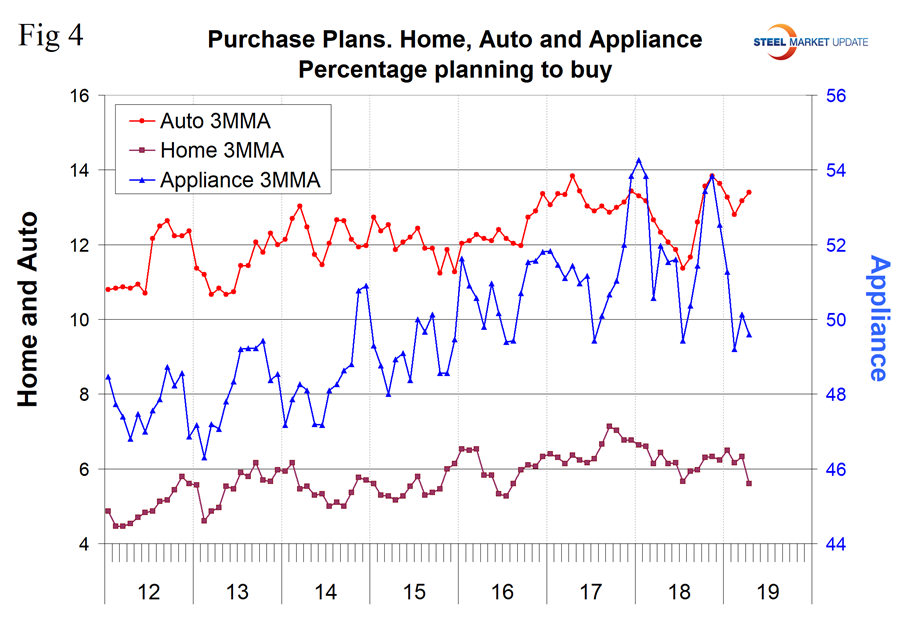

Consumer spending measures in April indicated that year-over-year plans to buy a car improved, but plans to buy a house or an appliance declined. In March, plans to buy a house were positive (Figure 4).

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure if the state of the economy, but basically is saying there’s not much change year over year. On a 3MMA basis, both the present and expectations components have fallen below their long-term trend line for the first time in two years, though both are historically high. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence, disposable income and a willingness to spend.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.