Market Data

March 29, 2019

Consumer Confidence Dips in March After February Gain

Written by Peter Wright

After declining for three straight months, The Conference Board’s measure of consumer confidence surged in February, only to give back most of that gain in March.

![]() The composite value of consumer confidence in March was 124.1, down from 131.4 in February. The 3MMA (three-month moving average) decreased from 126.6 in February to 125.7 in March, which was almost the same as March last year. We prefer to smooth the data with a moving average to reduce monthly volatility. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. Both components are now below their nine-year trend line (Figure 1).

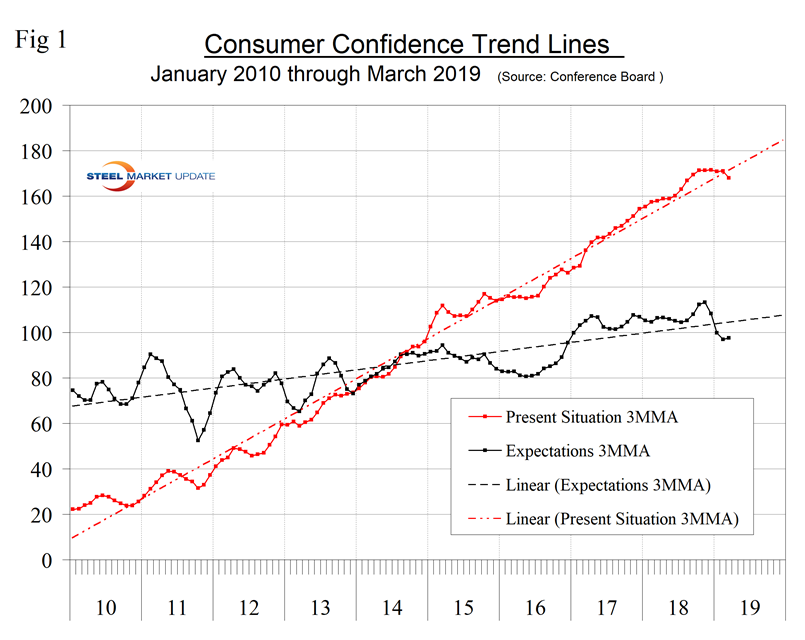

The composite value of consumer confidence in March was 124.1, down from 131.4 in February. The 3MMA (three-month moving average) decreased from 126.6 in February to 125.7 in March, which was almost the same as March last year. We prefer to smooth the data with a moving average to reduce monthly volatility. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. Both components are now below their nine-year trend line (Figure 1).

“Consumer Confidence decreased in March after rebounding in February, with the Present Situation the main driver of this month’s decline,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “Confidence has been somewhat volatile over the past few months, as consumers have had to weather volatility in the financial markets, a partial government shutdown and a very weak February jobs report. Despite these dynamics, consumers remain confident that the economy will continue expanding in the near term. However, the overall trend in confidence has been softening since last summer, pointing to a moderation in economic growth.”

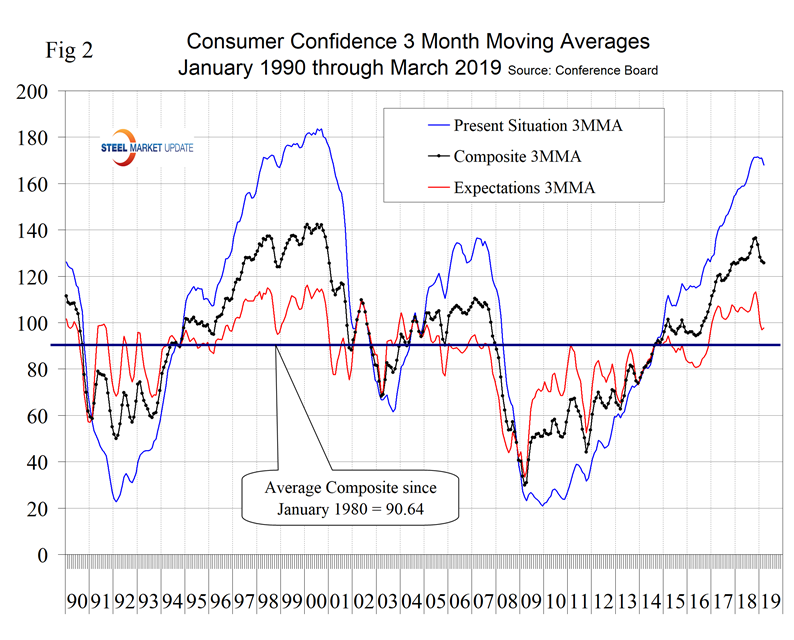

The decrease in the monthly composite was mostly due to consumers’ view of the present situation, which was down by 12 points to 160.8. Expectations declined four points to 99.8. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

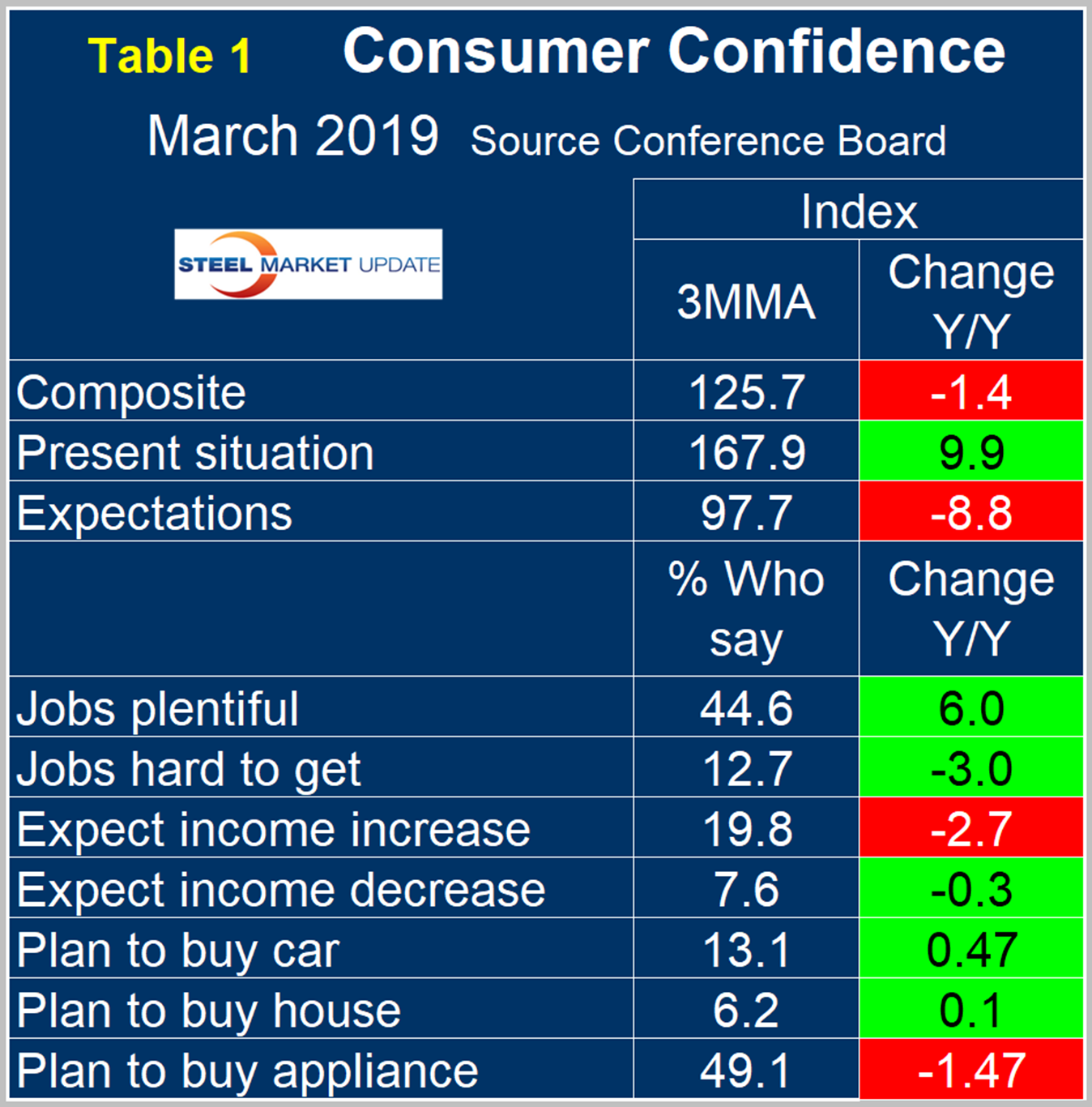

On a three-month moving average basis the expectations component is now lower than it was a year ago. The consumer’s view of the present situation has surged since December 2010, but has slowed in the last six months. Comparing March 2019 with March 2018, the 3MMA of the present situation was up by 9.9 and expectations were down by 8.8 points (Table 1).

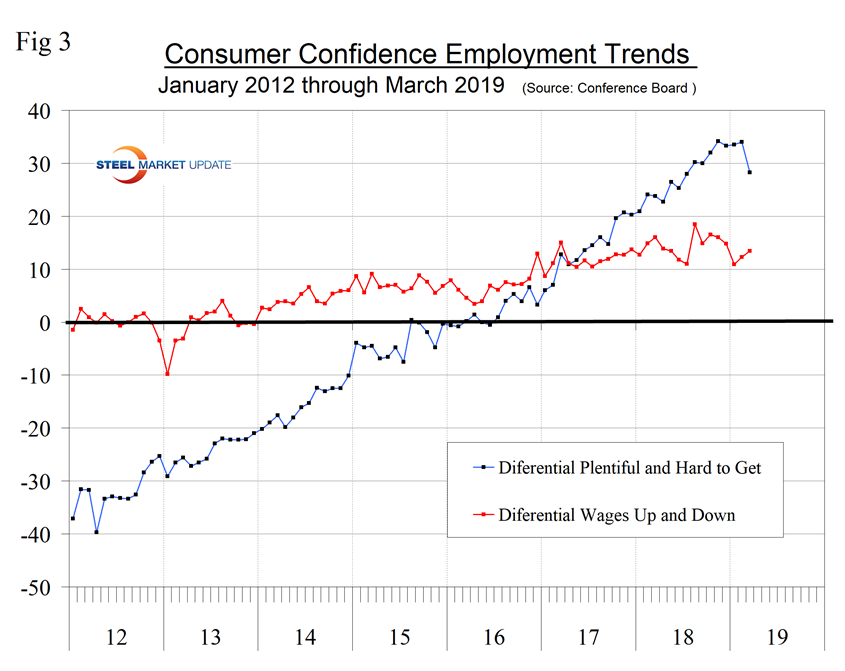

The consumer confidence report includes encouraging data on job availability as 42.0 percent of respondents reported jobs to be plentiful and 13.7 percent reported jobs hard to get. Expectations for wage increases were not so positive, as the percentage expecting a raise declined from March last year.

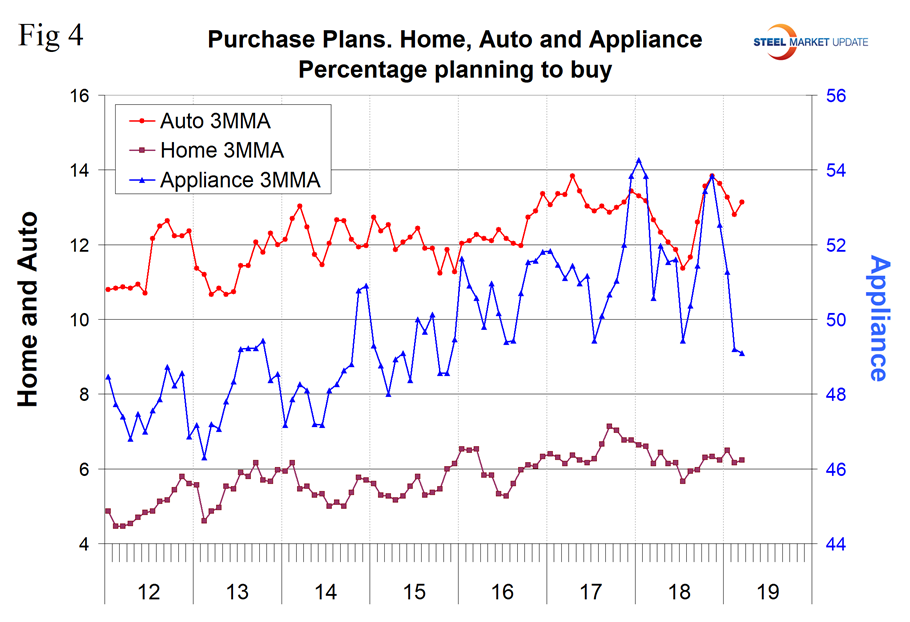

Consumer spending measures in March indicated that year-over-year plans to buy a car and a house improved, but plans to buy an appliance declined. This was an improvement from the February report when all three declined (Figure 4). Plans to buy an appliance were the lowest in over three years.

SMU Comment: The Conference Board Consumer Confidence Index is a volatile measure of the state of the economy, therefore it’s too early to be concerned at this point in time. The present situation component of the index is historically high, though it has fallen below it’s trend line for the first time in two years. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence and disposable income.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. Its mission is to provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.