Market Data

March 21, 2019

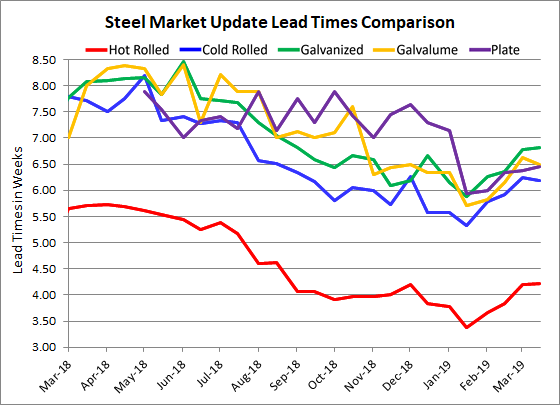

Steel Mill Lead Times: Not Much Change

Written by Tim Triplett

Lead times for spot orders of flat rolled steel saw little additional change in the past two weeks after moving out by a few days following the mill price increase announcements in January and February. Hot rolled lead times now average a bit more than four weeks, cold rolled more than six weeks, plate six and a half weeks and galvanized nearing seven weeks.

Lead times for steel delivery are a measure of demand at the mill level. The longer the lead time, the busier the mills. The busier the mills, the less likely they are to negotiate on price.

Hot rolled lead times now average 4.21 weeks, about the same as the 4.19 weeks reported in early March. Current lead times for hot rolled are still well below the 5.70 weeks at this time last year.

Cold rolled orders currently have a lead time of 6.19 weeks, little changed from the 6.24 reported around March 1. Cold rolled lead times at this time last year stretched to 7.72 weeks.

Similarly, average lead times for galvanized steel have stuck around 6.82 weeks, similar to the 6.77 weeks earlier in the month. Galvanized lead times were considerably longer at around eight weeks in mid-March 2018. The current average lead time for spot orders of Galvalume is around 6.5 weeks.

Lead times for spot orders of plate steel now average 6.45 weeks, up a tick from 6.38 in SMU’s last market canvas.

Two out of three service center respondents consider current lead times to be typical for this time of year, while the other third are evenly split on lead times being slightly longer or slightly shorter than normal. As one executive commented: “The mills’ ineffectiveness at providing consistent delivery is one of the reasons service centers exist.”

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.