Market Segment

March 16, 2019

Ternium Achieves Record Earnings in 2018

Written by Sandy Williams

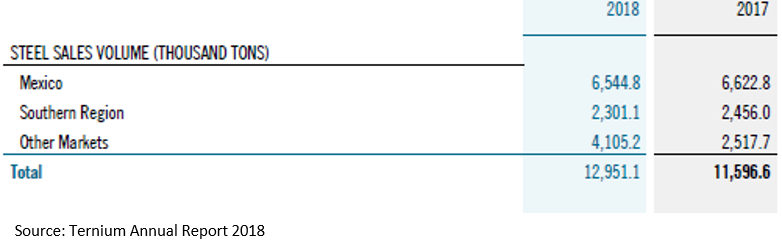

Latin American steel mill Ternium reported the highest annual EBITDA in its history last year at $2.7 billion, a 40 percent increase from 2017. Net income was $1.5 billion, driven by an 18 percent increase in sales and higher steel product shipments.

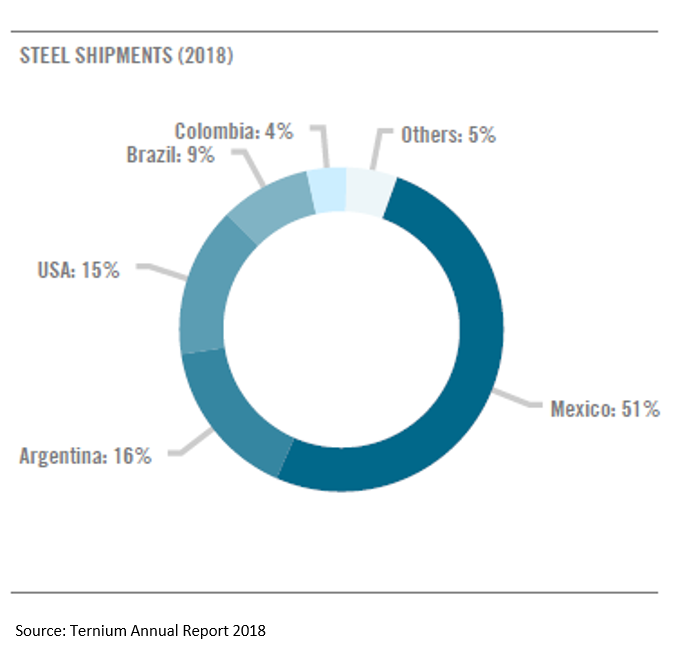

Ternium’s Mexico segment shipped 6.5 million metric tons of steel in 2018, representing 51 percent of the company’s total shipments. The Mexican market is now the largest steel market in Latin American with apparent steel demand of 25.9 million MT.

Steel prices in Mexico rose in the first quarter of 2018 driven by higher material costs. Prices continued to climb after the U.S. imposed 25 percent steel tariffs under Section 232 in March, remaining high until August and then normalizing in the latter half of the year.

Ternium’s shipments of finished steel products to the United States (excluding slabs to Calvert) decreased in 2018 due to the tariffs. Finished steel production within the U.S. by Ternium facilities increased slightly year-over-year, achieving new records.

Ternium’s shipments of finished steel products to the United States (excluding slabs to Calvert) decreased in 2018 due to the tariffs. Finished steel production within the U.S. by Ternium facilities increased slightly year-over-year, achieving new records.

Ternium has undergone significant upgrades of its Mexican mills in the past few years to meet the growing needs of the domestic auto, home appliance and HVAC industries. In September 2017, Ternium announced the construction of a new hot-rolling mill in Pesqueria that will be completed in 2020. The hot-rolling mill will be supplied with slabs from Ternium mills in Brazil and elsewhere and will expand the company’s product range in Mexico.

New hot-dip galvanizing and paint-line facilities are expected to start up in 2019, adding 350,000 MT of annual hot-dipped galvanizing capacity and 120,000 MT of painting capacity to Ternium’s portfolio.

Slab shipments to AM/NS Calvert in Alabama continued from Ternium Brazil in 2018. Steel shipments from Brazil to the U.S. are subject to a quota rather than the 25 percent tariff under Section 232. Between January 2019 and termination of the agreement in December 2020, Ternium expects to supply Calvert with 2.3 million metric tons of slabs.

Ternium is Latin America’s leading flat steel producer with an annual crude steel production capacity of 12.4 million metric tons. The company operates in Mexico, Brazil, Argentina, Colombia, the southern United States and Central America through regional manufacturing, service center and distribution networks. In addition, Ternium participates in the control group of Usiminas, a leading flat steel company in the Brazilian market.