Market Data

March 12, 2019

BLS: Net Job Creation Through February 2019

Written by Peter Wright

February’s employment report was not all bad news in spite of the surprisingly low job creation result.

Net job creation in February at first glance was terrible, but our analysis of Friday’s reported by the Bureau of Labor Statistics (BLS) was not so bad. Job creation in February, at just 20,000, was far below economists’ expectations and the 311,000 jobs created in January. January was revised up by 7,000 and December up by 5,000. Rising employment and wages are the main contributor to GDP growth because personal consumption accounts for almost 70 percent of GDP. Steel consumption is related to GDP; therefore, this is one of the indicators that helps us understand the reality of the steel market.

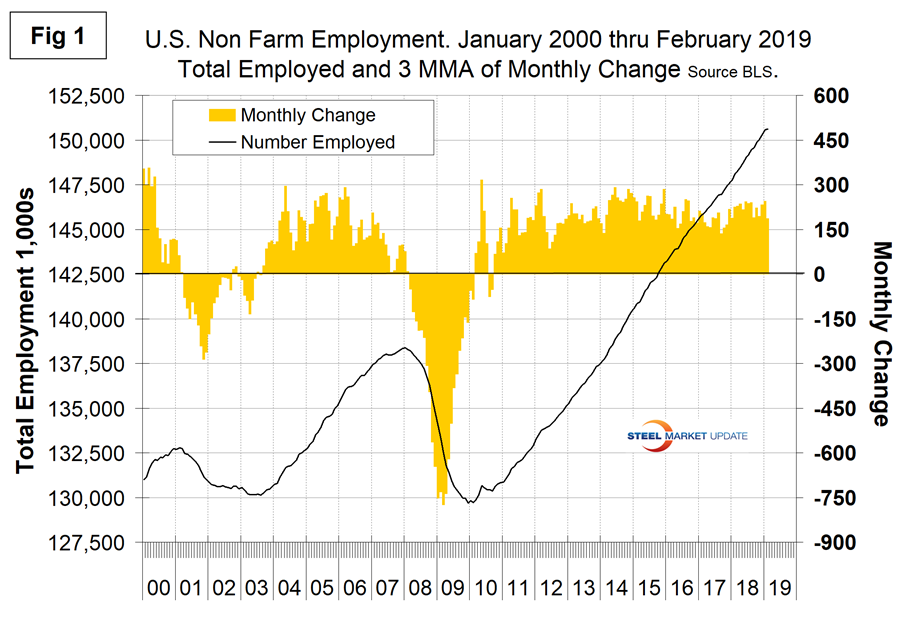

Figure 1 shows the three-month moving average of the number of jobs created monthly since 2000 as the brown bars and the total number employed as the black line.

We prefer to use three-month moving averages in our analyses to reduce short-term variability, but in averaging employment statistics in this way we obscure what we think is inferior data. Already in Figure 1 we can see that February wasn’t much out of line with recent history.

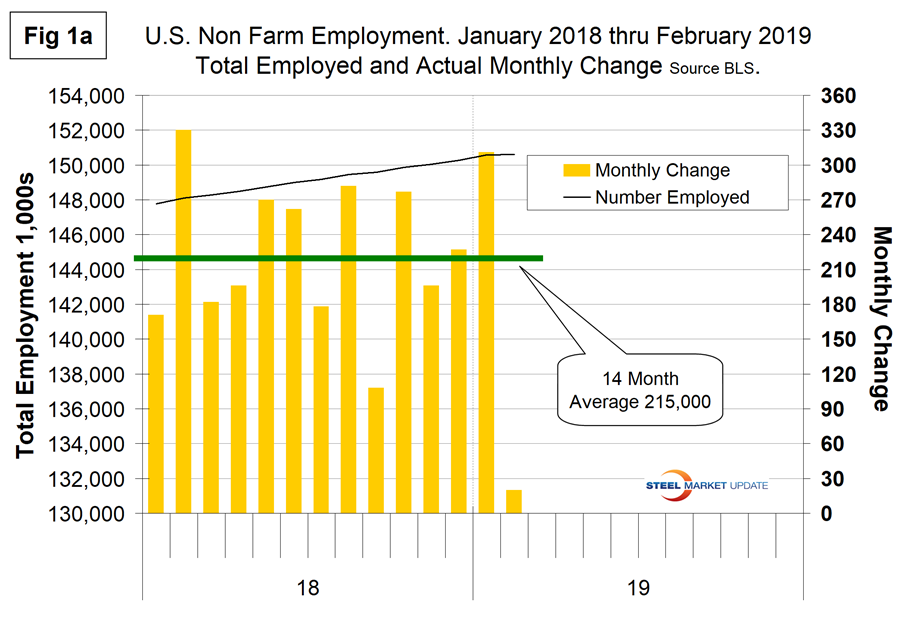

Figure 1a shows the raw monthly data since January last year and the extreme variability that has been reported. The average monthly job creation in the last 14 months has been 215,000.

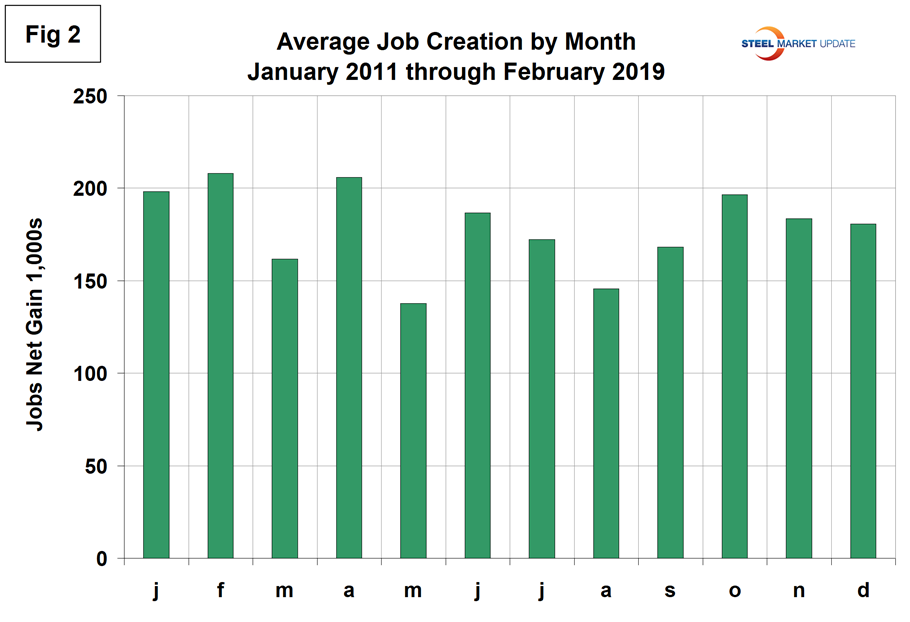

The employment data has been seasonally adjusted. We have developed Figure 2 to examine if any seasonality is left in the data after adjustment. In the nine years since and including 2011, the average month-on-month change from January to February has been positive 5 percent. This year the change was negative 94 percent; therefore, we wouldn’t be surprised if in next month’s data release February is revised up substantially. We think it’s significant to look at the results this way because some reports in the press, especially immediately following an apparently weak jobs report, will exaggerate the monthly result without putting it in a longer-term context.

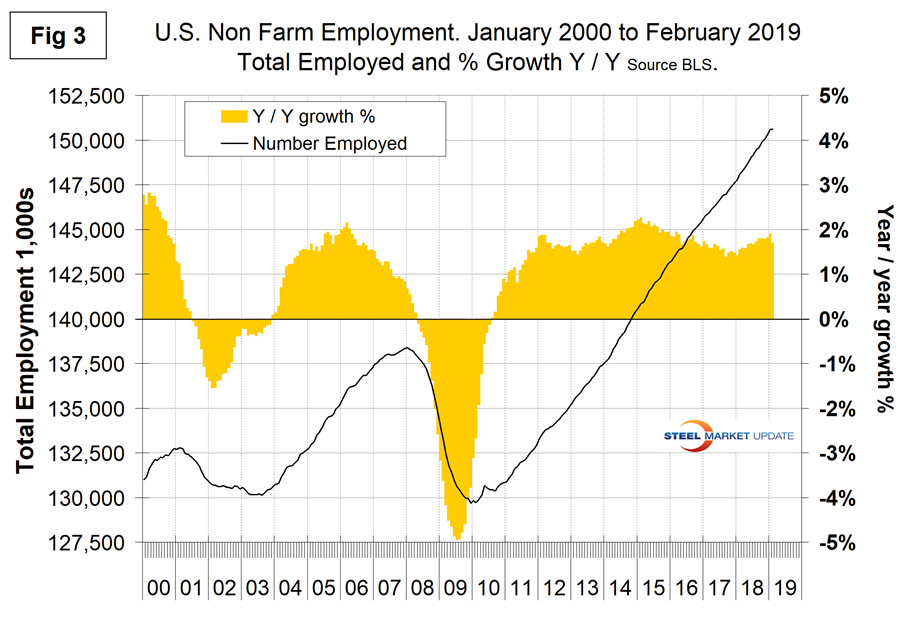

In order to get another look at the degree of change, we have developed Figure 3. This shows the same total employment line as Figure 1, but includes the year-over-year growth on a percentage basis and shows more clearly the steady improvement that occurred during 2018.

Last November was the first month ever for total nonfarm payrolls to exceed 150 million and in February 2019 was 12.241 million more than the pre-recession high of January 2008.

According to the latest BLS data, the average workweek for all employees on private nonfarm payrolls decreased by 0.1 hour to 34.4 hours in February. In manufacturing, the average workweek declined 0.1 hour to 40.7 hours, while overtime was unchanged at 3.5 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls fell by 0.2 hour to 33.6 hours. In February, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $27.66, following a 2 cent gain in January. Over the year, average hourly earnings have increased by 3.4 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 8 cents to $23.18 in February.

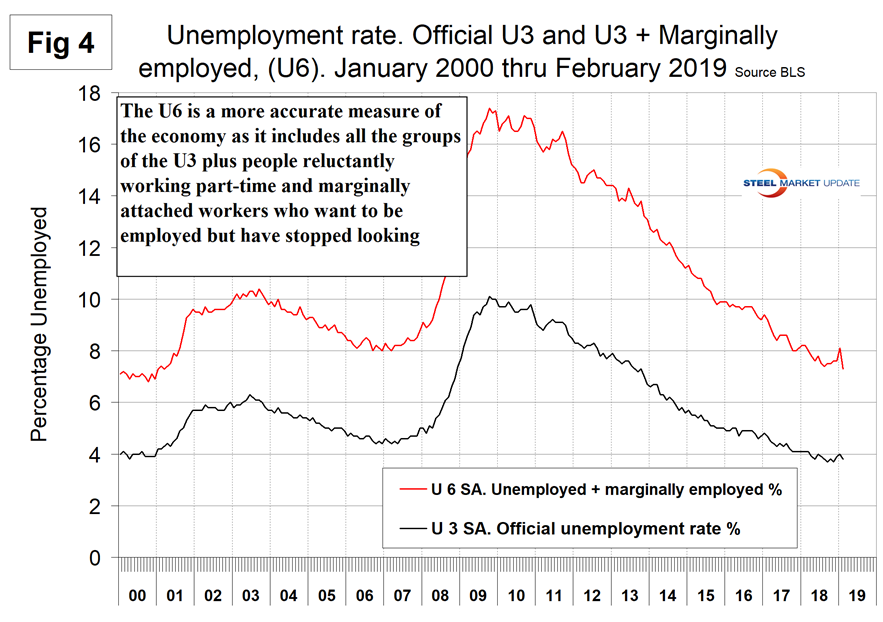

The official unemployment rate, U3, reported in the BLS Household survey (see explanation below) decreased from 4.0 percent in January to 3.8 percent in February. This is not a very representative number. The more comprehensive U6 unemployment rate declined from 8.1 percent in January to 7.3 percent in February (Figure 4). The difference between these two measures in February was 3.5 percent. This was the lowest since April 2006. This is an excellent result because U6 includes individuals working part time who desire full-time work and those who want to work but are so discouraged they have stopped looking.

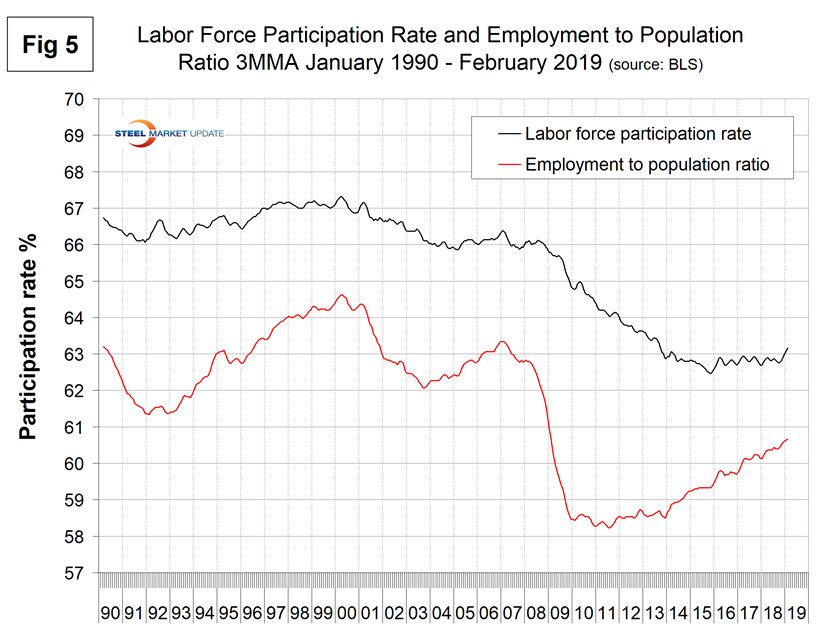

The labor force participation rate is calculated by dividing the number of people actively participating in the labor force by the total number of people eligible to participate. This measure was 63.2 percent in January and February, up from 62.9 percent in November; the 3MMA also at 63.2 percent hasn’t changed much in over two years. Another gauge is the number employed as a percentage of the population, which we think is more definitive. In both January and February, the employment-to-population ratio was 60.7 percent, the highest number since December 2008. The employment-to-population ratio has made progress for the last four years, but the labor force participation rate has been stalled for two years. Figure 5 shows both measures on one graph.

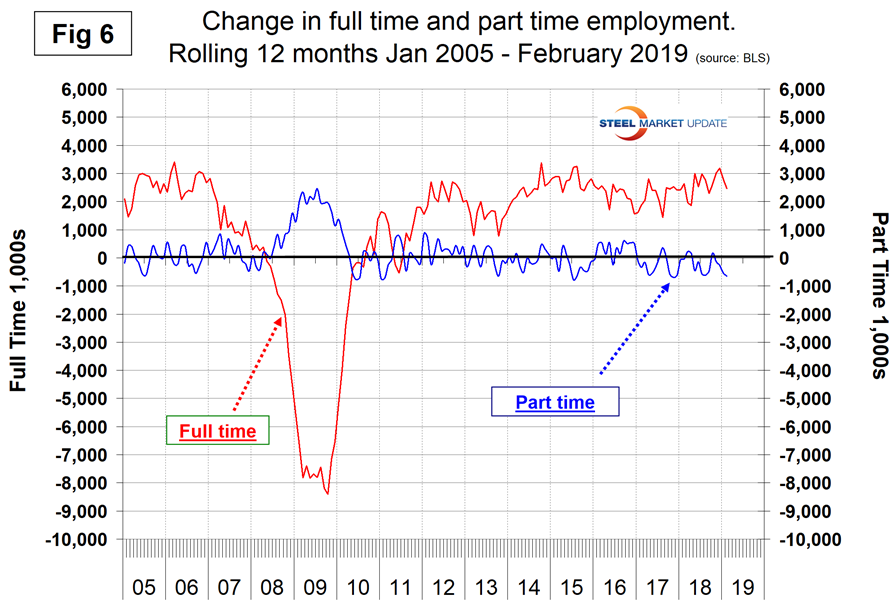

In the 38 months since and including January 2016, there has been an increase of 7,419,000 full-time and a decrease of 500,000 part-time jobs. Figure 6 shows the rolling 12-month change in both part-time and full-time employment. This data comes from the Household survey and part-time is defined as less than 35 hours per week. Because the full-time/part-time data comes from the Household survey and the headline job creation number comes from the Establishment survey, the two cannot be compared in any given month. To overcome the volatility in the part-time numbers, we look at a rolling 12 months for the full-time and part-time employment picture shown in Figure 6.

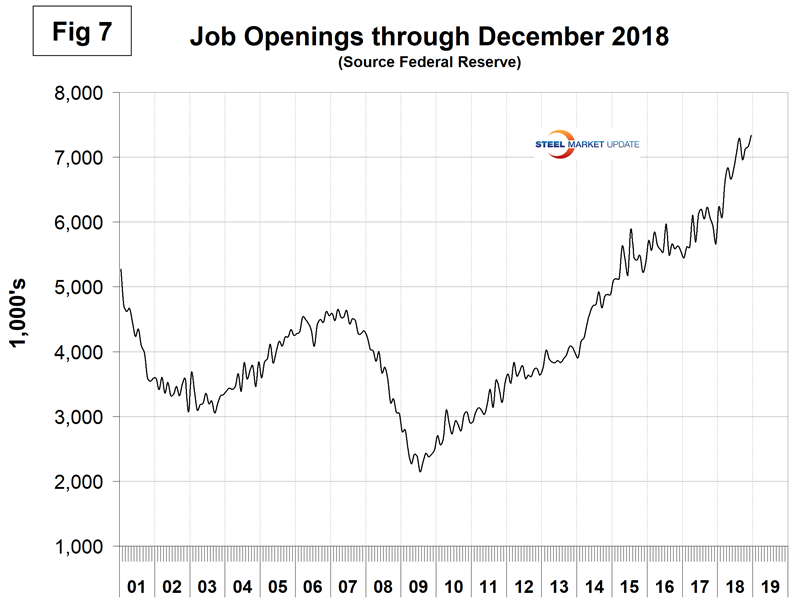

The job openings report known as JOLTS is reported on about the 10th of the month by the Federal Reserve and is over a month in arrears. Figure 7 shows the history of unfilled jobs through December when openings stood at 7,335,000. This was an all-time high. There are now more job openings than there are people counted as unemployed.

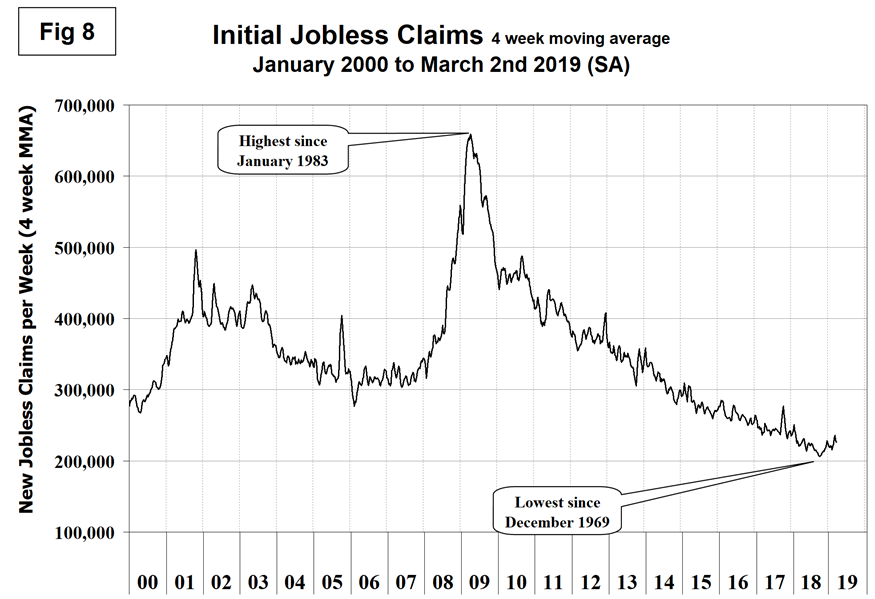

Initial claims for unemployment insurance, reported weekly by the Department of Labor, have increased by 4,500 on a four-week moving average since January this year, which is slight. New claims in September were at the lowest level since 1969. The U.S. is enjoying the longest streak since 1973 of initial claims below 300,000 (Figure 8).

SMU Comment: It’s premature to conclude that the very negative job creation performance in February is bad news. Job openings continue to be very high, new unemployment claims are very low and there are fewer discouraged people who can’t find a job. We expect February to be revised up, but even if it isn’t it will take a couple more months to determine if February was the start of a trend.

Explanation: On the first Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS reports on the results of two surveys. The Establishment survey reports the actual number employed by industry. The Household survey reports on the unemployment rate, participation rate, earnings, average workweek, the breakout into full-time and part-time workers and lots more details describing the age breakdown of the unemployed, reasons for and duration of unemployment. At Steel Market Update, we track the job creation numbers by many different categories. The BLS database is a reality check for other economic data streams such as manufacturing and construction. We include the net job creation figures for those two sectors in our “Key Indicators” report. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. For example, among hundreds of sub-indexes are truck transportation, auto production and primary metals production. The important point about all these data streams is the direction in which they are headed. Whenever possible, we try to track three separate data sources for a given steel-related sector of the economy. We believe this gives a reasonable picture of market direction. The BLS data is one of the most important sources of fine-grained economic data that we use in our analyses. The states also collect their own employment numbers independently of the BLS. The compiled state data compares well with the federal data. Every three months, SMU examines the state data and provides a regional report, which indicates strength or weakness on a geographic basis. Reports by individual state can be produced on request.