Market Data

March 10, 2019

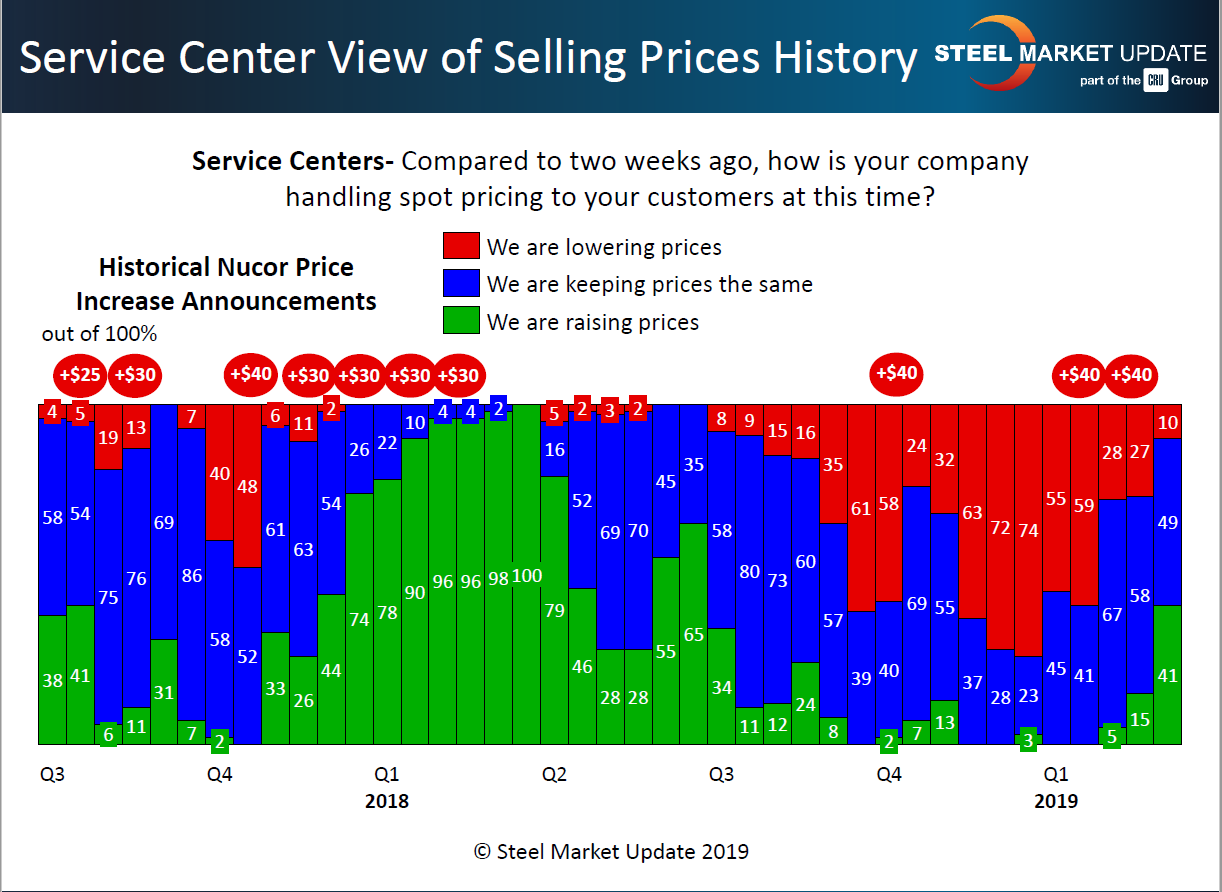

Distributors Beginning to Move Spot Prices to End Users

Written by John Packard

Flat rolled steel service centers are beginning to support the concept of higher steel prices. Distributors are raising spot pricing to their end-user customers, and in the process, they are supporting the domestic steel mill flat rolled price increase announcements.

Steel Market Update canvasses the flat rolled and plate steel markets twice a month through the use of a questionnaire to end users, service centers, steel mills and trading companies. One of the important elements of our survey is to ask the manufacturing companies as well as the flat rolled steel distributors how service centers are handling spot pricing to the end users.

Last week, we found 38 percent of the manufacturing companies reporting their service center suppliers as raising spot prices. This is more than twice the percentage reporting the same way two weeks ago. At the same time, the percentage of manufacturing companies reporting spot prices as falling declined from 39 percent to 14 percent. At the beginning of February, 59 percent of these same companies were reporting spot pricing as falling from their service center suppliers. The percentage, as you can see below, was even higher through the fourth and early first quarters.

The service centers, responding independently from the manufacturing companies, reported similar results. Forty-one percent of the service centers responding to last week’s survey reported their company as increasing spot pricing to their spot customers. Only 10 percent of the service centers admitted their company was continuing to offer lower spot pricing to their customers compared to two weeks ago.

The graphic below depicts the service center results. The red ovals above the bars show the Nucor price increase announcements. Since late January, Nucor has announced $80 per ton in sheet increases.

Based on the results of last week’s questionnaire, SMU is of the opinion that there is some price momentum to take steel spot prices higher from here. The question is, how high can prices go? That will be determined by the need to buy inventory and the overall demand in the marketplace.