Market Data

March 7, 2019

Steel Mill Negotiations: Talks Tighten, But...

Written by Tim Triplett

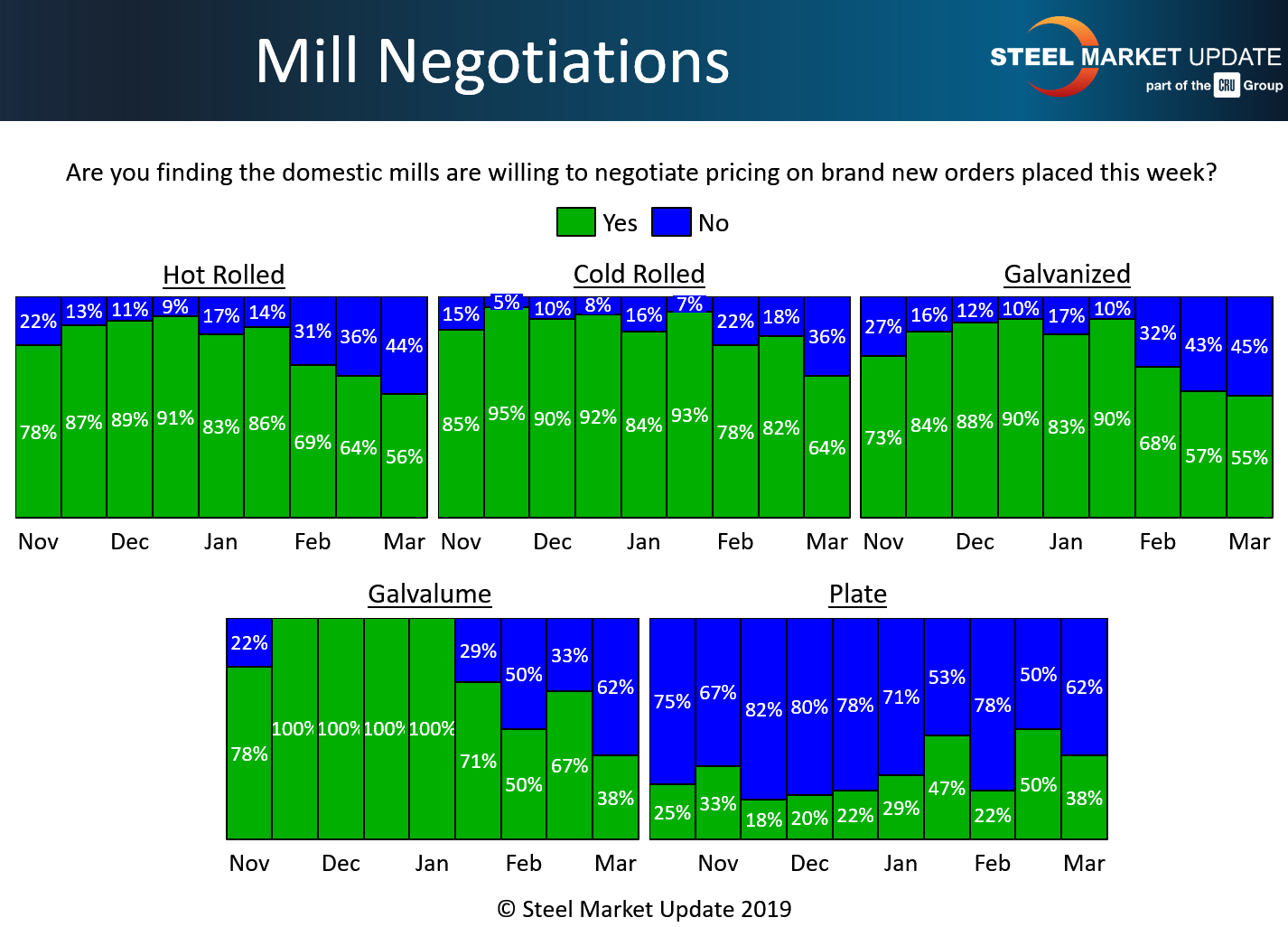

Not surprisingly, steel buyers report a tightening in negotiations with the mills following the two $40 per ton price increases announced in January and February. However, the majority of those responding to Steel Market Update’s market trends questionnaire this week say the mills are still willing to talk price–on all products but plate and Galvalume–if that’s what it takes to get the order.

In the hot rolled category, 44 percent said the mills are now holding the line on HR, while 56 percent said they still find mills willing to negotiate. One month ago, 69 percent of respondents said mills were open to negotiations, so talks have tightened significantly.

In the cold rolled segment, 64 percent said they have found mills open to price negotiations, down from 82 percent two weeks ago. Thirty-six percent reported current mill prices on cold rolled as firm.

In the galvanized sector, 55 percent said the mills were open to price discussions, down from 68 percent a month ago. About 45 percent of GI buyers report that prices are nonnegotiable, up from 32 percent in early February. For Galvalume, nearly two-thirds of the buyers now say the mills are unwilling to negotiate. The ratio is the same in the plate market, where 62 percent say the mills are holding firm.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.